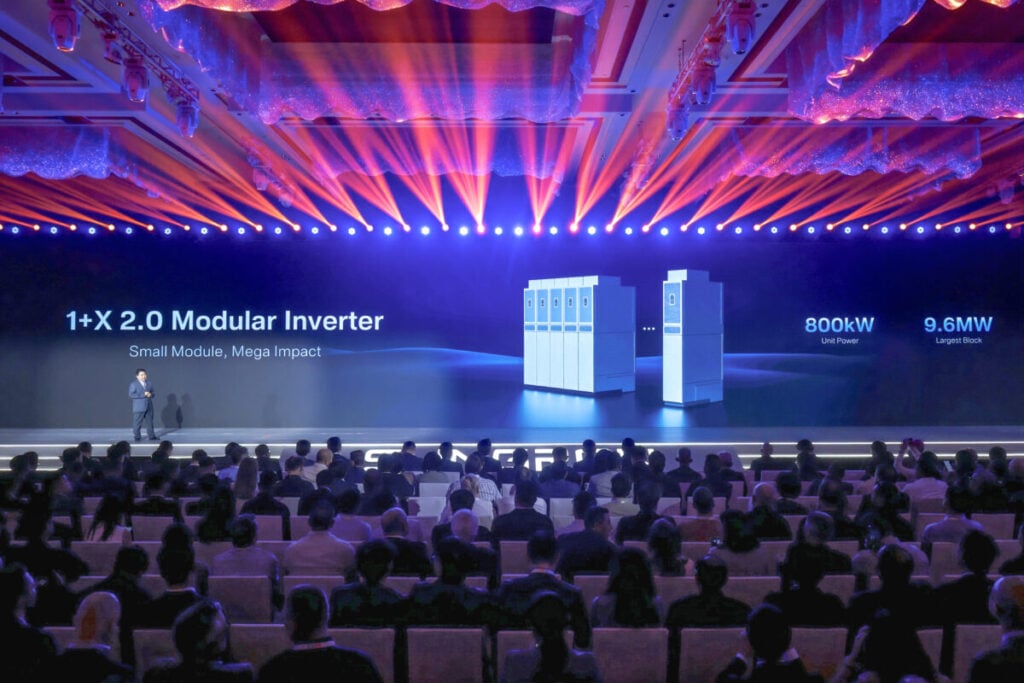

At the Global Renewable Energy Summit 2025 earlier this month, Sungrow unveiled the 1+X 2.0 Modular Inverter, bringing new technological innovations and product upgrades to the industry.

Four years ago, Sungrow launched the world’s first 1+X 1.0 Modular Inverter for PV and storage, which achieved breakthroughs in multiple dimensions.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The current 1+X 2.0 Modular Inverter, based on the 1.0 version, has further upgraded the modular design. Ranging from 800kW to 9.6MW, it offers exceptional flexibility to meet diverse global application scenarios. It also enhances DC-side safety protection, which improves product reliability. Additionally, it features leading grid-forming capabilities, supports both AC- and DC-coupled solutions, and effectively reduces the levelised cost of energy (LCOE).

Sungrow has tailored its main product models for key global PV markets, with a full-scale global rollout expected in Q4 of 2025.

Shortly after the product launch, PV Tech interviewed Lee Zhang, vice president of Sungrow and president of its utility-scale PV Business unit. They delved into the technical details and R&D story behind the new inverter from multiple perspectives.

Industry demands behind the product upgrade

The launch of Sungrow’s upgraded 1+X 2.0 Modular Inverter reflects deep-seated industry trends.

Lee Zhang noted that the previously released 1+X 1.0 version brought significant changes to central inverters. Traditionally, the large size and bulkiness of central inverters made operation and maintenance (O&M) difficult, leading to substantial power generation losses—issues that the 1.0 version effectively addressed.

However, the industry has since encountered new challenges. With the continuous evolution of the PV sector in recent years, application scenarios have become increasingly diverse. Extreme environments such as deserts, offshore areas and high-altitude regions now demand higher reliability in system design and equipment. Meanwhile, grid requirements and power consumption have also undergone notable changes.

With increasing renewable energy integration into power grids, issues such as weakened grid stability, transient overvoltage, frequency oscillations and power quality have become more prominent. Renewable energy curtailment has emerged as a global challenge, with many countries and regions experiencing solar power curtailment and periodic negative electricity prices, undermining investment returns.

