Solar and storage are playing a central role in Japan’s goal of enhancing energy security. Uranulzii Batbayer and Aniket Autade of Rystad Energy look at recent developments in the market to assess Japan’s progress in reaching its 2030 targets.

As a leading economic power in Asia, Japan has emerged as a global frontrunner in the transition to carbon neutrality. Despite facing a significant decrease in energy self-sufficiency, dropping from 20% to 11.3% after the 2011 Fukushima nuclear accident, Japan remains determined to enhance its energy independence. The country is targeting a 36-38% share of renewable energy in its power mix by 2030, with a primary focus on increasing self-produced renewables such as solar and wind.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Solar energy, in particular, has played a pivotal role in Japan’s renewable landscape, with a targeted 14 16% share of solar PV by 2030. In pursuit of this goal, Japan has undergone substantial solar PV development since 2012, offering a feed in-tariff (FiT) subsidy system that provides a fixed payment for each kilowatt-hour produced over periods of up to 20 years for approved renewable generators.

However, the FiT system imposed a growing burden on end-users, and generators became detached from electricity demand. From 2022 onwards, Japan introduced a feed-in-premium (FiP) subsidy system, designed to incentivise companies to generate more power during peak hours and less during off-peak periods. Presently, both FiT and FiP systems are being offered, but there is a gradual shift towards adopting FiP exclusively. The FIP system ties generators to market prices and this approach provides greater incentives for increased supply during peak demand hours, potentially facilitated through the use of battery storage.

However, the transition from FiT to FiP introduces elements of competition and instability due to price volatility and imbalance risks. The shift may make the subsidy system less attractive for certain businesses. Additionally, challenges related to land scarcity for solar PV installations contribute to more subdued growth in new solar installations.

Japan solar PV market in 2023

With 1.1GW of new solar PV installations in 2023, the total installed amount of solar PV reached 122GW, constituting 12% of Japan’s overall power mix. While 2024 is anticipated to witness a slight uptick in installations, the trend leans towards smaller projects below 50MW in scale.

In 2023, the installed capacity of solar PV remained under 200MW, with 45% of projects falling below the 50MW threshold. Notably, installations were predominantly concentrated in Hyogo, Miyagi, and Mie prefectures. In the last year, foreign companies, including Vena Energy from Singapore and Sonnedix from Spain, accounted for 47% of the developers and secured positions in the top five solar PV developers in Japan.

When conducting an economic analysis (with a discount rate of 5%) of solar PV projects implemented in 2023, categorised by project size (under 50MW, between 50 to 100MW, and over 100 but less than 200MW), the net present value (NPV), which signifies the project’s profitability, was notably highest for Pacifico Energy’s 120MW Sanda Mega Solar project, in Hyogo Prefecture, and lowest for the 34MW Samegawa Aosono Megasolar project, in Fukushima Prefecture. The levelised cost of electricity (LCOE), representing the lifetime cost of electricity generation, was highest for projects under 50MW. Interestingly, unlike NPV or LCOE, payback year did not exhibit a direct correlation with project capacity but ranged from eight to 11 years.

In general, larger capacity projects, with a higher NPV and lower LCOE, appear to yield higher profits. However, it is acknowledged that such projects may require more extensive land and entail higher initial costs, likely contributing to the observed trend of limited installations of larger capacity projects.

Despite these developments, achieving the ambitious target of generating 36-38% of electricity from renewable sources by 2030, especially concerning the solar PV sector, appears challenging at the current decelerating rate of installation. Exploring alternative avenues for accelerating solar PV deployment becomes imperative to bridge the gap and meet the set targets.

Rooftop solar in Japan

In recent years, Japan has witnessed a surge in rooftop solar installations, with 1GW of rooftop solar capacity added in 2023, taking the total installed capacity to 59.6 GW. This positive trend is expected to continue in the coming years, driven by both the repowering of ageing rooftop solar projects and the implementation of mandatory rooftop solar initiatives.

The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) has outlined comprehensive measures for housing and buildings to achieve carbon neutrality by 2050. According to this plan, 60% of newly constructed detached houses will incorporate solar power generation equipment by 2030. Looking further ahead, by 2050, it will be common for houses and buildings that are rational to have solar power generation equipment.

In a significant move, starting in 2025, companies engaged in the construction of buildings exceeding 20,000 square meters annually will be obligated to install rooftop solar systems. Kyoto has been at the forefront of this mandatory push for rooftop solar systems. Since April 2020, it has been compulsory for buildings in Kyoto with a total floor area of 2,000 square meters or more to incorporate renewable energy equipment, such as solar power generation. This mandate was further expanded in April 2021 to include buildings with a total floor area of 300 square metres or more. Consequently, with these regulations in place, the expansion of rooftop solar installations is anticipated to gain further momentum.

As of the end of 2023, rooftop solar accounted for nearly half of Japan’s cumulative 107.31GW installed solar PV capacity. When compared to other Asian nations, Japan boasts one of the highest ratios of rooftop solar to solar PV capacity. This trend is promising for renewable energy in Japan, especially as solar panel installations on land face constraints related to land scarcity and decreasing subsidies.

