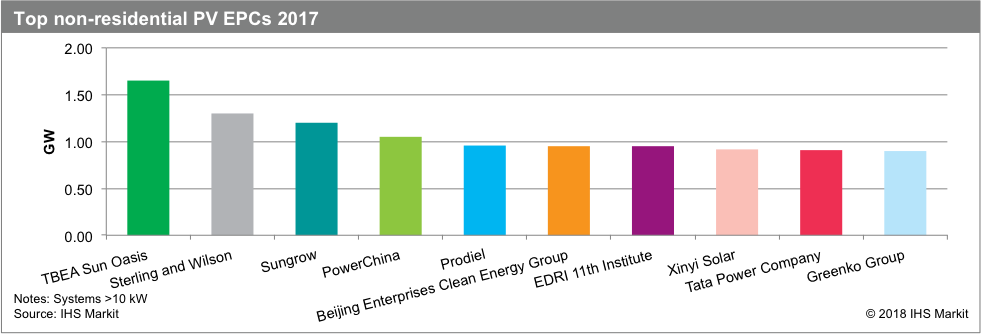

After ranking the 2017 PV solar Engineering, Procurement, and Construction (EPC) companies and confirming the final numbers at least twice, IHS Markit has determined the 30 largest EPC providers installed 20 GW of non-residential PV representing 24% of the total market. Declining from 30% in 2016, the EPC landscape reversed a consolidation trend because of increased fragmentation in the booming Chinese market. Per the inset chart, the top 10 EPCs installed 13% of non-residential PV demand.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Combining both in-house development and third-party EPC services, TBEA Sunoasis maintained its position as the largest EPC provider with 2% global market share in terms of installed PV capacity. In addition to TBEA Sunoasis (1), Chinese EPCs dominated the top 10 with Sungrow (3), PowerChina (4), Beijing Enterprises Clean Energy Group (6), EDRI 11th Institute (7), and Xinyi Solar (8).

Meanwhile, Sterling and Wilson climbed to second position by doubling its annual installations as a third-party EPC contractor, driven by India and the Middle East. The 42% year-on-year growth in India’s PV market has benefitted a concentrated group of local EPCs with the combined market share of the five largest EPC companies growing from 46% in 2016 to 52% in 2017. India’s Tata Power Company (9) and the Greenko Group (10) also joined Sterling and Wilson (2) in the top 10 EPCs.

Headquartered in Spain, Prodiel was the only European EPC to land in the top 10 at fifth position.

By the way, US solar EPCs just missed the top 10 global list with Cypress Creek Renewables and Swinerton Renewable Energy placing eleventh and twelfth respectively.

Based on announced PV project installations in 2018 and 2019, IHS Markit expects the 10 largest EPC companies will together install more than 10GW over two years. Sterling and Wilson will lead the group as a result of securing contracts in the Middle East, Africa, and Latin America.

Josefin Berg, IHS Markit Research & Analysis Manager for the Solar & Energy Storage research group, said:

“The EPC landscape is still evolving, and the ranking will change in tune with how PV demand develops in different markets.

“There are two parallel trends: We are both seeing further consolidation in the major utility-scale PV markets, and a rise of new, local EPC providers in early-stage markets.”

The full IHS Markit ranking and analysis of global solar EPCs including installed PV capacities and market shares are discussed in the Solar EPC and O&M Provider Tracker report for IHS Markit Solar Service subscribers.