Integrated PV module manufacturer SolarWorld has reported preliminary third quarter 2016 financial results that reflect the impact of overcapacity and global solar panel price declines after recently discarding both its revenue and profit guidance for the year.

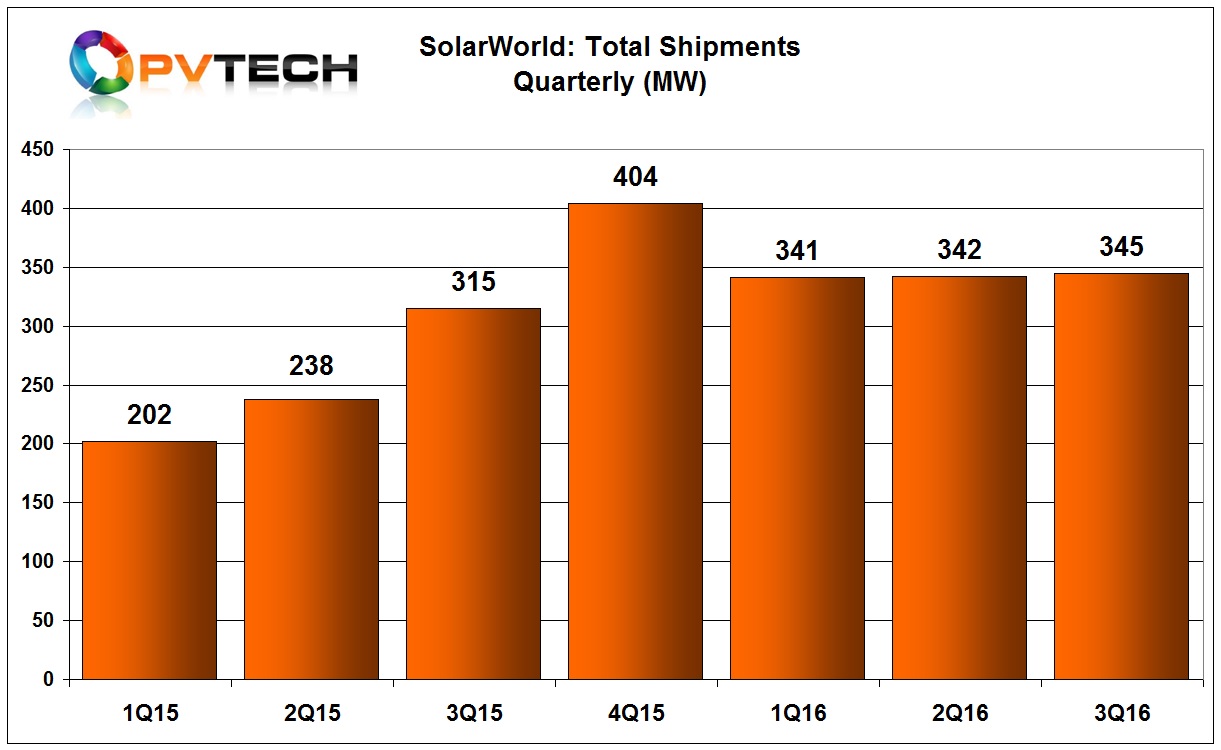

SolarWorld reported total product shipments (modules, mounting systems & inverters) of 345MW in the third quarter of 2016, compared to 342MW in the previous quarter.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Total product shipments have flat lined throughout 2016, although shipments are up significantly from the first nine months of 2015 when shipments reached 755MW, compared to 1,028MW in the first nine months of 2016, a 31% increase.

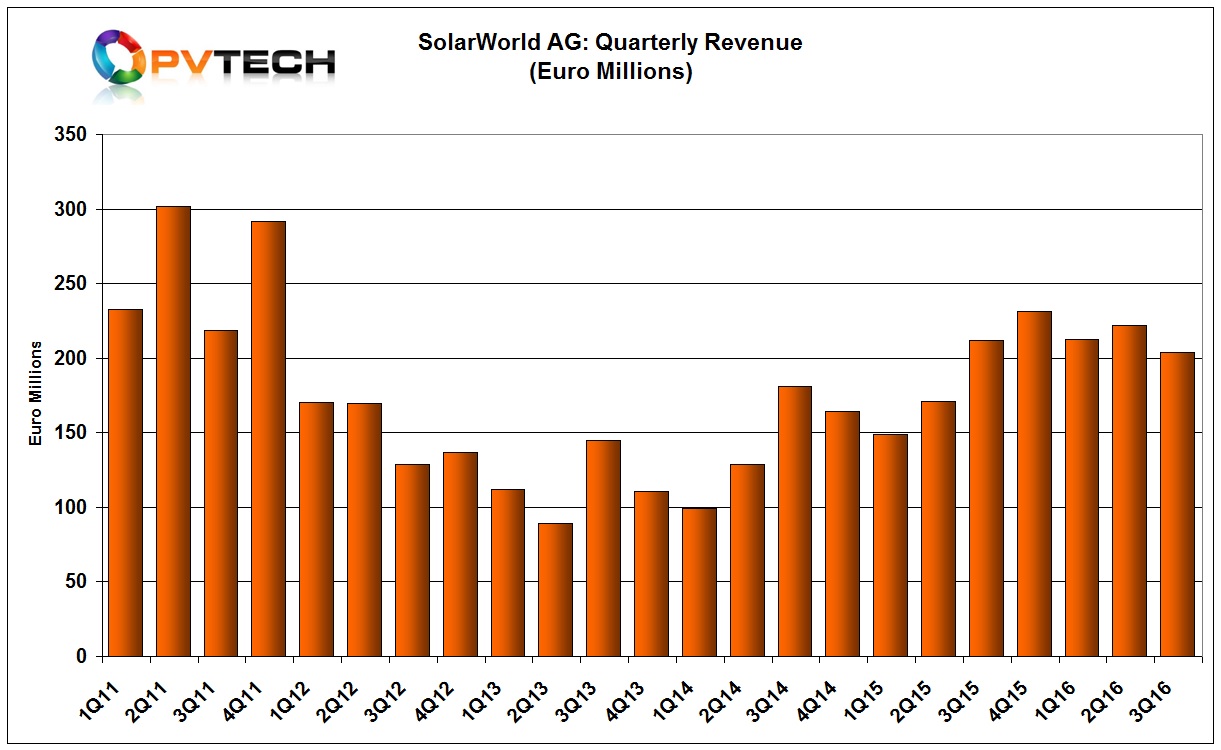

SolarWorld reported third quarter 2016 revenue of €204 million, down 8% from the previous quarter. Revenue in the first nine months of 2016 reached €639 million, around 20% higher than in the prior year period.

The company cited ‘increasing dumping by Chinese manufacturers’, for the ASP erosion in the quarter. This led to the company making an inventory write-down of €13 million in the quarter, increasing negative EBITDA to €12 million, compared to an EBITDA of €5 million in the prior year quarter. EBIT loss in the quarter was €25 million.

SolarWorld reported a negative EBIT €30 million for the first nine months of 2016, compared to a negative EBIT of €5 million in the prior year period.

Due to the quarterly losses and inventory write-downs, SolarWorld reported cash and cash equivalents of €84 million at the end of the third quarter, compared to €148 million at the end of the previous quarter, a 43% decline.

SolarWorld highlighted: “The group has taken measures to adapt its production volume more flexibly to demand, lower costs further and thus to improve liquidity in Q4”.