Out of Japan’s currently installed rooftop solar capacity, 47.7GW, or about 80%, is designated for commercial and industrial (C&I) use, with the remainder allocated for residential use. However, the government has set higher FiT prices for residential rooftop solar to incentivise further growth. The current FiT price for residential solar is JPY16 (US$0.1088) per kilowatt hour (kWh), while for C&I it is JPY10 per kWh. However, the FiT rate for residential rooftop solar is gradually decreasing, having initially been set at JPY39 per kWh. Therefore, installing rooftop solar panels sooner rather than later on residential properties is advisable to maximise profit margins for residents.

Solar curtailments

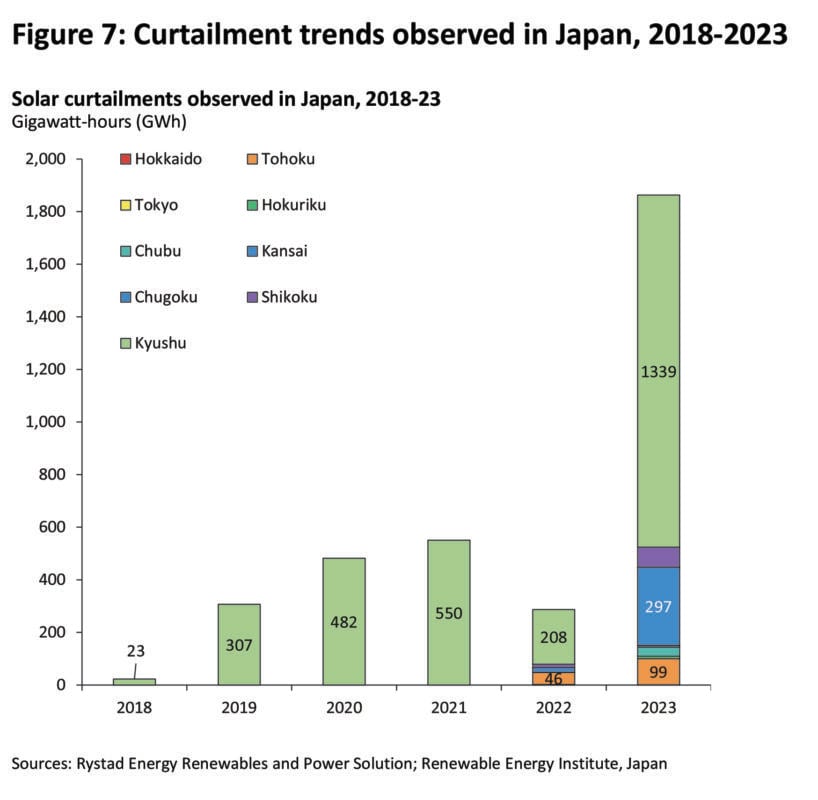

Despite a positive upward trend in rooftop and utility solar PV installations in recent years, 2023 marked a record for renewable curtailments in Japan, with solar curtailments increasing five-fold. A total of 1.63 terawatt-hours (TWh) of solar output was curtailed in the 11 months to 30 November 2023, compared to 0.29TWh over the same period in 2022. This led to revenue losses of between US$110 million and US$150 million for solar assets. The losses are significant for developers in Kyushu and Chugoku, as seen from the curtailment trends in the graph below.

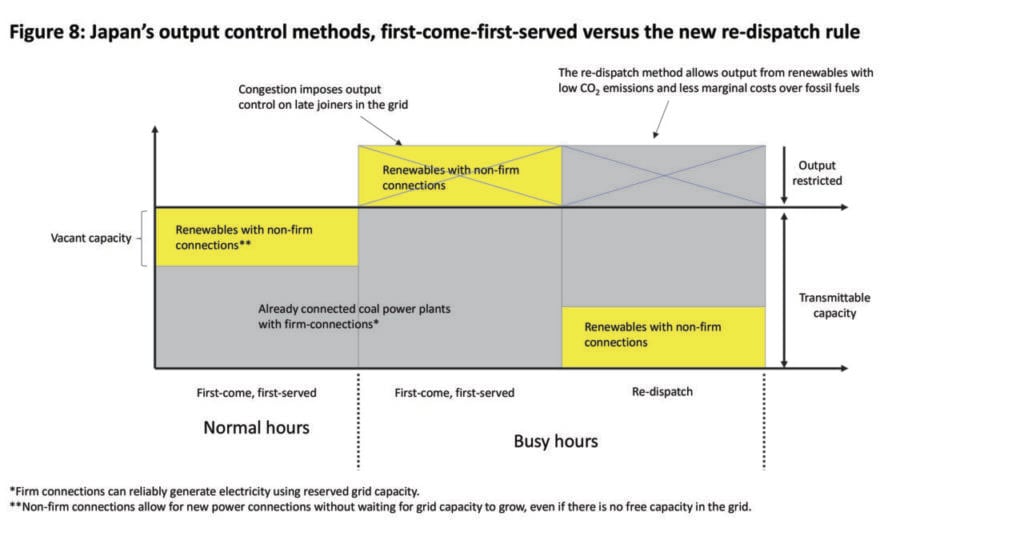

As a countermeasure in the wider renewable energy market, Japan has amended the order in which solar and wind projects dispatch power to the grid. This move is designed to reduce revenue losses due to curtailment issues. The new ‘re-dispatch method (certain order)’ rule, unveiled on 28 December 2023, replaces the ‘first come, first serve’ method, which gave existing thermal plant priority over renewable energy sources during periods of grid congestion.

