In the first edition of PV Tech Power ten years ago, our cover article looked at the issue of PV module quality, which had come to the fore after a period of heavy cost-cutting in the industry. Following a decade of technological innovation, the overwhelming dominance of Chinese manufacturers and a global explosion in solar capacity that has seen costs fall dramatically, we are revisiting the issue. Will Norman asks if the seeds for a looming quality problem have already been sown.

In conversation with PV Tech Power, John Davies – the CEO and founder of 2DegreesKelvin, a UK-based solar quality and testing consultancy – recounts a tale from his company’s years testing solar modules for damage in the field. He remembers a recent instance of testing a roughly 50MW-scale site for a client that had bought two batches of modules, one of a lower power output class and one higher.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

“We tested around 2,000 modules,” Davies says. Around 13% of the higher powered batch of modules were impacted by grid finger interruptions [a type of manufacturing soldering error], and they were operating at around 1% higher than the power output advertised on the box; “pretty much exactly where you’d expect it to be for brand new, fresh-out-the-packet modules,” he says.

“In the lower power class, approximately 80% of the modules were affected by grid finger interruptions, and the power was approaching 8% down on flash tests,” he continues.

The batches were both ordered from the same manufacturer and delivered to the same recipient, but the difference in the product quality was stark. Ultimately this case resulted in a successful warranty claim as the modules were newly delivered and evidently sub-par, but things are not often so straightforward.

Tracing the source

“I don’t think we’ve ever received modules from the field where we didn’t see some cell cracks,” says Cherif Kedir, president and CEO of the Renewable Energy Test Centre (RETC) in Fremont, California. “Where they happen, how they happen and how long it takes to happen is quite debatable and everybody is pointing fingers at everybody else.”

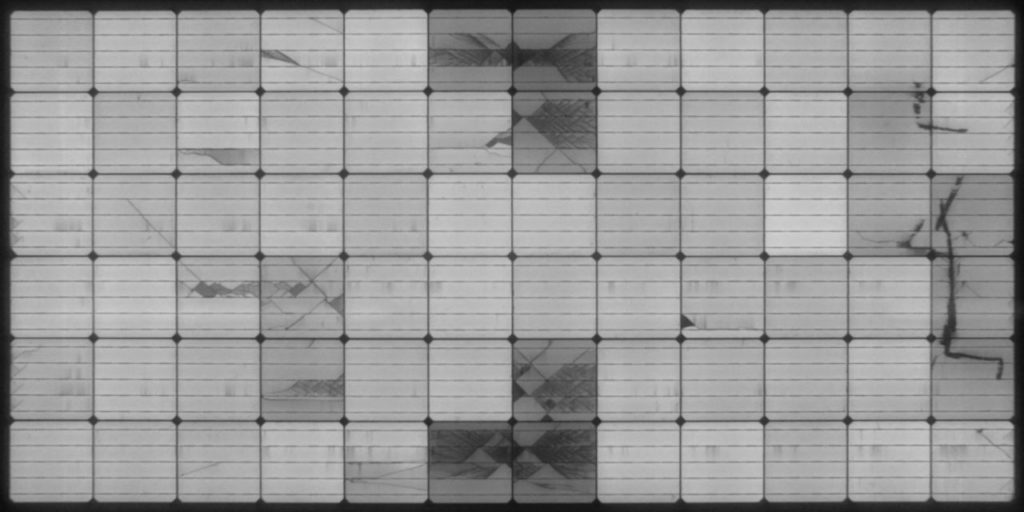

Alongside cell micro-cracks and grid finger interruptions, common defects in solar modules also include backsheet cracking, striation rings and soldering errors.

A report earlier this year from the Clean Energy Associates (CEA) in the US found a rise in solar PV module defects, most notably micro-cracking, line cracks and soldering errors, which it said came largely from the manufacturing side. While cracking can occur at almost any point during a solar module’s life – from the factory to shipping, to unpacking, to installation to weather damage – the CEA’s findings specifically highlighted a rise in manufacturing errors.

According to the CEA website, microcracks – which are invisible to the naked eye and only show up under electroluminescence (EL) testing – “have the potential to develop into a loss of active cell area and reduce the output of the entire string containing a defective module. Over time microcracks can lead to diode activation or hot spots that represent a safety risk.”

Wherever they come from, damage and cracking cause loss of power and return on investment for an asset owner, but also introduce an element of instability to a large-scale, high-voltage piece of infrastructure.

Cherif Kedir says that data on where a defect has occurred in the chain from manufacturing to O&M is almost impossible to come by.

