As the world shifts towards renewable energy, the European solar sector finds itself in a transformative era. It’s a time marked by rapid technological progress and significant economic shifts, presenting both challenges and opportunities. This landscape is where innovation thrives, strategic collaborations form and new policy directions take shape. Together, these pivotal moments contribute to Europe’s energy transition.

The geopolitical impact on solar industry

The current solar industry is significantly influenced by geopolitical factors, particularly the dominance of Chinese components in the global market. This dominance presents a unique challenge for European companies. The influx of low-cost Chinese solar products has put immense pressure on European manufacturers, affecting both market dynamics and production strategies. A staggering 91% of all photovoltaic (PV) import expenditure in Europe was on imported Chinese products, amounting to €18.5 billion (US$19.86 billion). In 2023, installations in Europe reached nearly 60GW, which was significantly larger than the US market of around 33GW for the same time period.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The dependency on Chinese solar supply chains is a double-edged sword. While it offers cost benefits that are accelerating installations, it also places European energy security in a vulnerable position. There is a strong need to build a robust European solar ecosystem that can compete globally while ensuring energy security. Diversifying the supply chain by investing in re-establishing manufacturing in Europe is imperative.

Moreover, the closure of several companies across Europe serves as a reminder of the volatility of the solar market. This situation is exacerbated by a flood of solar panel inventory sitting in Europe and the willingness to sell at, or below cost to clear out the surplus, leaving European companies in a precarious position. A coordinated European response will help balance these challenges and establish a European domestic solar supply chain.

Learning from global counterparts

To strengthen its position, Europe must look to examples set by countries like the US, India and Turkey. These nations have successfully implemented incentives and established partnerships to foster growth in domestic manufacturing. For example, the SEMA coalition is an industry group lobbying to develop the ‘end-to-end’ solar manufacturing chain in the US. Europe could benefit significantly from strategies similar to the Inflation Reduction Act, such as creating non-tariff barriers and providing incentives to support domestic production and stimulus for developers to use domestically produced components.

There is also a significant opportunity for innovation in cell and wafer production technology. The current focus is ramping up in manufacturing the next generation of solar cell technologies. New factories are ramping up on heterojunction (HJT) and tunnel oxide passivated contact (TOPcon) cell technologies and companies are working to extend efficiencies for both. These technologies are showing cell efficiencies approaching 26% at a production scale.

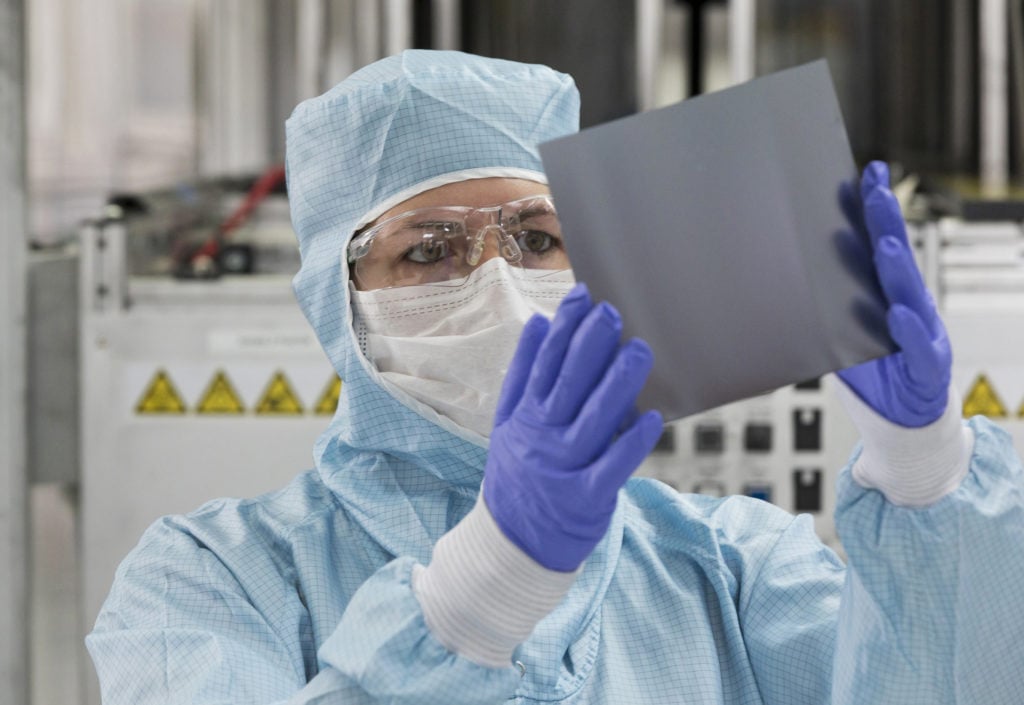

Many European and US companies are working on next-generation Perovskite solar cells which are typically built on an HJT cell platform and offer the potential for a steep change in efficiencies up to nearly 30%. There are also opportunities for innovative breakthroughs in the way wafers are produced.

Taking a multifaceted approach

For the European solar industry to flourish in the face of the evolving global energy landscape, a comprehensive strategy is crucial. This strategy encompasses a strong commitment to innovation and research, vital for discovering new materials and enhancing solar cell efficiency. As seen with recent initiatives like the Net Zero Industry Act and Germany’s Solar Package and resilience bonus, European programmes are still at the starting gate, indicating both the potential and the need for accelerated action in this sector. This underscores the importance of public-private partnerships, as these collaborations are pivotal in driving the industry forward. Equally important is gaining policy support from European governments, including subsidies and regulations that encourage renewable energy use.

Strengthening the industry also involves building alliances between European solar companies, fostering shared advancements and resilience. The formation of supply chain and industry alliances, exemplified by the European Solar Manufacturing Council (ESMC), is a testament to the strength that lies in collaboration. By joining forces, companies can leverage each other’s strengths, mitigate risks and create a more robust and sustainable solar industry.

Educating the public about the benefits of solar energy is essential to increasing demand and support for the industry. Additionally, adopting sustainable practices in operations and products is not just ethically sound but also a vital business strategy in today’s environmentally conscious market. Together, these approaches form a holistic pathway for the European solar industry to lead in the green energy revolution, transforming challenges into opportunities for growth and innovation.

The journey ahead for the European solar industry is challenging but filled with potential. By embracing innovation, fostering supportive policies and building a strong, united front, we can navigate these challenges and emerge as a key player in the global solar landscape. At NexWafe, we are committed to this journey, driven by the belief that solar energy is not just a business but a critical component of our sustainable future.

Davor Sutija is CEO of NexWafe, a manufacturer of photovoltaic wafers based in Freiburg, Germany.