Europe could receive 24GW of renewable power through subsea transmission interconnections with North Africa, according to a report from energy research firm Rystad Energy.

As Europe’s demand for renewable energy capacity increases, North Africa’s significant solar, wind and land resources could prove a “key enabler” for the former’s energy transition goals, Rystad said.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

North Africa has higher solar irradiation levels and wind speeds and far more available land than most of Europe, which Rystad said could see the average solar plant in the region “triple” its yield compared with European projects.

To date, two 700MW high-voltage cables between Morocco and Spain are the only interconnections between the two continents. A third cable of the same capacity is planned, as well as the Xlinks project between Morocco and the UK. Xlinks – which would have 11.5GW of renewable energy generation capacity and a 5GW/22.5GWh battery energy storage system – was designated as a Nationally Significant Infrastructure Project (NSIP) by the UK government last year.

Rystad identified two other interconnection projects: the GREGY initiative between Greece and Egypt and the ELMED-TUNITA project between Tunisia and Italy.

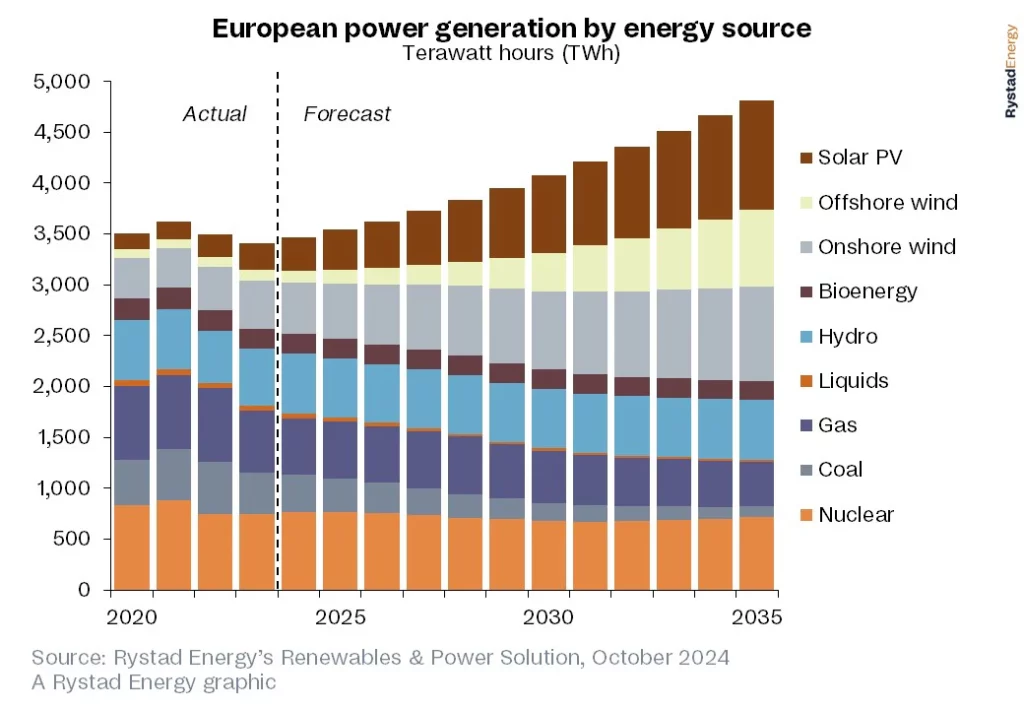

If the Xlinks, GREGY and ELMED-TUNITA projects come online, Rystad said they would require around 7.2GW of interconnector capacity and the construction of 23GW of renewable energy capacity in North Africa, requiring investment of over US$27.5 billion. At full capacity, they could supply 1.6% of Europe’s current overall power generation.

PV Tech Premium looked into the notion of transferring power from North Africa to Europe last year.

“The region’s geographic proximity makes it a natural fit for buyer-seller relationships, leading to large-scale solar and wind projects, along with subsea cables across the Mediterranean and even to the UK,” said Nivedh Das Thaikoottathil, senior analyst of renewables & power research at Rystad Energy.

He added: “North Africa’s renewable energy potential aligns well with Europe’s goal of reducing reliance on Russian natural gas.”

Supply and investment

Rystad said that the completion of North African energy projects is hindered by potential supply chain constraints. It said: “With limited local manufacturing capacity, the region must rely heavily on imports…This dependency not only exposes North Africa to supply chain risks and price volatility, but also highlights a significant vulnerability in its energy strategy.”

For solar, this translates to a reliance on Chinese imports which, whilst abundant (China can currently manufacture more than twice the world’s annual demand for solar modules annually), are exposed to possible supply disruptions.

Rystad said that the supply of high-voltage direct current (HVDC) and extra-high-voltage (EHV) subsea cables could also pose a challenge. Europe currently produces the majority of these cables, Rystad said, with production set to reach around 16,000 kilometres annually by 2030. However, demand is forecast to exceed 75,000 kilometres by the same time, which Rystad said could prompt interventions from Asian manufacturers.

By the end of the decade, the solar supply situation may have shifted slightly, as a number of manufacturers (albeit Chinese-owned) have announced investments for solar manufacturing capacity in the Middle East. Both JinkoSolar and Q-Sun have announced plans for 10GW cell and module production facilities in Saudi Arabia and Oman, respectively.

Middle Eastern countries have provided much of the investment for the major solar projects in North Africa to date. Last month, the UAE-based renewable energy developer AMEA Power announced a plan for a 1GW solar PV project in Egypt. AMEA Power is owned by Al Nowais Investments, one of the largest Emirati asset-holding companies. UAE state-owned developer Masdar also confirmed that around 30% of its last US$1 billion green bond raise came from investors in North Africa.

The benefits of interconnections between North Africa and Europe—greater investment and a greater clean energy supply, respectively—will likely entail reliance on Chinese and Middle Eastern products and investments in place of reliance on Russian gas.

European developers like Norway’s Scatec and French-owned Voltalia have also undertaken significant investments in the region.

This article was amended to show the updated planned capacity of the Xlinks project.