“The data stops when the module manufacturers put the modules inside the crates. There are some efforts right now by developers to perform field EL testing on the modules before they’re installed, but it’s not something that is sustainable or cost-efficient. It’s pretty cost-prohibitive to perform EL testing on millions or hundreds of thousands of panels, it just doesn’t make sense. Especially when the cost of PV is so low.”

Kedir says that some developers are testing samples of their module shipments to check for defects straight out of the box, searching for systematic problems across a considerable percentage of the test sample. This is the sort of process that Davies and 2DegreesKelvin engage in and can – sometimes – result in effective warranty claims to manufacturers or EPCs.

In Kedir’s estimation, buyers test straight out of the box so they can turn to the manufacturer and point to issues rooted there. Manufacturers can’t blame shipping, as the containers that modules are shipped in often come from the manufacturers themselves.

But issues that arise later or more obscurely can cause issues with the EPC, Kedir explains. Either the EPC has caused damage to the modules, which passes responsibility to them, or they’ve degraded too quickly, which throws the ball back to the manufacturer. “So you still have issues between manufacturer and EPC agreeing over whose responsibility it is,” he says.

In response to questions from PV Tech Power, George Touloupas, senior director, technology and quality at the CEA said: “Buyers must be very diligent with vetting suppliers, products and manufacturing facilities by engaging third parties to perform due diligence and audits before production starts. During production, before shipment, and even post-shipment, it is imperative to have the necessary oversight, inspections and testing to ensure quality and accountability.”

Third-party testing organisations, such as Fraunhofer ISE, TÜV Rheinland and RETC, can test modules either at the factory or installation stage, as well as auditing EPCs and manufacturers themselves. But, as Kedir points out above, testing thousands of increasingly cheap panels, or taking the time and effort to insist on supply or EPC auditing, takes financing and coordination that not all parties are willing to commit.

Site selection

It’s important to mention that, beyond manufacturer or EPC errors, site selection and extreme weather can play a role in module damage and could influence figures showing an increase in issues.

According to a report from insurer GCube, memorably titled ‘Hail No! Defending solar from nature’s cold assault’, the average claim for damage incurred by solar projects from hail has been almost US$58.4 million per claim in the last five years. NASA says that Earth’s changing climate since the Industrial Revolution has caused an increase in “extreme” weather events like heat waves, floods and severe hail.

Volume 37 of this publication last year covered the way that solar PV is adapting to worsening weather conditions. However, in our conversation, Kedir says that site selection itself, in relation to extreme weather, can play just as significant a role in quality.

“Something I do know, which is maybe more fundamental [than generally more extreme weather], is that modules are being installed in really crappy areas, in places where humans do not want to live because you’re going to have these huge boulders falling out of the sky and you don’t want them to decimate your house and your car or kill your kids.

“And so,” he continues, “these tend to be areas where land is very cheap, where developers can put modules. That’s a really bad combination.” He says that many installations are happening in areas where they probably shouldn’t be, either because of the price of land or the distance from communities or both, and that this could factor into the apparent rise in defects reported by the CEA.

An echo of the past?

The spiritual companion piece to this feature, published in the first PV Tech Power a decade ago, opened with a report that found hundreds of thousands of modules made by the now-defunct Netherlands manufacturer Scheuten Solar to be a fire hazard. This sort of drama seems to mostly have been ironed out in the last ten years as manufacturers have consolidated, expanded and honed their operations, and the big Chinese players have come to dominate the market.

There is, however, a convergence of dynamics and predictions in the solar market that has the potential to cause concern for the quality of solar modules being put on the ground.

Foremost among these is the falling price of modules over the last year. October 2023 saw the first time that bidding prices for modules in China fell below RMB1 per watt – roughly US$0.014 at the time of writing. PV Tech’s head of research, Finlay Colville, published a blog post in November predicting that the low price of modules would continue, putting pressure on large manufacturers to remain in the black and turn a profit on the huge capacity expansions they’ve invested in over the last decade. These pressures could lead to a downturn in fortunes for major manufacturers.

From low prices it follows that, faced with the need to manage the cost of production, manufacturers may be pushed to cut corners. Colville tells PV Tech Power: “At this point, we just don’t know what cost-cutting measures are going to be deployed in China or by Chinese manufacturers with capacity in Southeast Asia.”

Cherif Kedir says, more wryly: “A developer told me that he felt that the price of modules was so low he was waiting for the day modules were going to be sold by the pound rather than by power.”

Low prices are already having an impact. In recent months, the European solar manufacturing industry has been lobbying for emergency support from the EU as major players REC Group and Meyer Burger have pulled out of significant operations on the continent.

The reason is twofold: oversupply and alleged price dumping, which have made it extremely difficult for EU manufacturers to continue – let alone set up – operations. Reportedly there are multiple gigawatts of surplus modules in and around the port of Rotterdam, modules which the European Solar Manufacturing Council (ESMC) says are being produced at uncompetitively low cost, sometimes below the operating costs of the manufacturers themselves.

