Chinese solar manufacturing giant JinkoSolar will build a 10GW n-type solar cell and module manufacturing plant in Saudi Arabia.

The facility will be built and financed through a joint venture (JV) between JinkoSolar Middle East, the Renewable Energy Localization Company (RELC) – a subsidiary of the state-run Saudi Public Investment Fund – and Vision Industries (VI), an investor in Saudi clean energy industrial projects and supply chains. Both JinkoSolar and RELC will hold 40% equity and VI the remaining 20%.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

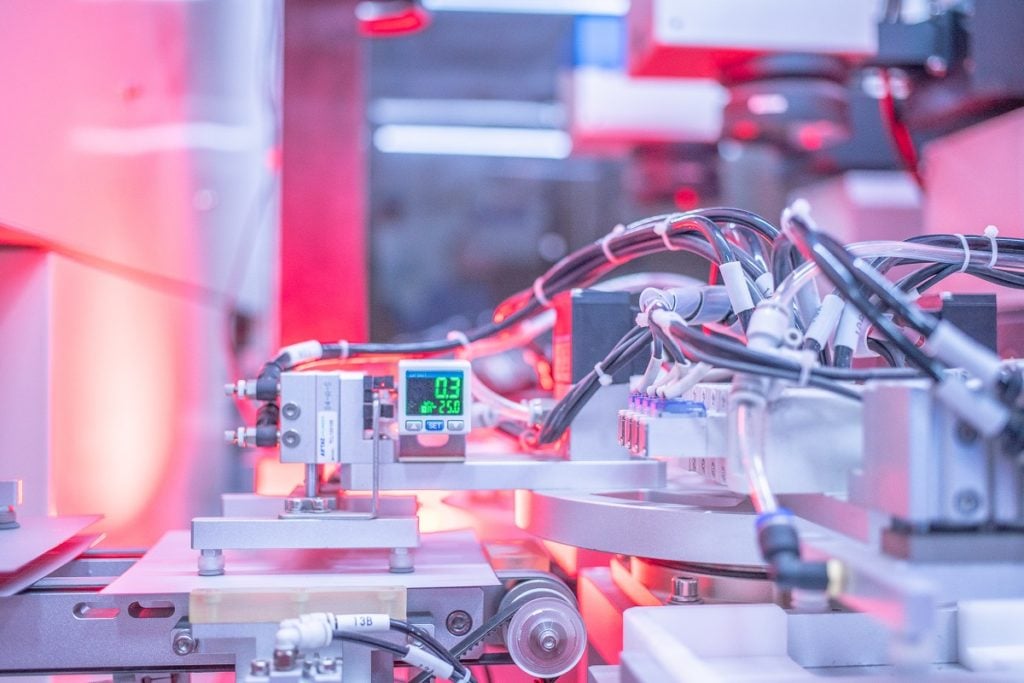

The facility itself will represent around US$1 billion in investment, delivered through both internal and external financing. JinkoSolar said the schedule for development and construction will be “subject to market conditions”, but at full capacity the planned site would produce 10GW each of n-type cells and modules.

The company did not confirm the specific n-type technology, but JinkoSolar primarily produces tunnel oxide passivated contact (TOPCon) n-type products. In its financial results for the first quarter of 2024, the company said that it intends n-type products to account for 90% of its global capacity by the end of the year as it phases out the previous generation of p-type cells and modules.

TOPCon is forecast to surpass 50% of solar market share in 2024 by the International Technology Roadmap for Photovoltaics (ITRPV) report published earlier this year.

Xiande Li, chairman and CEO of JinkoSolar, said: “This partnership is another major milestone in the execution of our globalisation strategy and will further help us optimise our global manufacturing and marketing infrastructure, as well as enhance our global competitiveness.”

JinkoSolar has signed a number of major supply deals for Saudi PV projects, most notably with ACWA Power, which is owned by VI.

US-based tracker producer Gamechange Solar has recently announced plans to build a 3GW tracker production facility in Saudi Arabia, and last month, fellow Chinese solar manufacturer GCL Energy announced plans to pursue a new polysilicon facility in the United Arab Emirates (UAE).

‘Global manufacturing’

As reported by PV Tech at the time, GCL’s decision was largely due to the overwhelming competition in the domestic Chinese market following huge polysilicon price slumps over the last year.

The price drops are affecting upstream manufacturers like JinkoSolar, too. In May, Li said that global module prices were near the bottom and, along with executives from fellow manufacturers TrinaSolar and Canadian Solar, called the current price situation in China “irrational”.

The financial results of the major Chinese manufacturers tell a story of challenges. PV Tech Premium looked into the financial performance of the “big five” manufacturers (Jinko, Trina, LONGi, JA Solar and Canadian Solar) over 2023 and Q1 2024, and reported year-on-year profit drops of between 29% for Jinko and 164% for LONGi.

Last week, the Chinese Ministry of Industry and Information Technology (MIIT) issued a draft rule raising the minimum capital ratio for solar manufacturing projects to 30%. This was broadly intended to “strengthen the management” of the Chinese PV industry and curb the massive capacity expansions and subsequent market impacts that have occurred in recent years.