Renewables investment firm Copenhagen Infrastructure Partners (CIP) has reached final close on its oversubscribed new fund, CI Energy Transition Fund I (CI ETF I), with €3 billion (US$3 billion) for green hydrogen and ammonia investments.

The fund will invest in next generation renewable energy infrastructure such as power-to-X (PtX) projects in hard-to-abate industries with an almost even split in commitments from new and existing investors in CIP funds.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Moreover, CI ETF I will be focused on greenfield projects in the OECD, with the goal to decarbonise industries such as aviation, shipping, agriculture, chemical manufacturing and steel production with the production of green fuels, feedstock and CO2-free fertilisers.

Investment in green hydrogen is not uncharted territory for the Danish fund manager, as it recently partnered with Portuguese developer Madoqua Renewables to build a green hydrogen and ammonia project in Portugal with an investment of €1 billion.

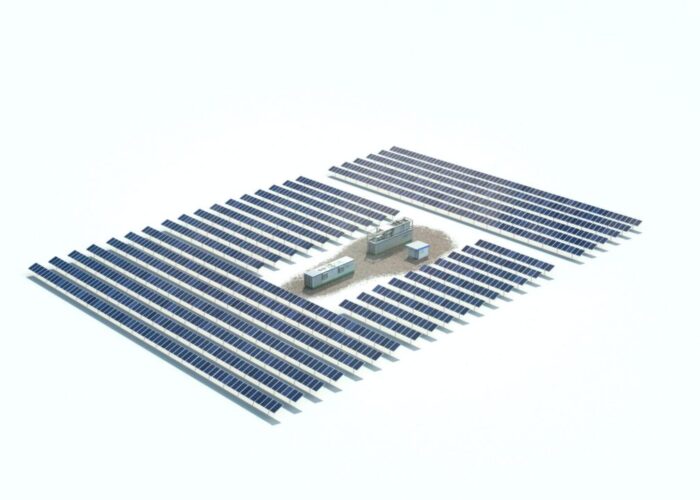

The Danish firm has also backed a green hydrogen facility in Western Australia that is set to be powered by 5GW of solar PV and onshore wind back in 2020.

Jakob Baruël Poulsen, managing partner in CIP, said: “Solutions such as power-to-X will be key for countries and industries to take the next big leap within reaching the commitments of the Paris agreement and achieving energy independence.”

Furthermore, the fund has already reached final investment decision (FID) on one investment and ownership on several other PtX projects across Europe (Denmark, Norway, Spain and Portugal), in Chile and Australia based on gigawatt-scale renewable energy production and electrolysis capacity of green hydrogen and green ammonia.

Once the current portfolio starts being operational it will have a capacity of delivering 4 million tonnes of green fuels per year.

Thus far, CIP has raised €19 billion for investments in energy and infrastructure across ten funds and expects to manage €100 billion in green energy investments by 2030.