This is an extreme result of low pricing and, possibly, a failure in governance, but it spells out the impacts that cost pressure can have on the manufacturing process. Niclas Weimar, chief technology officer at European testing firm Sinovoltaics tells PV Tech Power that this price pressure can have a direct impact on quality assurance.

“Without doubt, with the decline in module prices, there will be continued pressure on quality and thus higher risks for PV project developers,” Weimar says. “With hundreds over hundreds of PV module factories in the world with largely similar product portfolios and thus limited USPs, pricing remains one of – if not, the key – selling point in the fiercely competitive manufacturing business where corner cutting and minuscule savings on quality procedures can have a significant revenue impact.

“There are ways for factories to potentially cut costs, whether it’s on the resources for comprehensive quality management or on raw materials and their related logistics. However, such cuts come with significant quality risks.”

Colville adds: “Some of the cost of the module can be taken out simply by passing the ‘pain’ of a low pricing environment back onto your suppliers: but this only gets you so far. Making changes to the materials themselves that are used in production will have to be considered closely, and this is where everyone should be looking most closely.”

Concerning the materials used in production, John Davies’ story of the disparate batches of modules – one operating normally, one riddled with issues – delivered to the same site by the same manufacturer provides an anecdotal example. He says that the issue of varying batch quality suggests “it’s a bill of materials (BOM) issue, they’re getting their cells or wafers from different sources”. Due diligence needs to be done to investigate the BOM and the plants where the components for a module are being produced,

Davies says.

“Unknown, unverified, untested”

This brings us to the second of the factors that might influence an oncoming quality dip: supply chains. The largest manufacturers have grown massively and at an incredible pace in the last few years, which can strain their supply chains. Kedir says: “We’ve had issues with large, Tier-1 manufacturers who switch some of their primary components to unknown, unverified, untested suppliers in China and ship them to the US. And sometimes it’s happened without the knowledge of a lot of the people within the company.”

He continues, saying that RETC has encountered frequent issues in the field that have transpired due to supply chain swaps. “Sometimes the manufacturers came clean and told us and the developer and we conducted testing”, though he says that in some cases this testing resulted in 100% failure rates for materials, even after multiple rounds of testing.

Upstream supply chain issues do reverberate down to asset owners ‘on the ground’. According to Julian Elsworth, portfolio director at UK-based solar asset owner Foresight Group, the company is increasingly looking to source its modules from a “whitelist” of manufacturers in response to both concerns from financiers over forced labour in the solar supply chain and the lessons learned over the last ten years about module quality.

Having entered the solar industry a decade ago, he says the company has learned to prioritise the ability to test throughout the supply chain where possible: “You can send technical advisors to factories, so at that stage of the process you can check that everything’s being done correctly.” He says that if a manufacturer claims not to accommodate a certain testing method, asset owners now have more ability to buy from someone who does. In such cases, “they’re probably hiding something”, Elsworth says.

This applies to traceability in terms of quality assurance, but also to the issue of forced labour traceability that has a bearing on manufacturers’ supplies. As the PV industry is forced to scrutinise the provenance of its supply more closely, due to government, investor and consumer pressures, more uncertainty emerges. The reality of the situation – that close to half of the polysilicon produced in China comes from Xinjiang, and over 80% of the world’s polysilicon comes from China – could exacerbate the sort of supplier shifts that Kedir mentions, which have already caused quality issues.

Elsworth says: “We need to also look from that ESG angle; a lot of our bigger investors are starting to ask us about that problem, so we need to address that.”

Technically speaking

When it comes to module technology, the CEA told PV Tech Power that it did not have sufficient data for anything other than passivated emitter/rear contact (PERC) modules to draw any technological conclusions. This will presumably change in the coming year or two as n-type modules – particularly TOPCon – come to replace PERC as the market-leading tech.

Kedir says that, from the years of data collected by RETC, he believes that the industry has improved testing, assessing and stabilising technologies before they release them to the market.

For example: “PERC technologies, at the very beginning, were susceptible to light and elevated temperature induced degradation (LeTID), which was solved very quickly and the industry was able to react in a way that was pretty amazing.”

He continues, saying that TOPCon is experiencing some issues with UVID but that the technology is too new to have revealed all of the potential snags it might hold. “Stupid failures”, as he calls them, are rare and the shortfalls from a technological standpoint tend to be found in places that the manufacturer couldn’t have planned for.

Bifacial modules, for example, introduced far more frequent instances of hail damage because their glass is generally thinner than in modules with a single glass face and a backsheet. The introduction of double glass, however, allowed far less moisture to penetrate into the cell.

