Private infrastructure investment in solar energy during 2015 grew to US$9.4 billion, 72% higher than the average of the previous five years, according to new World Bank figures.

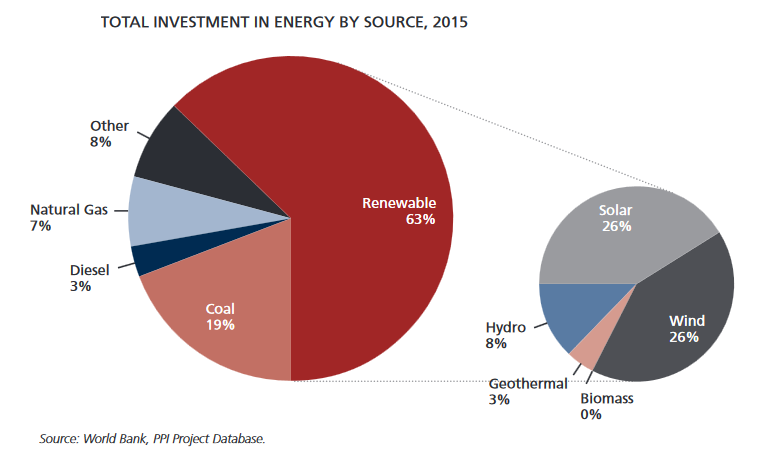

Solar also accounted for one quarter of all energy investments last year, as reported by the World Bank Group’s 'Private Participation in Infrastructure Database'.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Fernanda Ruiz Nunez, senior economist, World Bank Group, told PV Tech: “As markets mature and gain experience on renewable energy projects, and in solar in particular, we expect to continue to see solar investments growth, but we do not particularly expect a rapid rise in 2016 for solar projects.”

Nunez added: “Solar energy investments have increased 72% higher than the five-year average, but it is still too early to say that they are breaking away.”

The database reported that renewables overall made up 63% of global investment, up from the five-year average of 44% and signalling greater adoption of wind, which also stood at US$9.4 billion, hydro at US$2.9 billion, and geo-thermal at US$1.3 billion.

The World Bank noted in its report: “Renewable energy continues to make inroads in the energy mix of many developing countries. Solar energy commitments in particular have seen solid gains.”

The database also highlighted South Africa, which secured US$2.4 billion in solar deals, while Morocco, Chile, and China also closed US$4.1 billion combined.

Coal saw the highest investment of non-renewable sources with 19% of the overall share.

Despite the rise of renewables, investments in the overall energy sector still declined significantly to US$37.6 billion from the US$53.5 billion invested in 2014, while electricity generation projects also continued to diminish in both number and investment to US$33.6 billion, down from US$59 billion last year.

Nunez said: “The size of non-renewable projects in terms of capacity and investments is significantly bigger than renewable projects, so this is the reason investments in renewables are growing while overall investments in energy are falling. The deficit in energy in developing countries remains. The increase in renewables is mainly a reflection of countries implementing policies to promote sustainable sources of energy.”