In 2023, a collective US$1.8 trillion went towards energy transition technologies and their supply chains, including solar PV and other renewables generation, grids, electrified transport and clean tech factories.

According to the latest Energy Transition Investment Trends 2024 from Bloomberg New Energy Finance (BNEF), considerably more investment will be needed for renewable energy deployments to achieve net zero, though the massive oversupply of solar module manufacturing capacity in 2023 meant that investments into clean energy supply chains are already beyond the requirements of the Paris Agreement.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Renewables grows, but more to be done

BNEF’s report found that global investment into new renewable energy generation and storage projects rose 8% to US$623 billion in 2023 compared with 2022. This was more modest expansion than was seen in the electric transport sector, which became the largest sector for spending for the first time in 2023, growing 35% year-on-year to US$634 billion.

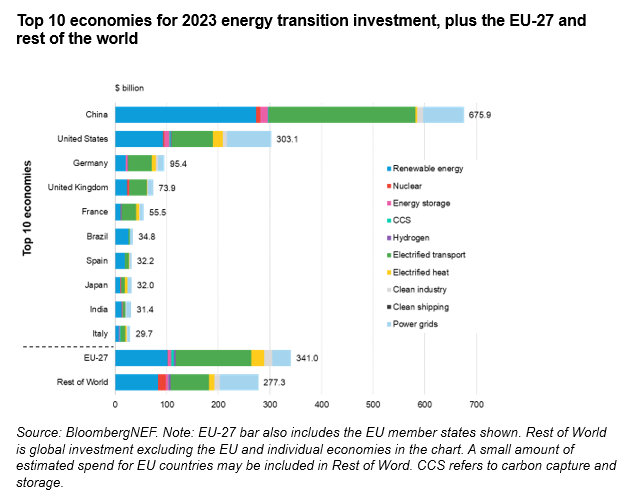

In terms of markets, China is still the clear leader with US$675.9 billion of investment last year, 38% of the global total. The US is the second-largest funding destination (US$303 billion) followed by Germany (US$ 95 billion) and the UK (US$74 billion). The 27 EU member states collectively recorded US$341 billion, BNEF said, making the EU the second largest contributor when considered as a whole.

The US’ investment growth is particularly visible in the renewable energy generation and grid sectors, which each neared US$100 billion respectively, far greater than any other nation besides China. The reason for this is clear: the Inflation Reduction Act (IRA), which contains in excess of US$360 billion in tax credit incentives for renewable energy investments, is beginning to take effect and make the US the primary alternative to China’s global dominance of the industry.

Despite the growth documented in this report, BNEF said that its Net Zero scenario – which is aligned with the Paris Agreement – would require almost triple the current level of investment. US$4.84 trillion a year is required between 2024 and 2030, rising to US$6.5 trillion a year in the following decade and US$7.5 trillion a year from 2041-2050.

Solar manufacturing “glut”

By contrast, the investments into renewable energy manufacturing – including solar module production, battery production and metal mining – are exceeding the levels needed for BNEF’s global Net Zero scenario. This is largely due to massive expansion and overcapacity of solar module production in China.

The report said: “The current solar oversupply is such that no new factories are required by 2030. The supply glut will put pressure on solar module prices for years to come, and weakens the case for localising production in markets with little existing solar manufacturing.”

On the topic of oversupply, PV Tech head of research Finlay Colville published a blog late last year predicting that, following years of growth, 2024 would see a downturn in the solar manufacturing industry, partly as a result of massive capacity expansions by the major Chinese players which has forced prices to historic lows. Indeed, a report from energy analyst firm Wood Mackenzie earlier this month said that module production capacity in China was around three times greater than the entire global demand.

Regarding the case for local solar production in less established markets, in recent weeks European solar manufacturers and representative industry groups have been calling for aid to prevent a complete collapse of the industry. Reports emerged last year of massive oversupply in the European market, and the European Solar Manufacturing Council (ESMC) began warning of price dumping by Chinese manufacturers that made the marketplace uncompetitive for domestic products.

More recently, major European companies Meyer Burger and REC Group have announced the shutdown of facilities in Europe due to unsustainable market conditions.

In the US, the IRA has the potential to support a more positive story for manufacturers. Whilst abandoning operations in Germany, Meyer Burger is simultaneously setting up a new factory in Arizona, and many of the largest PV players including Canadian Solar, JA Solar, Hanwha Qcells and others are in the process of establishing US production bases.

As per BNEF’s graph above, the driving force behind clean energy manufacturing investment over the coming years is going to be energy storage. The report said that “Battery plants make up roughly 70% of the spending required over 2024-2030”, which is reported in depth by our colleagues at Energy-storage.news.