European countries need to double the pace of solar PV installations if the continent is to keep pace with its climate commitments, new research from Ember has revealed.

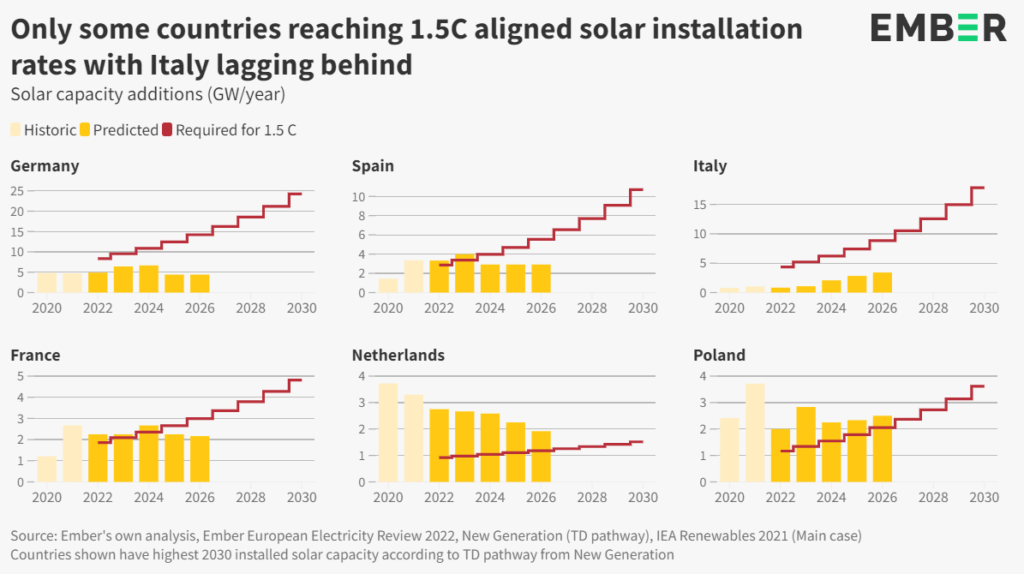

Deployment of solar and wind for this year and 2023 are “close to the required values”, with solar considered to be about 12GW away from its required installations. But by 2026 capacity additions would only meet half of what’s required to keep within a target of limiting the effects of climate change to 1.5 degrees Celsius.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Solar capacity additions have soared in recent years, the continent’s cumulative capacity rising from 104GW to 162GW over the past three years. That is equivalent to a yearly growth rate of 15% per year, but the next four years of additions will fall short in several key EU countries.

Poland and the Netherlands will be able to install above the 1.5C target for solar capacity needed, while Italy on the other hand is predicted to only install a third of its required capacity between 2022 and 2026 as shown in the chart below.

Issues such as the lack of available grid capacity will cause a downward trend of solar installs in Spain, Germany and the Netherlands, while the time taking to navigate permitting has also been highlighted as a major hindrance to installations.

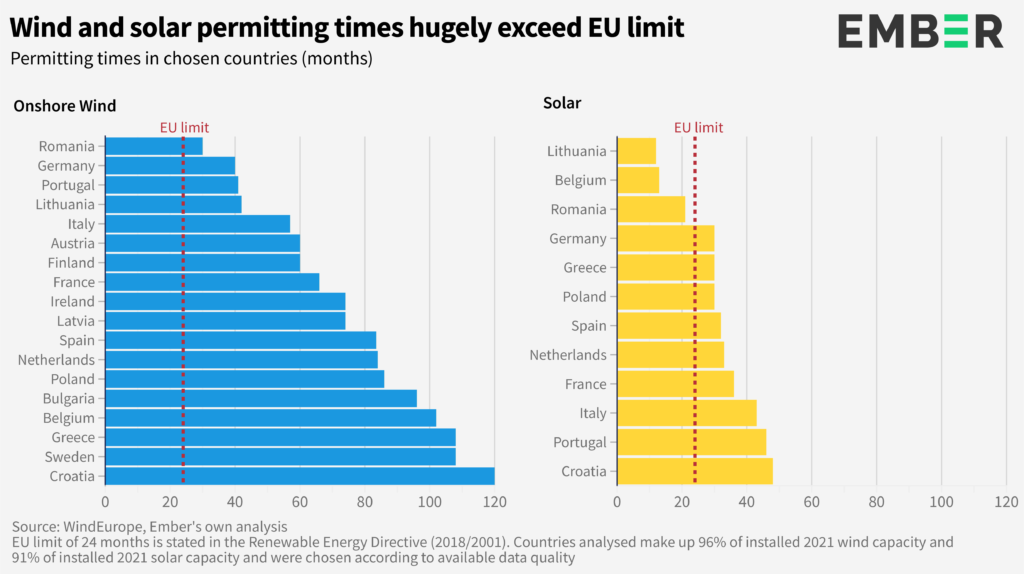

Permits for solar PV are exceeding the 2-year limit set by the EU in nine of the 12 countries analysed by the energy thinktank (which accounts for 91% of current installed solar capacity), with Portugal and Croatia almost doubling that timeframe.

Permitting has been repeatedly raised by developers and the EU has moved to address it within the bloc’s REPowerEU strategy, published in May, which sought to introduce a simplified and faster permitting process that would accelerate the deployment with a maximum timeframe of one year.

Harriet Fox, energy & climate data analyst at Ember, said: “Europe no longer lacks renewables ambition, but it is now facing an implementation gap. Higher targets have not yet translated into accelerated deployment on the ground. Europe needs to urgently buckle down on removing permitting barriers to unleash the full potential of renewables.“

Common issues with permitting include a lack of digitalisation of the process, not enough resources at local level, delays caused by legal appeals and an overlap of responsibilities between different authorities.

Moreover, if the EU is to keep pace of its nearly 600GW of solar PV by 2030, it will have to focus on removing barriers to installation such as permitting length and the amendment to the Renewable Energy Directive has to be passed this autumn.

Due to administrative barriers gigawatts of European renewables are being delayed, with just 20GW of solar capacity waiting for grid connection permits in Poland alone, according to the Ember report.