China-based polysilicon production Daqo New Energy Corp said polysilicon shipments to third-parties would continue to decline as in-house wafer production continued to expand and its polysilicon facilities running at full-capacity.

Daqo reported first quarter 2016 polysilicon production levels lower than the previous quarter, due to Chinese New Year and shorter days.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

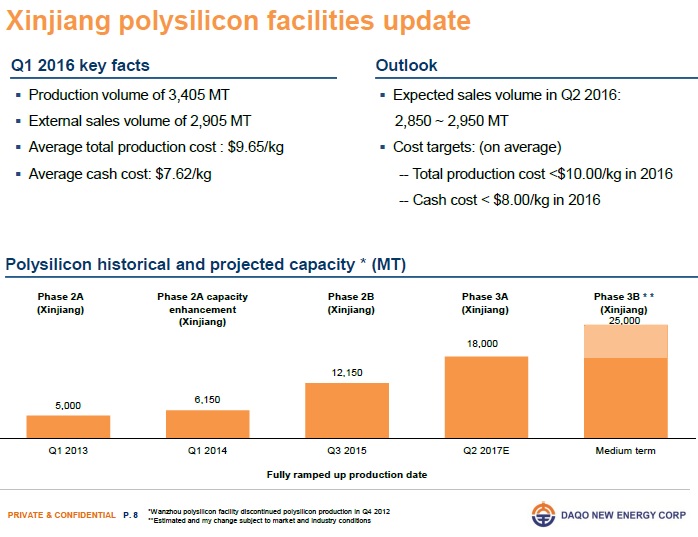

Dr. Gongda Yao, CEO, Daqo said: “During the quarter, we produced 3,405 MT of polysilicon, representing full utilization of our manufacturing facilities, which surpassed our name plate capacity of 12,150MT per year. The slight decrease in polysilicon production volume compared to Q4 of 2015 was primarily due to a smaller number of calendar days in Q1 of 2016, and the impact of the Chinese New Year holidays.”

Daqo sold 2,905MT of polysilicon to external customers in the first quarter of 2016, compared to 3,092MT in the previous quarter. The lower external shipments are expected to continue while the company ramps solar wafer production and is capacity constrained until its Phase 3A polysilicon facilities are completed.

The company said that its Chongqing wafer facilities consumed 520MT of polysilicon in the first quarter of 2016, up from 415MT in the previous quarter, despite the holiday period and short calendar days in the reporting quarter.

Daqo noted that wafer production volume is expected to increase to 25 million pieces per quarter by mid-2016, up from 21 million pieces in the fourth quarter of 2015.

Polysilicon average total production cost and cash cost were said to be US$9.65/kg and US$7.62/kg, respectively, during the first quarter. Polysilicon average total production cost and cash cost were US$9.74/kg and $7.69/kg, respectively, in the previous quarter.

Average selling price (ASP) of polysilicon was US$13.72/kg in the first quarter of 2016, compared to US$13.86/kg in the prior quarter.

The company noted that during April and May, polysilicon market prices had increased by approximately 40% to 45% from the January level, driven by low levels of channel inventory and an increase in downstream customer demand.

Financial results

Daqo reported first quarter revenue of US$57.7 million, compared to US$59.3 million in the previous quarter. Non-GAAP gross margin was 32.6%, compared to 31.9% in the previous quarter.

EBITDA (non-GAAP) was US$21.9 million in the first quarter, compared to US$23.4 million in the previous quarter. EBITDA margin (non-GAAP) was 38.0%, compared to 39.5% in the previous quarter.

Gross profit was approximately US$16.7 million, compared to US$16.9 million in the fourth quarter of 2015 and US$8.5 million in the first quarter of 2015.

Gross margin at its Chonqing wafer facility was said to have improved to 28.3% in the quarter, compared to 27.0% in the previous quarter.

Revenues in the quarter from wafer sales were US$17.8 million, compared to US$16.4 million in the fourth quarter of 2015 and US$14.6 million in the first quarter of 2015.

Guidance

Daqo guided second quarter polysilicon shipments to external customers to be in the range of 2,850MT to 2,950MT. Wafer sales volume is expected to be approximately 23.5 million to 24.0 million pieces.