“Last month, I visited the Nordics, where people mentioned that negative electricity prices are quite common. According to data from Eurelectric, the EU recorded over 1,400 occurrences of negative electricity prices in 2024. Regions like the Middle East also face significant grid volatility. Now, we need systems that can automatically adapt to grid conditions and enable more intelligent O&M,” said Lee Zhang. “To address market demands, we initiated the R&D project for the 1+X 2.0 Modular Inverter, aiming to introduce more advanced technological products to tackle these challenges.”

Customer needs and feedback played a crucial role in product development. To this end, Sungrow conducted in-depth research by engaging with over 200 clients across more than 50 countries and regions, gathering insights on customer requirements and product application scenarios.

“Customer feedback helps us refine product details,” Lee Zhang explained. “For example, in North America, clients expect higher availability and 1.8 times transient overvoltage tolerance. In the Middle East, customers need products capable of full-load operation under extreme conditions like 50°C+ temperatures and severe sandstorms.”

“In Europe, reliability is paramount. Clients adhere to the IEC 62109 standard while also seeking solutions to mitigate negative electricity prices. In Australia, DC-coupled PV-plus-storage systems have become a typical response to frequent negative pricing. In China, the market demands lower LCOE, enhanced safety and superior environmental adaptability—such as corrosion-resistant equipment for offshore solar projects.”

Across markets, common requirements include broader scenario applicability, stronger environmental resilience, higher safety and reliability, improved grid support capabilities and flexible PV-plus-storage integration. “Based on these market shifts and demands, hundreds of Sungrow’s technical engineers spent nearly two years on R&D and innovation, ultimately succeeding in launching the 1+X 2.0 Modular Inverter,” said Lee Zhang.

What advanced technologies does the 1+X 2.0 Modular Inverter incorporate?

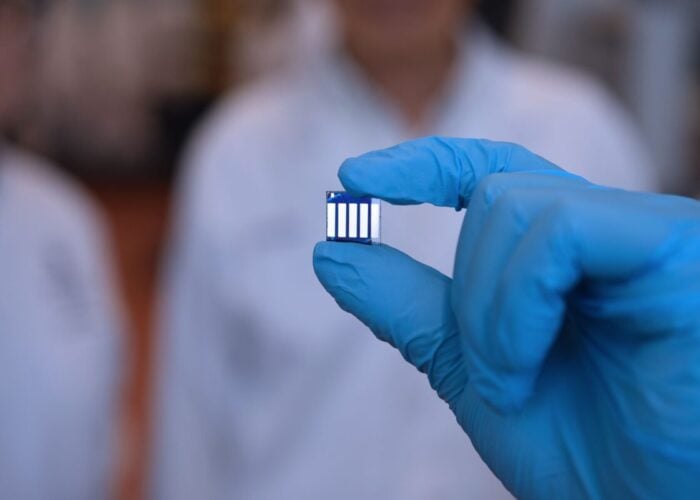

At the product launch event, Sungrow showcased the physical unit of the 1+X 2.0 Modular Inverter. Compared to its predecessor, the new solution design offers more modularity. Each unit features an 800kW rated power capacity and can be flexibly combined like Lego blocks, supporting parallel connections of up to 12 modules to form a 9.6MW block.

Lee Zhang explained: “Through system and equipment optimisation, we finalised the single-module capacity at 800kW. Compared to the previous 1.1MW module in the 1+X 1.0 Modular Inverter, it enables more flexible block designs and lower LCOE.”

“Additionally, each module adopts a split modular design. The power conversion components, such as IGBTs, are in the upper inverter module, which weighs only 105kg—lighter than our 350kW string inverter—and supports plug-and-play operation. If an issue arises, maintenance personnel can replace the upper components within just one hour, ensuring rapid servicing and higher operational uptime.”

For inverter products, reliability is the lifeline. To ensure the reliability of inverter products, Sungrow has established a comprehensive reliability assurance system covering the entire product lifecycle from component selection to overall design.

Lee Zhang cited an example: “In recent years, utility-scale PV projects in the Middle East have grown significantly. However, the region’s extreme heat and high solar irradiance place greater demands on inverter cooling. We upgraded the thermal management system with high-power-density semiconductors and efficient heat exchangers, leveraging digital simulation for full-scenario validation.”

“Our lab conducted rigorous high-temperature tests, with over 300 observation points per unit to ensure every component operates within safe thermal limits. We also pioneered multiple extreme-environment testing protocols, such as simulating high-radiation direct sunlight and multi-unit parallel operation under natural wind disturbances. These stringent tests confirm the product meets client expectations—delivering full-load stability even at 52°C ambient temperatures.”

