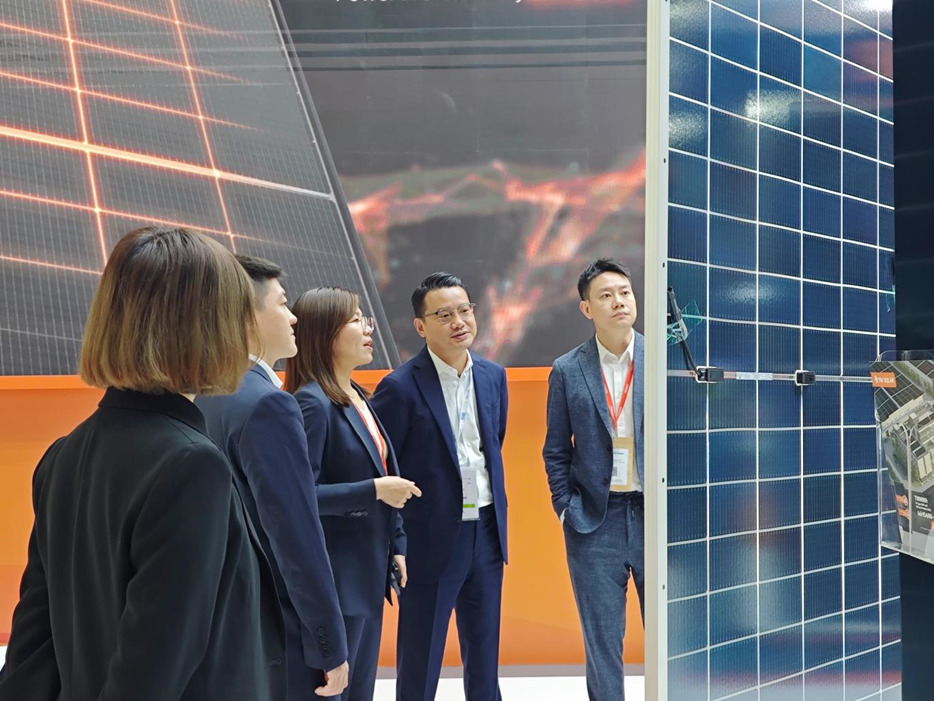

At the recently concluded 2024 edition of the World Future Energy Summit (WFES) in Abu Dhabi, major Chinese module manufacturer Tongwei displayed three product series: TPC, TNC and THC, focusing on its G12R, G12N and heterojunction (HJT) modules.

Tongwei has already established effective cooperation with some of the top distributors in the Middle East, creating a stable business framework and channels to open up the region’s markets. Looking ahead, Yan Li, vice general manager of PV business, tells PV Tech that major overseas markets are expected to continue to grow, but at a more rational pace. In 2023, Tongwei’s module shipments reached 32GW, ranking among the top five globally, and Li anticipates that its shipments will exceed 50GW this year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

PV Tech: What differences and developing trends have you seen at this year’s WFES, compared to previous years? What do you see as the specific characteristics of the Middle East market today?

Yan Li: The WFES is considered the most influential solar event in the region. This year’s exhibition is busier than ever, with an increase in the number of exhibitors and a record number of visitors compared to last year. On a product level, the most significant difference from last year is the clear trend towards larger sizes for n-type products, with large-format products such as 182mm and 210mm having become mainstream.

From the 125mm of more than a decade ago to the current 210mm, the PV industry’s development over the past two decades has been an evolutionary history of wafers growing larger. Behind this evolution is continual technological innovation, which has always been focused on reducing costs and increasing efficiency. In theory, larger wafers mean higher module output for products of the same type, leading to lower LCOE, so the advent of the large-size era, led by 182mm and 210mm, is an inevitable trend.

The Middle East market is mainly driven by utility-scale power plants in two countries, the UAE and Saudi Arabia, with an expected total capacity of 13.5GW in 2024. The installed capacity of these two countries alone accounts for about 53% of the region’s total, with its average annual capacity forecast to be around 15-20GW. Outside the UAE and Saudi Arabia, Oman’s potential for new additions is also gradually emerging.

PV Tech: Can you tell us a little about the products you have on display at this year’s event?

Yan Li: We have three series of products on display this year: TPC, TNC and THC, with a focus on promoting our G12R, G12N and HJT modules.

The trend for the PV industry moving from the ‘p-type era’ to the ‘n-type era’ has become clear. Our extensive experience and leadership in the industry has provided strong support for the development of new-generation N-type modules, with our independently developed TNC cells having achieved a mass production efficiency of up to 26.7%. The G12R-66 large module displayed here this week is an optimised design based on the traditional 182mm product, now capable of reaching a maximum output of 620W. Compared to the 182-72 module, this represents a power increase of over 40W and an efficiency increase of up to 0.5%.

Leveraging its advantages in power and efficiency, the new G12R series can effectively reduce BOS and LCOE, delivering superior performance. Additionally, the G12R-66 module maintains a width of 1134mm while increasing its length from 2278mm to 2382mm, maximising packing efficiency and reducing transportation costs.

At this exhibition, we have introduced for the first time our high-output, large-module product, the G12N. This module has been optimised from the traditional 182mm design and utilises our self-developed and self-produced large square cells. The G12N can reach a maximum output of 720W, which is an increase of over 130W and an efficiency improvement of up to 0.38% compared to 182-72 modules.

Through system yield analysis at 10 typical project sites around the world, the G12N-66 shows an average LCOE reduction of -2.64% and a maximum reduction of -4.3% compared with TNC 182-72 bifacial modules. In the case of utility-scale power plants, the G12N-66 is the product with the most significant advantages.

