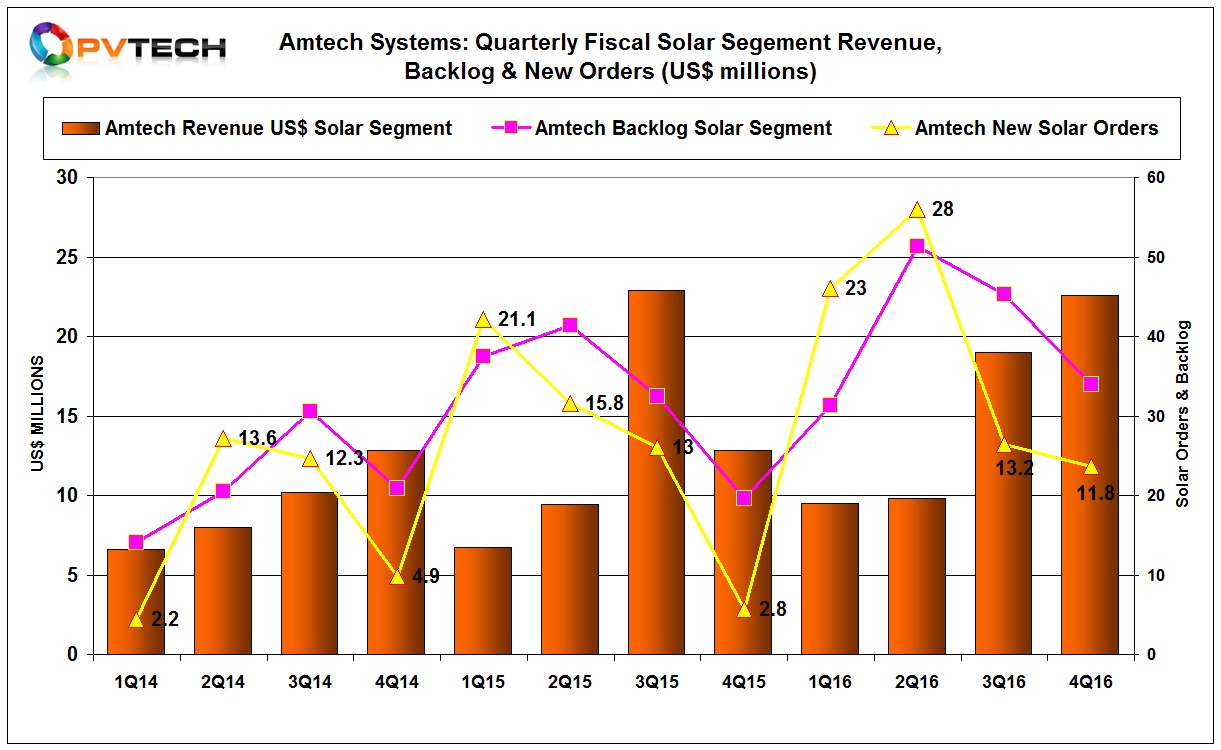

Specialist PV manufacturing equipment supplier Amtech Systems reported Solar segment sales of US$22.6 million in its fiscal fourth quarter of 2016, resulting in full-year preliminary Solar segment sales of US$60.9 million, up from US$51.8 million in 2015.

Amtech reported fiscal fourth quarter Solar segment sales of US$22.6 million, up from US$19 million in the previous quarter.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Solar segment new orders totalled US$11.8 million, down from US$13.2 million in the previous quarter, expected to be due to the sudden slow down in calendar year third quarter new capacity expansion announcements triggered by a major slowdown in Chinese end market demand and fears of overcapacity.

Amtech reported that its Solar segment order backlog stood at US$34.0 million at the end of its fiscal fourth quarter, down from US$45.3 million in the previous quarter. The order backlog remains strong, compared to the prior year period when order backlog stood at US$19.6 million.

Fokko Pentinga, Chief Executive Officer of Amtech, commented, “We are seeing a high level of interest in our newly introduced next generation technology solutions. There has been strong quoting activity throughout this past year which is translating to bookings including those for our new high throughput PECVD and ALD systems. We shipped our first combined PECVD and ALD PERC solution to a top-tier customer in November 2016. The market is showing interest in selective capacity expansion needs, line upgrades, and high-efficiency technology adaptation to ensure competitiveness and long-term profitable growth.”

The company reported gross margin of 29%, level with the previous quarter, while gross margins were higher in its Semiconductor segment, compared to Solar segment margins that were impacted by higher revenue deferrals. Order backlog includes deferred revenue and orders that are expected to ship within the next 12 months.

Amtech reported a net loss of US$0.3 million in the quarter, compared to a net loss of US$1.2 million in the previous quarter. Total preliminary loss for the fiscal year was US$7 million.

Amtech said that it expected total revenue in the next quarter to be in the range of US$25 to US$27 million and total gross margin to be in the mid 20s percent range.