The PV industry also faces a challenge that cannot be ignored—fire risks. Third-party data shows that 90% of PV plant failures originate from the DC side. Some DC cables are exposed outdoors for extended periods, where any loose connections or insulation damage may lead to short-circuit faults, arcing, or even fires.

Lee Zhang said, “Unlike other systems, PV involves long DC cables with numerous connection points, and many issues occur at the DC level. That’s why we have particularly strengthened DC-side protection measures this time.”

It is reported that the 1+X 2.0 Modular Inverter provides a holistic AI-driven DC-side safety management system to address this issue.

When an arc fault is detected, the combiner box quickly disconnects the faulty circuit within 40 milliseconds. Meanwhile, through inverter cluster control technology, other combiner boxes in the same block are serially shut down to prevent fire risks.

Lee Zhang also mentioned a key point that Sungrow’s product design takes into account industry trends for the next five years. He said, “Looking back at the inverters we previously supplied to utility-scale power plants in Northwest China, when grid upgrades were later required, our products only needed software upgrades—all because we had completed some technical preparations in advance.”

Currently, the PV industry has reached a development stage in which it is strongly linked to energy storage. Energy storage systems have now become a standard configuration for PV power plants.

“Against this backdrop, DC coupling has become a key focus. The 1+X 2.0 Modular Inverter supports both AC- and DC-coupled schemes. In addition to storage configuration, grid-forming capability is now critical for stable PV system operation. The new solution has achieved major innovations in grid-forming, delivering stronger and faster inertia support and reducing response time from hundreds of milliseconds to just five milliseconds. This enables rapid grid frequency stabilisation and supports 1.8 times transient overvoltage tolerance,” Lee Zhang added.

Particularly noteworthy is that the 1+X 2.0 Modular Inverter achieves lower LCOE through end-to-end system optimisation innovations.

Taking a 1GW power plant as an example, the 1+X 2.0 Modular Inverter can save US$3.24 million in capex. Meanwhile, features like AI-powered fault diagnosis and portable O&M can further reduce opex by US$4.17 million, delivering total savings of US$7.41 million.

Competitive landscape and future trends

According to the latest April 2025 report “Global Electricity Review 2025” by think-tank Ember Climate, global clean energy generation additions reached 858TWh in 2024. Solar accounted for 474TWh of this, marking its third consecutive year as the largest source of new generation and the fastest-growing power source in two decades. Solar has flourished across Europe, North America, the Middle East, Asia and Australia. However, as renewable energy’s share dynamically increases, grid stability faces growing challenges.

“Each country or region has its unique grid characteristics. We’ve adopted a grid-specific security and stability solution. From grid operators’ perspective, customers expect equipment to avoid frequent grid connection/disconnection, and this requires in-depth research. Accordingly, Sungrow maintains close collaboration with global research institutions and grid companies. In the future, grid integration will be a key direction,” said Lee Zhang.

For PV companies, developing new products requires massive investments, especially when custom components are needed. Each product undergoes a lengthy and arduous process from R&D to production and application validation.

Lee Zhang said: “Current industry competition is intensifying, with particularly fierce price wars in the market, while technical requirements continue rising. This demands increased R&D investment and team-building from enterprises. I believe the market will only impose higher demands on inverter manufacturers’ comprehensive capabilities in the future.”

In this context, Lee Zhang called for inverter companies to return to value-based competition by enhancing product technology and quality, rather than engaging in endless low-price competition. Prolonged price undercutting would compromise inverter reliability and quality, ultimately harming the industry’s long-term healthy development.

Looking ahead, Lee Zhang remains confident about the development of the PV industry. He said: “Although the PV industry has already matured, there is still a certain distance to go before it becomes the dominant energy source. In the early stages, growth was driven by demand for clean energy, but in later phases, electrification will be the key driver—whether in power generation or other sectors like AI and EV charging. Currently, global electrification rates remain below 30%, but targets for Europe, the US and China all aim to reach 50% by 2050.”

“As an economical and flexible renewable energy source, PV offers diverse applications and broad prospects through continuous technological innovation. For example, it will play a crucial role in building urban load-centred large local area networks and microgrids. At the same time, the integration of PV with EV chargers will become a trend. In a few years, PV will also combine with hydrogen and other technologies to create diversified application scenarios,” Zhang concluded.