India has added 11.3GW of PV module annual nameplate capacity and 2GW of solar cells in the first half of 2024, according to market research firm Mercom India.

Cumulatively, the country has reached an annual nameplate capacity of 77.2GW for modules and 7.6GW for solar cells as of June 2024. Current module annual nameplate capacity far outpaces solar additions in the country which registered a record 15GW installed capacity in H1 2024.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

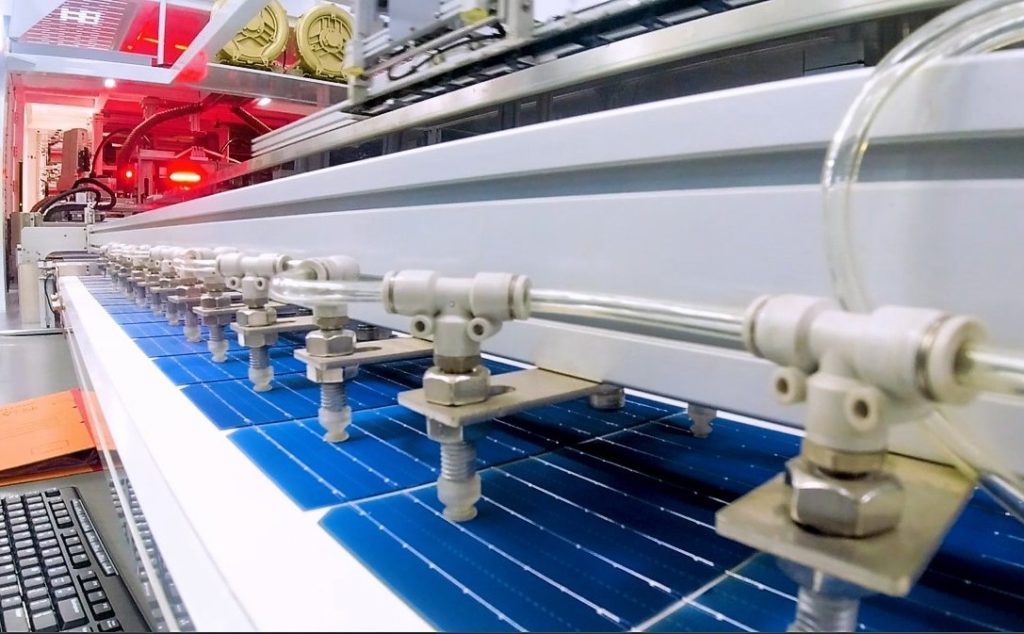

Despite tunnel oxide passivated contact (TOPCon) taking the top spot this year in terms of technology market leadership for solar cells, monocrystalline passivated emitter and rear cell (PERC) modules accounted for most of India’s production capacity. It is followed by TOPCon, polycrystalline and thin-film modules, for which US cadmium telluride thin-film manufacturer First Solar opened a 3.3GW facility in Tamil Nadu at the beginning of the year.

The added manufacturing capacity during H1 2024 was driven by strong demand, with a solar PV pipeline of more than 132GW between 2024 and 2026, along with the reimposition of the Approved List of Models and Manufacturers (ALMM) in April this year.

The majority of the solar cell capacity is located in the state of Gujarat with 52%, while 45% of solar modules are located in that state. Tamil Nadu and Rajasthan followed on the podium with 10% and 8%, respectively.

These three states have also been the focus of many of the recent solar cell and module capacity announcements in the past few weeks. However, after Gujarat, Telangana and Himachal Pradesh are the states with the most solar cell annual nameplate capacity with 28% and 10%, respectively.

80GW of cell capacity by 2026

As more and more companies start building module and solar cell plants in the coming months, Mercom estimates that India will have an annual nameplate capacity of over 172GW for modules and more than 80GW for solar cells by 2026. This will be on time for when the Indian Ministry of New and Renewable Energy aims to implement the cell ALMM on 1 April 2026. Since September more than 23GW of solar cell capacity and 42GW of modules have been announced across seven different companies.

The module capacity would represent nearly tenfold of the current pace at which India is adding solar PV capacity and nearly double its cumulative installed solar PV. If all the capacity estimated by Mercom becomes operational by 2026, India would have more than enough capacity for domestic demand but also to export its production to other regions, including the US (Premium access).

Exports of modules have seen a 16% increase year-over-year during the first half of 2024 with more than 3GW of Indian modules exported.

India’s push to build its own domestic manufacturing solar capacity comes at a time when the industry is facing an overcapacity of supply. By the end of 2024, BloombergNEF forecasts global installed solar PV additions to be near 600GW, while module annual nameplate capacity will reach 1.2TW. Finlay Colville, head of research at PV Tech wrote on PV Tech that the current downturn the solar industry is facing will extend into 2026.