In recent years, Kedir says that RETC has found issues due to the size of modules – much bigger panels with thinner glass to reduce weight, which has produced “a lot of mechanical integrity issues…the glass breakage is a pretty big issue that we see in lab testing and field forensics”.

“Certain things are getting better, while other things are getting worse”, he says.

John Davies of 2DegreesKelvin notes an increase in issues during the transition to n-type technology: “What I would say is that since we’ve gone to n-type, the volume of affected cells has gone up.”

Davies’ observation relates to speculation from PV Tech head of research, Finlay Colville: “Until recently, at least the wafer type was largely a constant. But now the industry is going through a rapid change from p-type to n-type cell types and while there is an argument that n-type substrates should make better quality modules, everything still has to be understood and checked.”

New players, new problems?

Turning west, everyone reading about solar PV in the US is aware of the Inflation Reduction Act (IRA), introduced by the Democrat government in 2022 with over US$360 billion in tax credits for renewable energy deployment and manufacturing. At the same time, the US market has been plagued with supply issues off the back of the twin-pronged attack of the Uyghur Forced Labor Prevention Act (UFLPA) and antidumping/countervailing duty (AD/CVD) tariffs.

In the face of supply issues, the emergent module manufacturers that have set up in the US in the wake of the IRA may have to scout around for suppliers to meet their demands – possibly resulting in the same “unknown, unverified, untested” producers Kedir mentions (though not in China, obviously).

He says that this will “hopefully” not become an issue for the big companies setting up in the US, like Canadian Solar, Jinko Solar, Qcells et al., particularly if the IRA is able to deliver on its full potential. However, newer and smaller entrants into the solar market may have to overcome quality issues that can sometimes be unavoidable.

“I really hate the statement that startups and small companies cut corners,” Kedir says, “but it’s the reality. They don’t necessarily cut corners because they want to, but because they have to.”

“If you are Jinko or JA and you have the purchasing power to go to the best backsheet or glass manufacturers and you say, ‘I want to buy 20GW or 50GW’, they’re going to mobilise their entire manufacturing and they’re going to give you the best price possible.”

Smaller companies don’t have that purchasing power. “I’ve seen manufacturers be completely cut off from their supply chain,” Kedir continues. “Cell suppliers, backsheet suppliers … just did not have the capacity to deal with someone who was buying 50MW or 100MW, and they ended up having to source alternative materials. Again, not because they wanted to, but because they absolutely had to.”

Diversified solar supplies are a good thing when it comes to energy security, national economic growth and a fair marketplace. Governments and trade bodies in the US, Europe and India are all trying to stimulate domestic PV manufacturing capacity to insulate their economies from China’s dominance of the PV supply chain, and new companies can offer alternative outlooks, stimulate change and drive new technologies.

However, the solar module production process consists of a well-oiled set of production lines, and George Touloupas of the CEA says that this takes time to perfect: “Our experience from performing quality assurance and production oversight over many GWs of projects has repeatedly shown that new factories take months to ramp up and iron out quality issues, and new manufacturers take even longer to improve.”

This sentiment is echoed by Niclas Weimar of Sinovoltaics: “Specifically in the US, the mushrooming of new factories across the country will bring a tremendous number of new opportunities, but at the same time there will also be quality challenges.”

In January 2024, Sinovoltaics announced plans to enter the US market in direct response to growing US capacity, the increased number of producers and the dramatic drop in prices for Asian-made modules.

“From our decade-long experience with PV module manufacturing in Asia, I expect newly set up factories to face their fair share of initial quality and related procedural issues,” Weimar says.

“Be it with the setup of robust quality management procedures specific to PV module manufacturing, the calibration of manufacturing and measurement equipment, the quality challenges of product design and certification, the creation and constant updating of quality standards or the establishment of proper quality control procedures. Add to this the current shortage of PV-skilled labour in the market.”

It’s unclear what the next year will hold for solar manufacturing, and what market forces may mean for the panels themselves coming off production lines. But the seeds for a looming quality problem may well

have already been sown.

The combination of falling prices, shifting supply chains and a wider pool of new manufacturers, coinciding with ever-greater demand and deployments for solar PV in a widening marketplace, seems like a recipe for uncertainty in the industry. Most pertinent for any observers will be the way that downward price pressures impact the big-name manufacturers.

Kedir offers some cautious optimism: “I hope that maybe some manufacturers are going to be responsible enough to slow down their manufacturing, maybe shut down a few lines so that the industry adjusts.

“But humans are a funny bunch. What may end up happening is some manufacturers are going to say, ‘I have deep pockets, I’m going to see this through and drive everybody else out of business’.”

The truth is that “the risk is there”, he says. “We’re here to keep the industry honest.”