The change is expected to save the renewable power industry between US$120 million and US$150 million in curtailment-related revenue losses. From January to November 2023, Kyushu province experienced a 12.36% curtailment rate for solar, with Chugoku province seeing curtailments of 5.1% for solar over the same period.

Under the new re-dispatch method, METI will prioritise renewables with low emissions and low marginal costs. The move also expands the scope of output control for both firm and non-firm connections, as shown in the graph above. The changes to dispatch order rules are positive for the renewables industry, which has seen new capacity additions growing faster than transmission line capacity growth. However, the impact the new dispatch rule will have on power prices in Japan remains to be seen, though we anticipate it will lead to greater volatility in spot power prices in the long term.

Battery energy storage systems

With the introduction of the FiP system and the increasing problem of curtailments, battery energy storage systems (BESS) have become a promising solution for businesses. Over the past year, seven battery projects, with a combined capacity of 358MW, have been launched. They have been primarily for wind projects that have completed their FiT subsidy term or offshore wind farms that want to store energy and sell it in the market through FiP for further profit during peak hours.

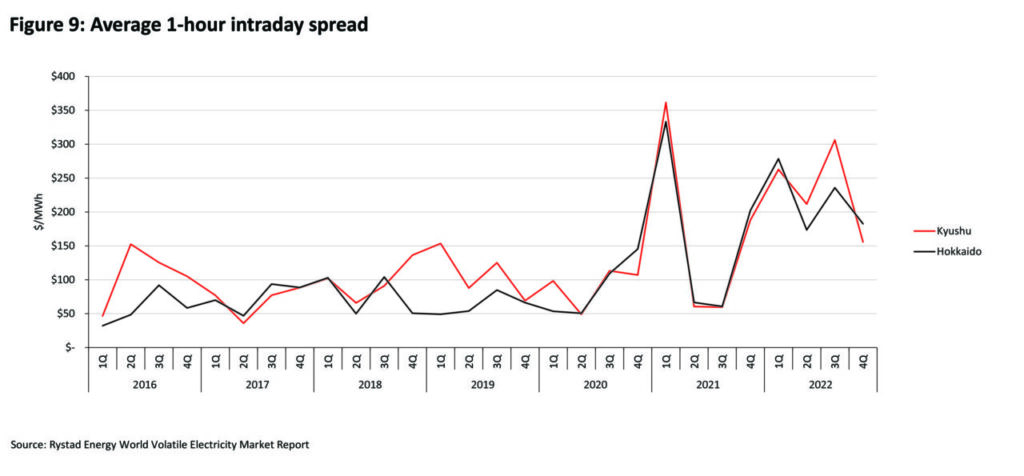

The FiP scheme is gaining momentum, and BESS is becoming increasingly popular for revenue generation through the energy arbitrage market. By charging during the lowest-priced interval of the day (24-hour period) and discharging during the highest-priced interval of the day, companies can generate revenue while contributing to the reduction of energy waste. The graph below illustrates the average one-hour intraday spread of Hokkaido and Kyushu, two prefectures that export a significant amount of electricity and have a high penetration of solar PV.

The combination of high solar penetration leading to low daytime prices and high gas prices causing high evening peak prices means Japan is a highly prospective market for batteries. With battery storage, companies can optimise their energy usage while promoting sustainability and contributing to the reduction of energy waste.

Final thoughts

It appears that Japan is making significant strides towards achieving its 2030 goal of having 36-38% of renewables in its power mix, including the goal of 14-16% of solar PV. This is largely due to its strategic planning and substantial government support. As a result, Japan’s energy security and self-sufficiency are improving. The implementation of subsidy strategies such as FiT and FiP has contributed to the growth of solar PV, although its growth has become stagnant recently.

However, rooftop solar is showing promise, and the government’s plan to make it mandatory for new buildings is expected to considerably help the country hit its renewable target. Despite the challenge of curtailment that comes with a large penetration of solar, the FiP scheme is opening a good market for BESS business in Japan. According to our analysis, BESS has the potential to generate significant revenue through the energy arbitrage market.

Japan’s energy future appears promising, thanks to significant government efforts. While some challenges may arise along the way, the continued support for innovative solutions such as BESS and rooftop solar is crucial. These measures will not only help address challenges but also create new business opportunities in the market.

Uranulzii Batbayar works at Rystad Energy as an analyst for renewable energy and power. She specialises in analysing the renewables and power markets in East Asia. Aniket Autade has been working at Rystad Energy for more than a year, covering the East Asia renewables and power market, excluding China.