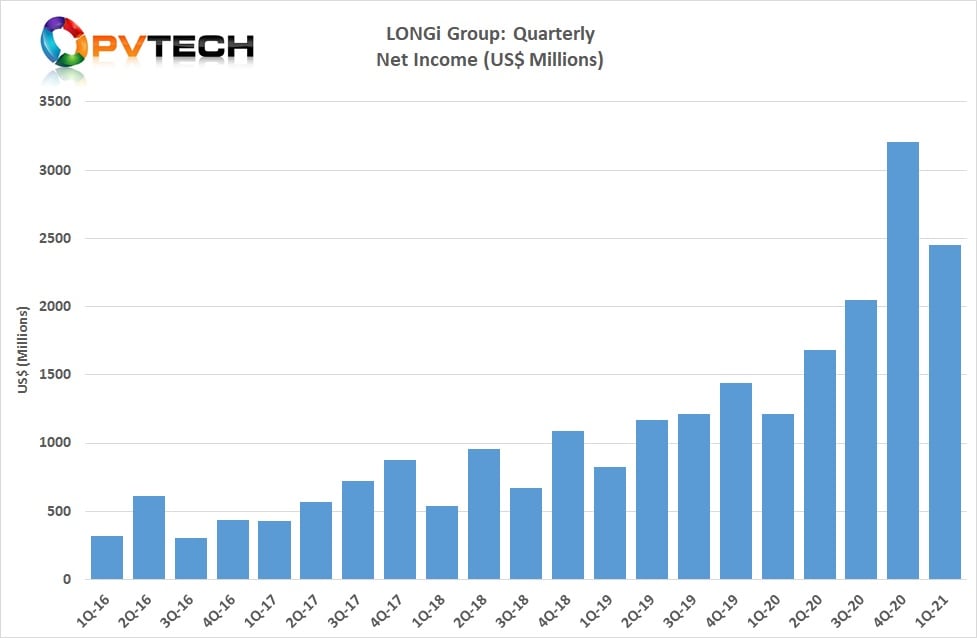

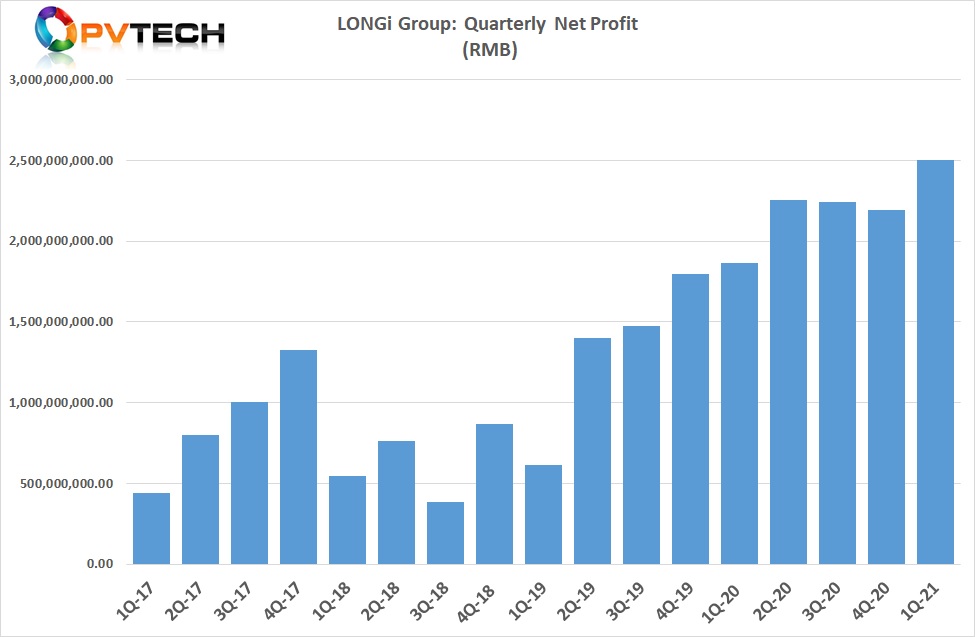

Leading monocrystalline wafer producer and ‘Solar Module Super League’ (SMSL) member LONGi Green Energy and subsidiary, LONGi Solar, have continued an unprecedented sales run, notching up first quarter 2021 revenue of RMB15.85 billion (US$2.44 billion), its second highest quarterly figures.

The performances comes after the company recently reported fourth quarter and full-year 2020 financial results, posting record revenue and shipments.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

LONGi also reported its highest quarterly net profit figures for the first quarter of 2021, reaching RMB2.5 billion (US$386.4 million), compared to a net profit of US$339.14 in the fourth quarter of 2020 on revenue of US$3.2 billion.

The record quarterly net profit increase could be attributed to higher Average Selling Prices (ASPs) after multiple wafer price increases made in response to higher polysilicon purchasing prices in the reporting quarter.

LONGi Group’s wafer, cell and module production capacities had reached 85GW, 30GW and 50GW respectively, at the end of 2020.

The company has guided 2021 capacity levels of 105GW for mono-wafers, 38GW for solar cells and 65GW of module assembly capacity, by the end of 2021.