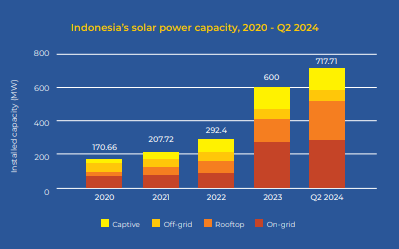

Indonesia’s Institute for Essential Services Reform (IESR) has noted that the country has passed 700MW of installed solar PV capacity but warns that this progress is “inadequate” to comply with the global climate target.

A recent report released by the think tank shows that Indonesia’s installed solar PV capacity reached 717.71MW in August 2024. Interestingly, the 145MW Cirata floating solar PV project, installed in November 2023, almost tripled on-grid solar PV capacity that year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The report also states that Indonesia has around 17GW of solar PV projects in its development pipeline. Indonesian state utility PLN will also develop around 3.2GW of solar PV by 2030.

Floating solar PV has emerged as one of the front-running technologies set to be deployed in Indonesia, recognised as the world’s largest archipelagic state. Due to a lack of transmission grids around some of these settlements, floating solar can power regions of the country via renewable energy.

Solar PV modules deployed on water can also be more efficient due to the effect in lowering temperatures. The shading from the panels can reduce water evaporation and preserve water for drinking or irrigation.

The Singapore opportunity

One of the major drivers for solar PV development in Indonesia is not only domestic decarbonisation but also the potentially lucrative opportunity to export green, renewable energy to the island city-state of Singapore.

For countries like Singapore, which have high energy demand but little land to accommodate renewable energy generation, getting energy across borders from places like Malaysia or Indonesia, which have ample land and solar resources, could be vital in decarbonisation and modernising the grid.

Because of this, Singapore has been working on establishing a number of power corridors with other countries, including the AAPowerLink project in Australia. The Australian project aims to deploy between 17GW and 20GW of solar PV capacity and between 36.42GWh and 42GWh of energy storage via a 4,300km subsea cable.

For Indonesia, the IESR states that Indonesian exports to Singapore will be worth a total of 3.4GW of capacity, which the think tanks estimate is around 7.56GW of solar PV power plant capacity.

Readers of PV Tech will be aware that Vena Energy and Shell Eastern Trading recently secured conditional approval from the Energy Market Authority of Singapore (EMA) to export 400MW of solar PV from the Riau Islands in Indonesia to Singapore.

Utility-scale solar PV costs drop

Another key takeaway from the report is that utility-scale solar PV development costs have dropped by 19% in the last five years, primarily due to cheaper solar PV modules and soft cost reductions.

To promote the adoption of utility-scale solar, PLN has organised bundled procurement involving various types of power plants and has established strategic partnerships with its subsidiaries.

The IESR has identified a need for an additional 746MW of flexibility capacity to enhance rooftop solar PV adoption. This additional capacity will come from flexible power plant operations, particularly coal, and a significant rollout of energy storage systems.

Regarding financing for Indonesia’s solar PV pipeline, the report states that, to date, around US$112 million has been allocated to the development pipeline in 2024.