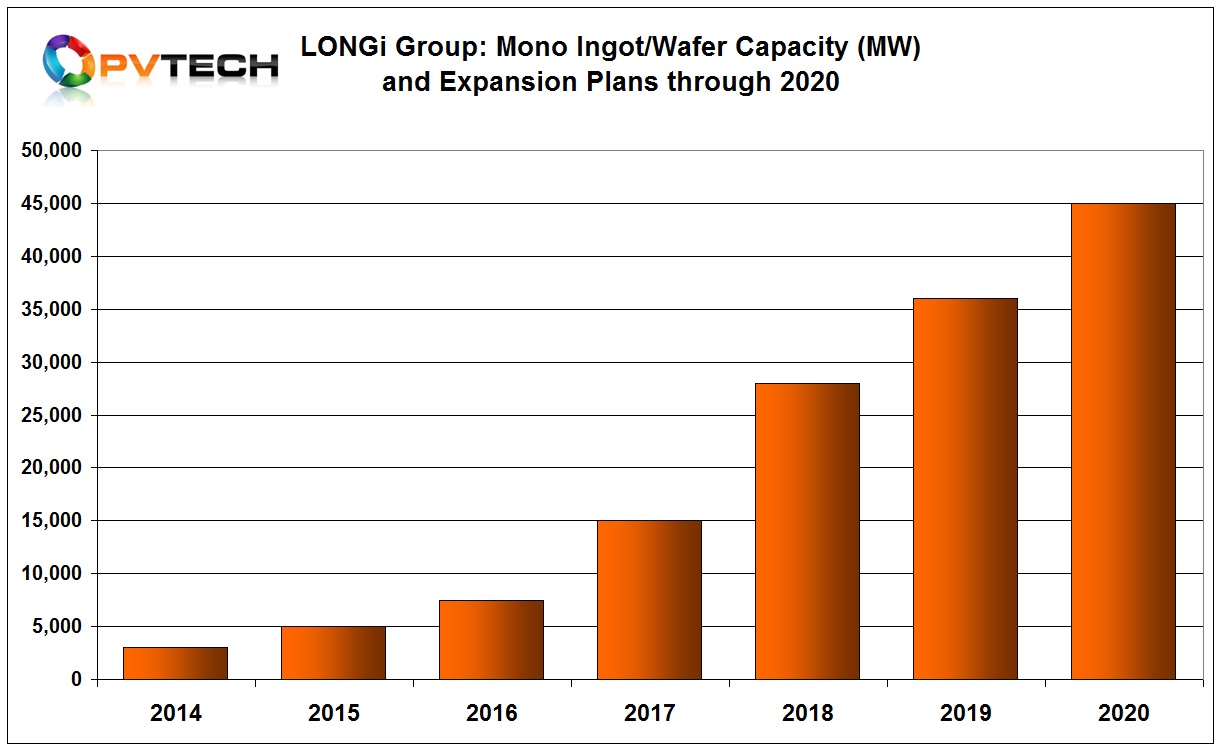

Leading fully-integrated high-efficiency monocrystalline module manufacturer and ‘Silicon Module Super League’ (SMSL) member LONGi Green Energy Technology has set a strategic plan to triple monocrystalline ingot and wafer capacity to 45GW in 2020.

LONGi said in a financial filing that it achieved 15GW of monocrystalline wafer nameplate capacity by the end of 2017, up 2GW from previous plans as the company accelerated production ramps to meet demand.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The new strategic plan, which is not a commitment to investors that it would action the plans and commit to the significant capital expenditures required, includes taking wafer capacity to 28GW by the end of 2018 and 36GW by the end of 2019. LONGi also said that the plan was to achieve 45GW by the end of 2020.

PV Tech had previously reported that LONGi was fast-tracking various ingot and wafer expansion plans currently under construction and pulling in projects nearing completion where possible.