Another product present here this week is our THC module, a stand-out product based on HJT technology. Designed to enhance system yield, the module combines high power, high efficiency, low degradation and an aesthetically pleasing appearance. Its maximum output can reach 755.03W, having broken HJT power and efficiency records six times in a row.

It fully leverages the high efficiency of HJT cells and incorporates TW Hi-TDC (high transparency double-coated glass), Hi-RT (high reflectivity) and Hi-DP (high-density packaging) technologies. This leads to a higher cell screen ratio and a significant increase in module power output. Additionally, the product adopts a universal design compatible with the industry’s various racks, inverters and power optimisers.

PV Tech: What have been your strategic deployments in the Middle East and Africa markets up to now?

Yan Li: Since the second half of 2022, we have significantly increased our investment in the module sector. With targeted product portfolios, systematic market promotion and brand promotion strategies, we have actively participated in PV industry exchanges and events in the Middle East. We maintain close contact with local companies, research institutions and government departments to jointly explore the innovation and application of PV technologies.

As of now, we have established close cooperation with a number of the region’s top distributors, setting up a stable framework and channels for future business. And we have received wide recognition from the Middle Eastern market and individual customers.

At the same time, we are of course actively establishing solid partnerships with core strategic customers in the region. By fully leveraging our brand influence and manufacturing advantages across the whole industry chain, we have made significant progress in developing relationships with key customers and are working with them to promote the construction of local PV projects.

PV Tech: What challenges and risks have you encountered in developing the Middle East market, and how can these be mitigated?

Yan Li: In terms of risk avoidance, we have always strictly controlled product quality and delivery times to ensure that we can complete customer orders on time and as expected.

Competition in the Middle East market is quite fierce, and the demands on products are higher. Many deserts in this region are extremely dry, but there are also humid desert areas adjacent to the coast, where the proximity to the sea results in high levels of salinity. Modules need to be able to withstand the harsh natural environment of intense sunlight, sandstorms, high salt and humidity. The requirements for sand and wind resistance and service life are even more stringent.

To overcome these challenges, our module products’ high-purity crystalline silicon is produced using the Eighth Generation Yongxiang Method, with an n-type monocrystalline rate of over 90%, reaching the level of electronic-grade crystal silicon. Using high-quality materials and advanced production processes, we also manufacture cells carrying our scientific and technological genes, passing a series of rigorous tests to ensure that all modules have excellent durability and stability to meet the high-quality levels demanded by customers here.

We have taken the important step of developing a marketing and technical team with cross-cultural communication skills, enabling us to fully appreciate the needs of the local market, having established a deep relationship of trust with our partners.

PV Tech: What’s your view of overseas market trends this year?

Yan Li: We expect that the major markets will continue to grow this year, but the growth rate will be relatively rational. The inventory issue in the European market, which began in May last year, has been the subject of considerable debate, naturally. At that time, the industry was undergoing a significant price adjustment in the supply chain, and end customers were cautious, adopting a wait-and-see approach. The supply chain was also undergoing technological changes, which kept the inventory issue in the spotlight.

However, with the outbreak of the Red Sea crisis at the end of November, most freight-forwarders opted to bypass the region in favour of the Cape of Good Hope, significantly increasing shipping costs and resulting in increased consumption of local inventory in Europe. Additionally, the industry’s overall production schedule was not tight during China’s Spring Festival in January and February this year. Returning to normal levels, the inventory situation has improved substantially compared to last year.

The Red Sea continues to be problematical and, with the significant recovery of end demand, the European market is expected to maintain a growth rate of about 20% in 2024, with a full-year demand forecast of 100GW.The Middle East and Africa market, driven by Saudi Arabia, the UAE and South Africa, is expected to maintain the highest growth rate, with full-year demand expected to reach 30GW.

Despite policy uncertainties in the US, such as the Withholding Order, Forced Labour Act and anti-dumping taxes on four Southeast Asian countries, the IRA (Inflation Reduction Act) policy incentives are expected to maintain growth momentum in the US in 2024. In Latin America, Brazil’s import tariff policy adjustments have had some impact on module demand, but the market size remains considerable.

China remains the largest single market in the Asia-Pacific region, while the rest of the countries in the region are expected to maintain steady growth due to the economic benefits of falling module prices and favourable carbon neutrality policies. Among these, with the Approved List for Models and Manufacturers (ALMM) officially coming into effect on 1 April, the Indian market may experience a decline in demand this year.

In addition to the major European regions – including more than 20 European countries such as the Netherlands, Poland, Germany and France – our modules are now exported to more than 60 countries and regions, such as the UAE, Australia, Brazil and South Africa. The fastest-growing market in 2024 is expected to be concentrated in the Middle East, mainly due to the reserves of government utility projects in countries like Saudi Arabia and the UAE. At the same time, South Africa’s tax rebate and its ongoing power crisis are expected to continue to be catalysts for the growth of its distributed market.

PV Tech: What is your forecast for global PV installations for this year?

Yan Li: Based on research and internal analysis from third-party institutions, it is estimated that the global demand for 2024 will be around 612GW, with the corresponding installed capacity projected to be about 480GW.

For future business expansion, we will continue to build on our previous efforts, expand our business in key markets, explore customer needs and business opportunities and demonstrate the transformation of China’s PV industry from manufacturing to intelligent manufacturing. We aim to contribute to the development of global renewable energy and expect to ship over 50GW this year.