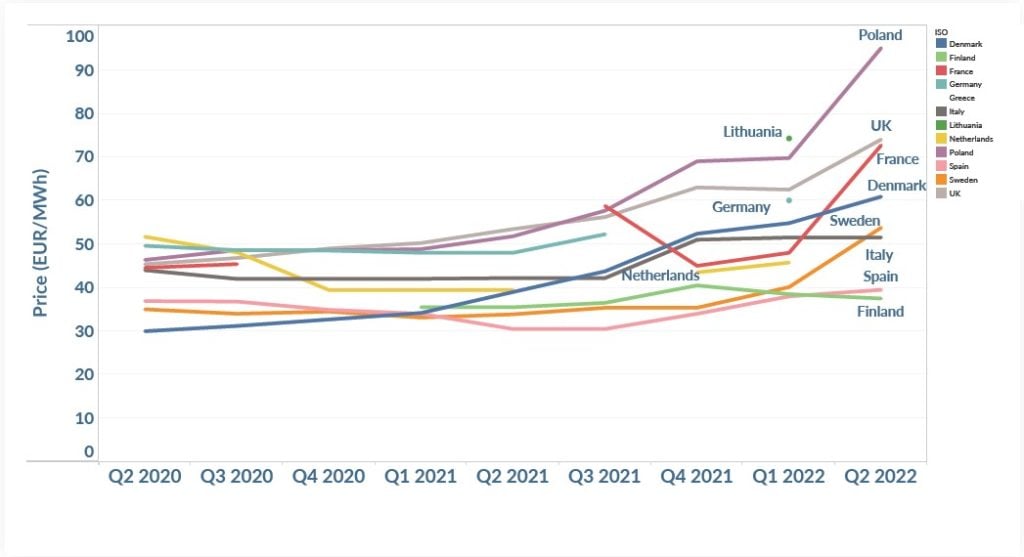

European power purchase agreement (PPA) prices have surged by a “staggering” 47% year-on-year as the continent’s energy crisis persists with soaring inflation, LevelTen Energy has said.

But despite the increase, PPA prices “remain attractive” due to wholesale electricity prices continuing to be stubbornly high.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Having previously forecast for PPA prices to level off this year in Europe, Russia’s invasion of Ukraine have caused prices to soar with supply failing to keep up with demand, Flemming Sørensen, VP of Europe at LevelTen Energy said within the power pricing firm’s latest Price Index report.

As a result, Europe’s P25 Index – an aggregation of the lowest 25% of solar and wind PPA offers – now stands at €66.07/MWh (US$66.20/MWh), a 16% hike on Q2, an almost eight percentage point increase on the previous quarter when prices increased 8.1%.

Meanwhile, PPA pricing has also been swayed by drives from European government to accelerate the deployment of renewables, as well as the growing economics of merchant business models.

“With public and private sector renewable ambitions growing, developers have no shortage of options when it comes to selling their clean electricity,” said the report.

This is a trend seen in Poland, where P25 solar prices have reached €95/MWh – prices spiked 36.2% due to the cessation of natural gas imports from Russia – with developers taking their projects to the wholesale market as its electricity prices remain high, forgoing PPAs.

And there are ongoing concerns about the risk of price cannibalisation in renewables markets with solar production outpacing demand in some markets – most notably in Sicily – which could lead to “diminishing revenue for developers and uneconomical procurements for buyers”, the report has claimed.

The P25 Index for solar offers rose 19.1% to €59.43/MWh in Q2, nearly €10 higher from Q1 2022. Markets in Spain and Finland remained more stable, however, with P25 index prices for solar even falling slightly – by 2.6% – in the latter.

Issues impacting Europe’s PPA are set to persist for some time yet too, with Sørensen stating that there isn’t a “clear end in sight” as the root causes of the imbalance could take years to resolve.

Developers continue to struggle to build new solar and wind projects, which are sorely needed, due to tough permitting and interconnection challenges and the rising cost of inputs and labor,” added Sørensen.

Similar issues are being felt in the North American market – where solar projects in particular have been dogged by low availability of PV modules in the wake of the Department of Commerce’s AD/CVD circumvention enquiry – with PPA prices on the rise across the Atlantic as well.

PPA prices have continued to rise over the past two years, with P25 solar and wind PPAs reaching US$41.92/MWh in Q2 2022, a 5.3% increase from the previous quarter and more than 30% higher year-on-year.