The COVID-19 crisis will this year push global solar growth back to 2019 levels as project returns are “decimated” by having to fund orders with a value-soaring US dollar, experts have warned.

Prior to the COVID-19 outbreak, dynamics including tumbling technology costs and abundant finance had fuelled predictions of a solar boom in 2020, but the advent of the pandemic has forced some to rethink existing forecasts.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

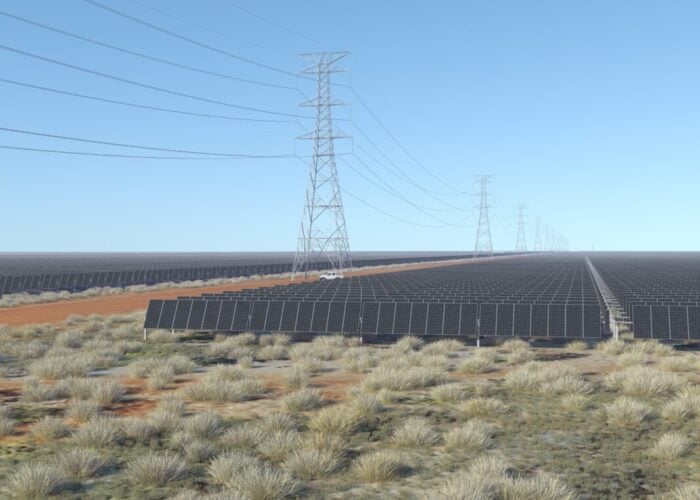

Rystad Energy, for one, said this week it had initially expected 140GW of worldwide solar additions in 2020 but has now lowered the figure to 126GW, a repeat of 2019’s number. The consultancy extended the analysis to wind power, set to add 71GW where 75GW had been predicted.

The Oslo-headquartered firm predicted an even bleaker outlook for the years beyond 2020, pointing at impacts from currency value swings. Foreign exchange rates will “decimate” the prospects for solar in 2021 and those of wind players from 2022 and beyond, Rystad said.

Procurement capital cost rises of ‘up to 36%’ possible

Analysts’ attempts to put a figure on COVID-19’s solar impacts come as anecdotal evidence continues to pile of delays across key markets, including the talk of rising layoffs in the US and the struggle of Italian developers to secure project licenses and bank guarantees.

According to Rystad, the core issue may not be supply chain delays – global shipments have “more or less” arrived as expected, the firm said – as much as the surging value of the US dollar, typically the currency of choice for developers purchasing components.

“Projected returns on developments under procurement are already plummeting as unfavorable exchange rates result in soaring equipment prices,” Rystad said, adding that the risk is greater for utility-scale wind projects, whose capex flows are more US dollar-reliant than solar’s own.

Coupled with nosediving local currencies, the towering of the US dollar could see solar and wind projects pay up to 36% more in capital costs during the procurement phase across certain markets, according to the firm's estimates.

Mexico, Brazil exposed as emerging markets face risks

According to Rystad, the fallout expected around foreign exchange rates will be felt more strongly across emerging renewable markets, from Asia to Latin America and the Middle East.

The firm singled out Mexico and Brazil amongst the worst hit. Both countries may boast large utility-scale solar pipelines but are witnessing declines with local currencies, Rystad said, adding: “Projects hoping to be commissioned in 2021 will be significantly slowed or even indefinitely delayed.”

Elsewhere, India may be less impacted by depreciation while Australia faces a mixed outlook. Work will continue on under-construction PV projects but those in search for finance and components will “surely stop”, Rystad said, pointing at the 17-year low value of Australia’s dollar value.

In addition, the firm believes Chinese and US renewables will be least affected by exchange rate swings while in Europe – where Rystad expected 2020 solar additions of 20GW pre-pandemic – the impacts could aggravate if the Euro’s value continues to drop.

PV Tech has set up a dedicated tracker to map out how the COVID-19 pandemic is disrupting solar supply chains worldwide. You can read the latest updates here.

If you have a COVID-19 statement to share or a story on how the pandemic is disrupting a solar business anywhere in the world, do get in touch at [email protected] or [email protected].