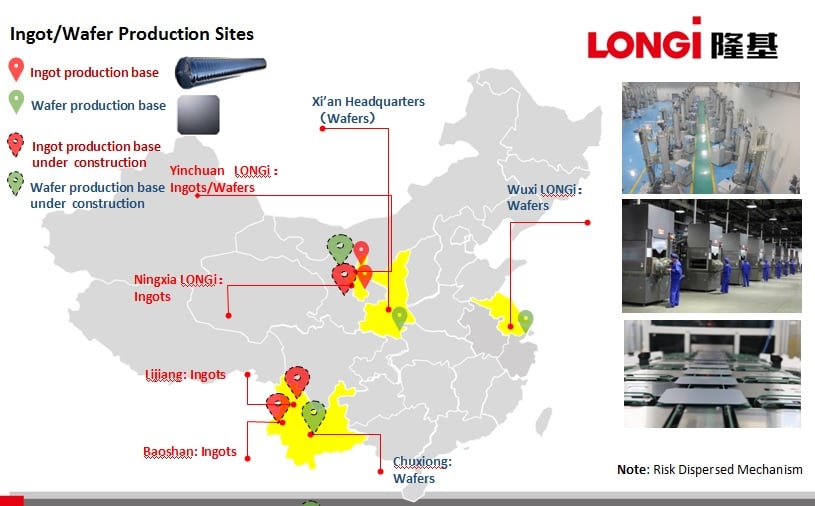

In 2017, LONGi was undertaking the construction of a 5GW ingot production plant in Lijiang, China. The company also announced in early 2017 that Trina Solar and Tongwei, via its polysilicon subsidiary, Sichuan Yongxiang were to form a Joint Venture (JV) to own and operate the facility. LONGi also planned a 5GW ingot/wafer plant in Baoshan, China.

The company had also expected to complete and have begun operating a 1GW wafer plant in Kuching, Malaysia at the end of the year.

A 1GW ingot production plant in Ningxia was also expected to have started production in the fourth quarter of 2017.

As a result, LONGi’s target of 28GW of ingot/wafer nameplate capacity by the end of 2018 looks highly plausible. The tripling of capacity to 45GW would require a significant round of investments in the multi-billion dollar range.

Reasons behind the wafer capacity expansion

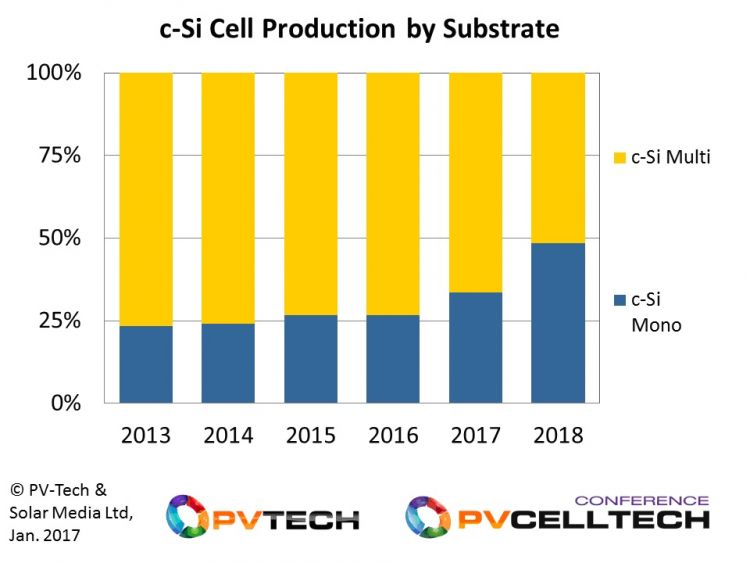

As PV Tech has previously reported, Finlay Colville, Head of Solar Intelligence at Solar Media has projected that monocrystalline solar cell production is expected to account for 49% of all crystalline cell production in 2018 and become the dominant technology used in the PV industry by 2019, driven by LONGi.

The company is both supporting its own in-house cell and module capacity expansions but the key is its support for other monocrystalline solar cell production capacity expansions from merchant cell producers such as Aiko Solar and Tongwei Group as well as module manufacturers such as SMSL member, Trina Solar.

LONGi has also been making significant investments in R&D, which is driving monocrystalline ingot and wafer technology efficiency and cost reduction strategies to further the adoption of monocrystalline products.

R&D spending at LONGi puts it in the top league of industry spenders, which include CdTe thin-film leader, First Solar and high-efficiency cell and module leader, SunPower, according to PV Tech’s annual R&D spending report.

The ingot and wafer capacity expansions go hand in hand with technology advancements at the R&D level, with the expected result that mono technology continues to expand market share and become the lowest cost high-efficiency end-products on the market. In 2017 for expample, LONGi 's production of P-type mono-facial PERC cell efficiency, as well as bifacial PERC cell front side efficiency, had reached 21.3% on average.

Although LONGi’s strategy is to retain its market leading position and be a global supplier, end market demand in China is also increasing and growth is expected to continue, notably for high-efficiency modules due to the ‘Top Runner’ program and the significant growth in the Distributed Generation (DG) market.

Recent official figures put China’s solar installations at around 52.83GW in 2017, up from 34.54GW in 2016. China therefore accounted for around 50% of the global solar market in 2017.