Microinverter supplier Enphase Energy has reported a doubling in Q1 revenue but warned of tumbling demand as the COVID-19 crisis keeps solar installers at home.

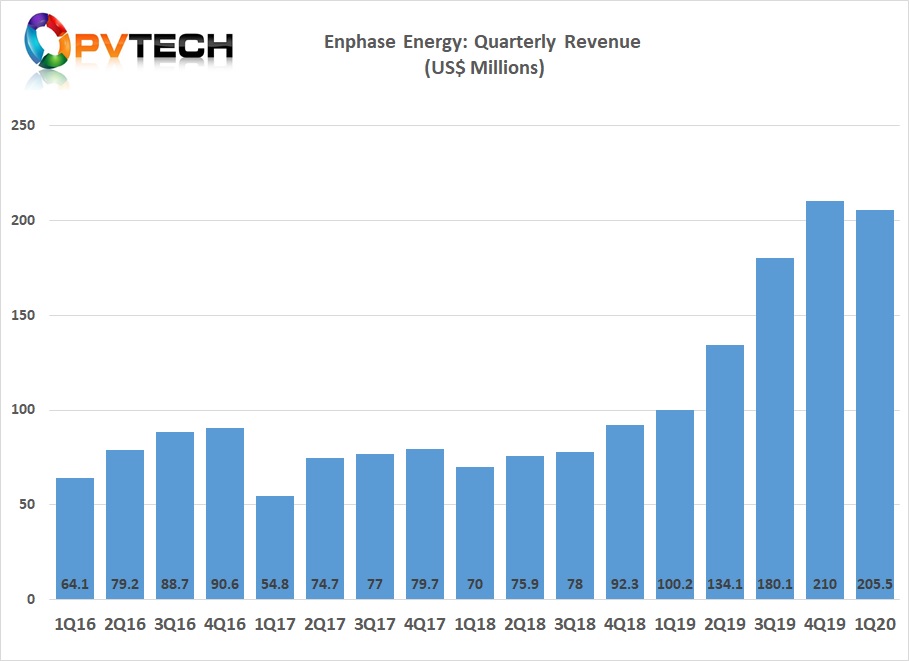

Enphase revealed that total revenue for Q1 2020 stood at US$205.5 million, a 105% increase year-on-year and a slight reduction from revenue of US$210 million in the previous quarter.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

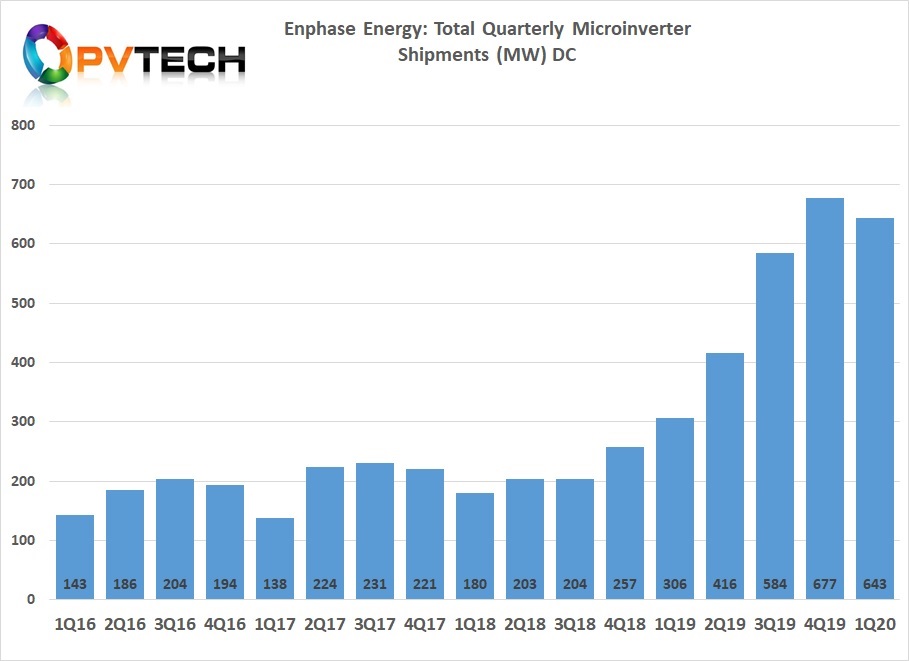

It shipped around 643MW of microinverters, again more than double the 306MW it shipped in Q1 2019, equivalent to more than 2 million units.

The equipment manufacturer also hailed a record-high margin of 39.2%, driven it said by a disciplined approach to spending and product pricing.

But while those figures constitute a boom for the California-based firm, it was quick to issue a dampened outlook for the current quarter as the ongoing effects of the COVID-19 pandemic impact across its business.

Enphase now expects Q2 2020 revenues to be in the US$115 – 130 million range, a figure which would constitute a year-on-year slide.

During an investor call held after the market closed yesterday, chief executive Badri Kothandaraman cited various industry reports as providing evidence that residential solar installs in the US had fallen by between 30 and 50%, with some markets – most notably New York, hit hard by the virus and California, which has extensive shelter in place rules – hit hardest.

While Kothandaraman said the market could yet rebound towards the end of May or early June, Enphase is gearing up for growth again in Q3.

As a result of the reduced demand in Q2, Enphase said it was working with its supply chain partners in North America and China to “optimise” its inventory moving forward.

Its manufacturing facility in Mexico was deemed essential and has experienced no significant production disruption as of yet. Around 700,000 units were manufactured in Q1 and the factory witnessed a run rate of around 70,000 per week towards the end of the quarter. Enphase still expects to be capable of producing some 1 million units per quarter from its Mexico facility by Q4 2020, but only if demand allows for it.

With demand low and installer activity uncertainty, Enphase said it had also postponed the launch of its Encharge domestic storage product until June, but had been successful in migrating all of its installer training services to online platforms. Enphase, Kothandaraman said, had “not missed a beat” in supporting its installer base throughout the pandemic.

Meanwhile, Enphase Energy also confirmed its intent to repurchase up to US$200 million worth of shares between now and March 2022.

Enphase Energy Q1 2020 investor call transcript provided by Seeking Alpha.

PV Tech has set up a dedicated tracker to map out how the COVID-19 pandemic is disrupting solar supply chains worldwide. You can read the latest updates here.

If you have a COVID-19 statement to share or a story on how the pandemic is disrupting a solar business anywhere in the world, do get in touch at [email protected] or [email protected].