Australian utility AGL Energy has proposed a structural separation of the company that would involve the creation of two separate businesses: one focused on energy retail and the other on large-scale electricity supply.

AGL, which is by far Australia’s largest greenhouse gas emitter, said the retail unit would be called “New AGL” and become the country’s largest multi-product energy retailer, “leading the transition to a low carbon future”.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

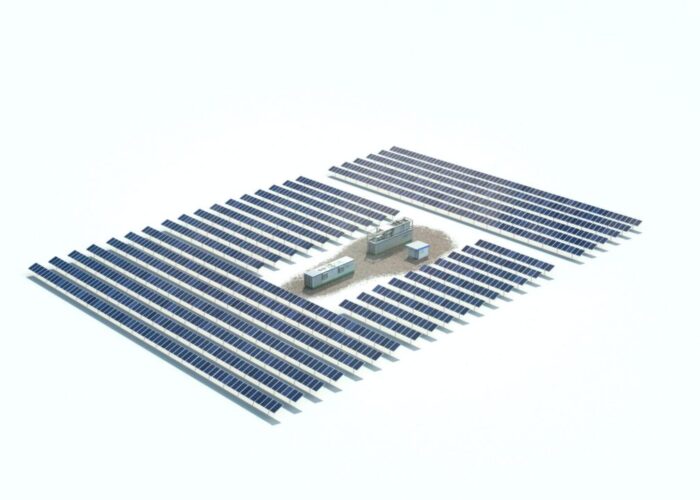

Boosted by the recent acquisitions of Solgen Energy Group and Epho, the business will target the deployment of more than 70MW of commercial solar per year. AGL said the renewables development platform “would be a cornerstone” of New AGL, which would have access to PowAR, an AGL-backed clean energy investment vehicle that is set to increase its portfolio of solar and wind assets to 1.3GW thanks to the recently announced acquisition of Tilt Renewables’ Australian unit. It is expected New AGL would be carbon neutral for scope one and two emissions from day one.

The second busines, dubbed “PrimeCo”, would become Australia’s largest electricity generator, according to AGL, and have 8GW of nameplate thermal capacity. In a presentation for investors, AGL said “coal generation has an essential role to play in Australia’s energy transition as the backbone of the NEM [National Electricity Market]”.

AGL CEO Brett Redman said: “The accelerating market forces of customer, community and technology are driving the imperative to create this new path and separate AGL into two distinct organisations.”

The move to split off its coal-fired assets into a separate unit has been condemned by critics who say the company is dodging its responsibility to manage their shutdown. “Just seven years after it acquired the last of its coal-fired power stations, AGL is walking away from managing their closure, by spinning them off into PrimeCo,” said Dan Gocher, director of climate and environment at the Australasian Centre for Corporate Responsibility.

“The demerger does nothing to reduce emissions, but it may appease some institutional investors who have been demanding AGL do something to reduce its carbon exposure.”

AGL said it will aim to confirm the timing and nature of the proposed structural separation by the end of the year.