Around 35GW of PV manufacturing projects in Europe are at risk of being mothballed as elevated power prices damage the continent’s efforts to build a solar supply chain, research from Rystad Energy suggests.

The consultancy noted that the energy-intensive nature of both solar PV and battery cell manufacturing processes is leading some operators to temporarily close or abandon production facilities as the cost of doing business escalates.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

It added that the power prices are increasing the risk that planned projects which have not secured funding yet may fall through.

Audun Martinsen, Rystad Energy’s head of energy service research, said high power prices not only pose a significant threat to European decarbonisation efforts but could also result in increased reliance on overseas manufacturing.

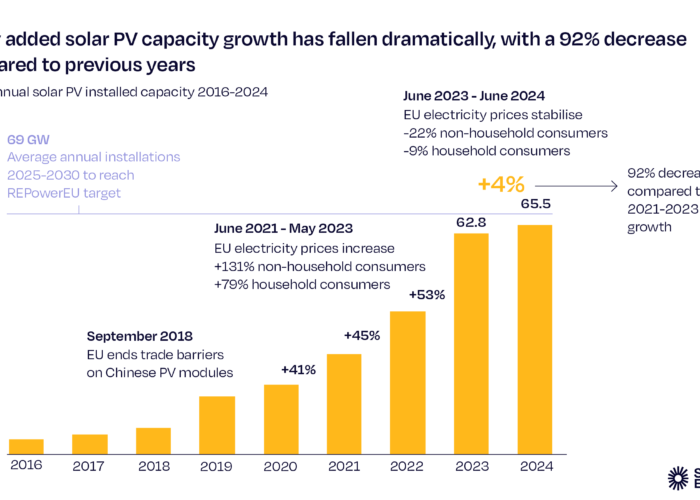

“Building a reliable domestic low-carbon supply chain is essential if the continent is going to stick to its goals, including the REPowerEU plan, but as things stand, that is in serious jeopardy,” he added.

European electricity prices reached unprecedented levels in recent months due to reduced gas deliveries from Russia, summer heatwaves and unplanned nuclear and hydropower plant outages, according to Rystad.

The consultancy revealed that while power prices in Europe have retreated significantly since record highs in August, rates remain in the €300 – 400/MWh (US$297 – 396/MWh) range, many multiples above pre-energy crisis norms.

While Europeans have benefitted from reliable and affordable electricity, the research suggested that low-carbon manufacturers have based their build-up of production capacity on stable power prices of around €50/MWh.

With manufacturers in other regions, such as Asia, enjoying lower electricity input tariffs, European producers “are becoming increasingly uncompetitive by comparison”, Rystad said.

As part of measures aimed at addressing high energy prices, EU ministers agreed last week to set a mandatory temporary solidarity contribution on the profits of businesses active in the petroleum, natural gas, coal and refinery sectors.

Member states will use proceeds from the contribution to provide financial support to households and companies and to mitigate the effects of high retail electricity prices.

The high costs of European PV manufacturing were revealed in a recent report from the International Energy Agency (IEA), which found China is the most cost-competitive location to manufacture all components of the solar PV supply chain, with costs in the country 35% lower than in Europe.

The IEA said that without financial incentives and manufacturing support, the bankability of manufacturing projects outside of panel assembly “remains limited outside of China and few countries in Southeast Asia”.

The European Solar Initiative, launched last year by trade body SolarPower Europe and innovation group EIT InnoEnergy, calls for the continent to reach 20GW of solar PV manufacturing capacity by 2025.

However, Rystad warned that with Europe expected to be short on gas for several years and high electricity prices to continue as a result, attracting financing and investment for solar manufacturing plants “could prove challenging”.