China-based polysilicon producer Daqo New Energy is to increase its capacity at its Xinjiang plant by 7,000MT, which is intended to serve the high-purity needs of monocrystalline solar wafers and the expanding semiconductor sector.

Daqo noted that the Phase 3B expansion plan included the adoption of new designs, processes, technologies and equipment that would further improve the quality and purity of its polysilicon products as well as the ability to conduct further debottlenecking projects that could increase its capacity to 30,000MT per annum, up from 18,000MT to date.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The company said that the project design and initial preparation works for Phase 3B Project would be completed by the end of 2017 and constructions through equipment installations would be completed by the end of 2018. Daqo plans to start pilot production in the first half of 2019 and reach full capacity by the end of the second quarter of 2019.

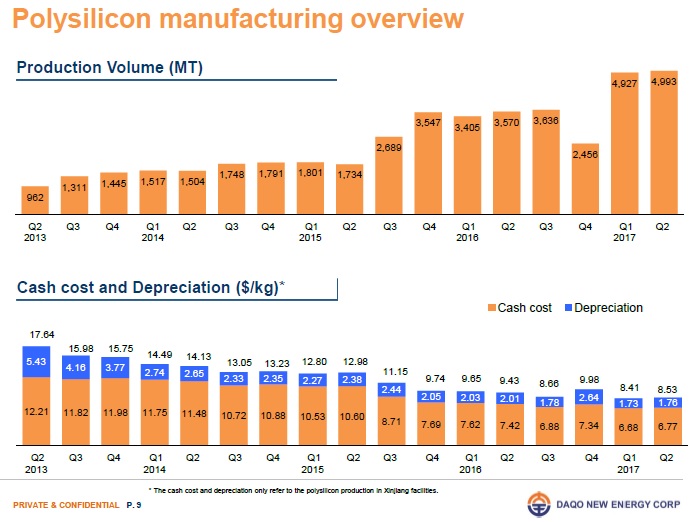

Already a polysilicon production cost leader, Daqo noted that overall total production cost at the Xinjiang facilities could potentially be decreased to US$7.50/kg. The company is targeting to reduce production costs to around US$8.0/kg by the end of 2018.

The company is targeting polysilicon production quality of electronic grade 1, the highest grade for the new expansion. Daqo claimed in its second quarter earnings call that around 80% of its production was above electronic grade 3.