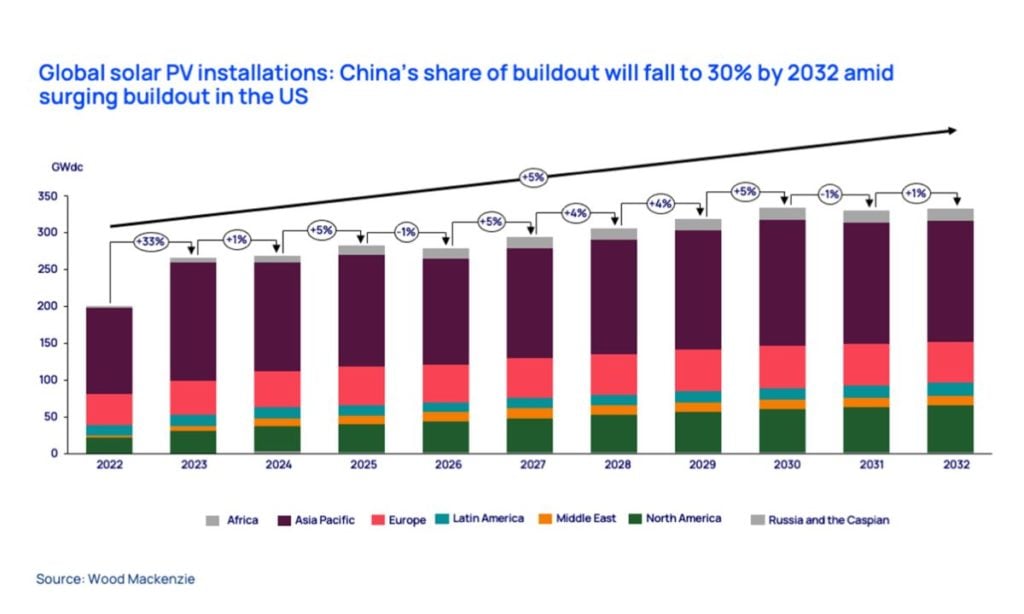

As solar PV continues its accelerated growth, 2023 is expected to be no exception with 270GW of capacity to be added, according to Wood Mackenzie.

In its latest Global solar PV market outlook update for Q2 2023, Wood Mackenzie expects an accelerated buildout across all regions to continue, with capacity addition to raise upwards to 330GW per year by 2032, with an annual average growth of 5% from 2023 to 2032.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

In the foreseeable future, China will continue to dominate the solar supply chain from polysilicon to modules, as the country currently exceeds 80% of the manufacturing market’s share across all stages. Despite policy incentives launched in the US, India and Europe for domestic PV manufacturing, these are not expected to dent China’s market share in the near future, which will shift the focus of the exports from modules to cells and wafers.

After a deceleration last year due to supply chain issues, the US is poised to have stellar growth in 2023 with a 39% year-on-year recovery. The country has managed to get around the supply chain issues in the opening quarter of 2023 which started with a record Q1 of 6.1GW of capacity added across all markets and all but community solar registered a record-setting Q1.

During the period between 2023 and 2032 the US is expected to install 465GW of solar PV capacity.

As European Union state members deliver updated National Energy and Climate Plan (NECP) and increase their solar targets, such as Spain nearly doubling its previous goal from 39GW to 76GW of solar PV by 2030, Wood Mackenzie forecasts that Europe will add more than 530GW of capacity between 2023 and 2032.

Faster permitting regulations and countries updating its auctions mechanism – Germany increased the maximum bidding price for ground-mounted solar auctions to encourage higher participation earlier this year – will be other key drivers for Europe’s growth in 2023.

The accelerated decline of electricity rates in Q1 2023, did not slow down the pace of solar installations, however continued inflation and interest rate hikes will contribute to slower growth than seen in 2022, according to Wood Mackenzie, although the company expects the distributed market to grow by 5% in 2023.

Moreover, Romania has become an emerging solar PV distributed market in Europe and is expected to reach a cumulative 6.5GW of solar capacity by 2027. Earlier this year, PV Tech Premium explored how an upcoming Contract for Difference in the country was attracting developers to Romania.