The US Department of Commerce (DOC) will apply countervailing duties (CVD) to solar cells imported from Southeast Asia following an affirmative preliminary determination.

This is the first determination reached in the ongoing antidumping and countervailing duty (AD/CVD) investigation into imports of crystalline silicon solar cells, whether or not assembled into modules, from four Southeast Asian countries.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The DOC’s International Trade Commission (ITC) released a list of companies operating in Thailand, Cambodia, Malaysia, and Vietnam that it says are receiving subsidies to produce crystalline solar cells. Countervailing duties are designed to offset these subsidies and any adverse effect they have on domestic US market conditions and producers.

The ITC named 17 companies across the four countries and also provided subsidy rates for “All others” in each country. A number of preliminary determinations were reached based on “adverse inference,” where a company did not supply the ITC with evidence.

Among the companies named are Korean manufacturer Hanwha Qcells and the world’s largest solar manufacturer JinkoSolar (both operating in Malaysia), and JA Solar, operating in Vietnam.

The ITC also provided the US with import statistics from each of the four countries, which show massive increases over the last three years. In 2023, over 12.3GW of solar cells (in modules or not) worth around US$3.9 billion were imported from Vietnam compared with 5.3GW in 2021. Thailand and Cambodia saw similarly large increases, from 4.2GW in 2021 to 10.6GW in 2023 and 799MW in 2021 to 6.7GW in 2023, respectively.

The DOC’s final determination is expected in February 2025 and an issuance of orders will come in April if all determinations are affirmative.

‘An important early step’

The AD/CVD case was brought in April by the American Alliance for Solar Manufacturing Trade Committee, a group comprising US Cadmium Telluride (CdTe) thin-film solar manufacturer First Solar, the US arm of Hanwha Qcells, REC Silicon and Meyer Burger.

The petition alleges that Chinese-owned or affiliated solar manufacturers in the four countries are benefitting unfairly from subsidies that result in “price dumping” of solar products below viable cost in the US, which ultimately damages US solar manufacturers.

Tim Brightbill, the group’s lawyer, said the preliminary determination was “an important early step in a year-long process to determine the amount of illegal government subsidies benefiting these companies. This preliminary determination shows that we are still very early in these investigations, and we expect the final determination to reflect the true harm these imports bring to US manufacturing.”

Following the initial April petition, the Alliance subsequently brought a Critical Circumstances lawsuit to the DOC over a “surge” in imports from Southeast Asia this year and sought retroactive tariffs to be applied. The ITC did not provide data for 2024 imports.

Brightbill said: “We are confident that the duty rates will increase as Commerce continues to investigate newly alleged subsidies. It is our understanding that producers in all four countries are still responding to detailed questionnaires required in these cases which will impact the final findings.”

US module prices have risen

When the AD/CVD petition was brought, US energy market analyst Clean Energy Associates (CEA) warned that an affirmative finding could trigger a cell supply “bottleneck” for the US, as the supply from non-AD/CVD countries would be less than market demand.

CEA later predicted that AD/CVD could raise the price of US-made solar modules by up to US$0.10/watt and imported products by US$0.15/watt. This is because the majority of US manufacturing capacity produces modules which rely on imported cells; until domestic cell capacity catches up with module assembly, the cells to supply US modules will be harder to get.

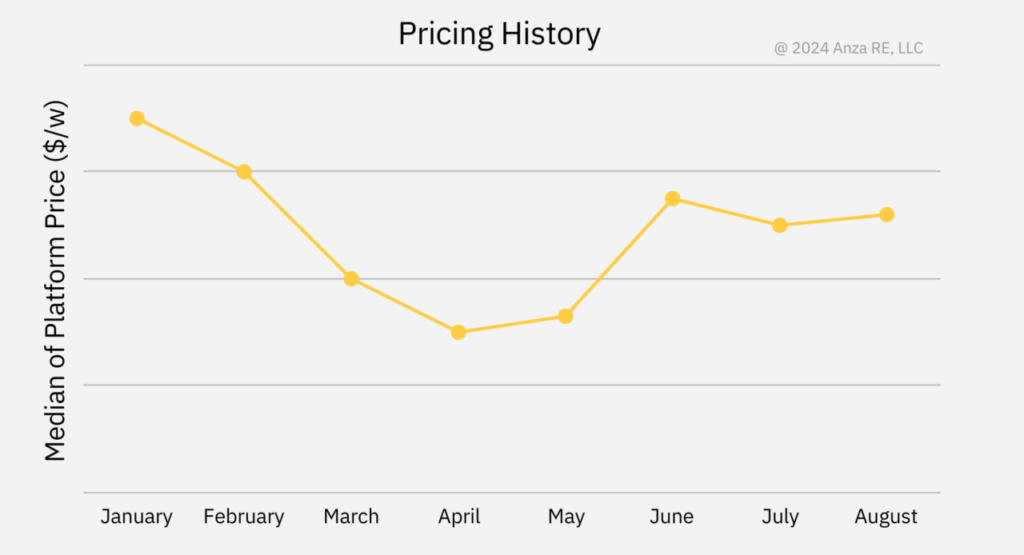

In data released today, solar data platform Anza Renewables said that US solar module prices showed a “notable rise” in Q3 2024 “as the effects of the AD/CVD petition begin to take hold”. Anza said that the median price of US modules rose by 8.8% from April (when the petition was filed) to August.

In its report, it said that AD/CVD and other US tariff shifts have “created a more complex market landscape where rising costs are more pronounced for specific suppliers” in Southeast Asia. “Overall, we saw an increase in pricing by about 15% for Southeast Asian module supply from its lows in April to August 2024.”

Anza added: “Several factors contribute to the ongoing market shifts…a range of interconnected dynamics are also at play.”