The US’ two leading states in solar and energy storage, New York and California, have taken steps towards valuing the locational and time-of-use value of distributed energy resources and other states should follow, the Solar Energy Industries Association (SEIA) has said.

The national trade group has just published a whitepaper, ‘Getting more granular: How value of location and time may change compensation for Distributed Energy Resources (DERs)’. This looks at the way in which, increasingly, the deployment and operation of distributed and clean resources such as renewable energy, demand response and energy storage can be considered strategically from the viewpoint of the utility or grid operator.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Essentially, to reduce operating costs, add resiliency to power supplies and enable the spread of distributed, clean energy without conferring high capital costs of investment, distributed energy resources should be considered in the planning of a distribution grid, SEIA argues. DERs can provide not only power but also grid services, such as peak load reduction, which can be particularly useful to grids that have a high penetration of solar PV, to give just one example.

To achieve this and other goals such as reducing the need to build grid infrastructure such as substations utilities and grid planners could use renewables-plus-storage in a strategically deployed way. However, the trade group said, “distribution grid planning must evolve to allow more transparency into system needs, enable more robust data exchange between utilities and DER providers, and include DER as a standard component of utility load forecasts”.

Adding ‘granularity’ in this context means that if the value of solar and other DERs was forecasted and measured frequently, perhaps in half-hourly or 15-minute windows throughout the day, and tariffs and metering reflected this – and if the location of those DERs relative to nodes on the grid that most needed them were also correctly valued – it would give stakeholders in a power network the ability to balance electricity supply and demand on an instantaneous or near-instantaneous basis.

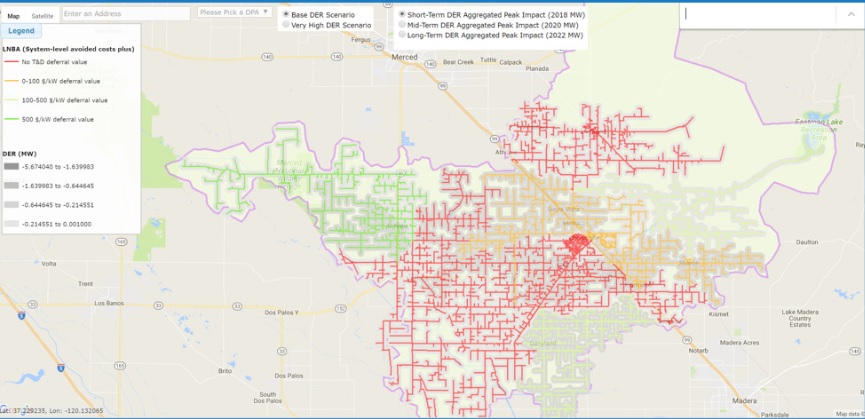

SEIA advised that in addition to highlighting local capacity needs, utilities should create maps of their service areas, showing where DERs could have most locational value, for example those points on the grid that suffer high peaks in late summer, where traditionally a multi-million dollar substation would have been considered, might be good places at which to site solar-plus-storage or other DERs. DERs, SEIA argues, should be directed towards “high-value locations” where possible.

New tariffs for new paradigms

New York has introduced a “Value of Distributed Energy Resources” tariff for large C&I utility customers and for community solar. As with California, the state is moving away from net metering for solar and introduced a new methodology for calculating C&I and community solar bills late last year. Part of New York’s REV (Reforming the Energy Vision) programme, the tariff has been introduced to create a “value stack” for each potential solar project and adding together the ways in which each project will benefit the grid at its selected site. New York’s Public Service Commission considers the tariff to be a “first step” towards phasing out net metering, which will remain in place for residential customers until 2020.

California, on the other hand, has introduced Net Metering 2.0, under which distribution system data will be used to create capacity maps, locational value determined and ultimately modifying the distribution planning process. As with the New York “Value” tariff, it has been acknowledged that at present this is a transitional step and the state’s Public Utilities’ Commission ruled that the whole net metering programme will be reassessed next year, once the locational value data has been captured.

While California and New York are touted as leading examples, among the recommendations from SEIA are that the value of backup power or uninterruptible power supplies using DERs are properly assessed. At present, even in California, backup power is considered desirable and systems are being sold for this purpose, but are not yet valued at utility or grid-level.

“The modern grid must more effectively use DERs such as solar to meet system needs,” the whitepaper said.

“Increasingly, states leading the way in grid modernization are determining locational values and considering compensation mechanisms to guide DER to areas where they can have the most impact.”

SEIA considers that these mechanisms must incorporate recognition of “the full range of values” DERs can provide for an electrical network. The ability to offset traditional investment, to reduce demand especially at peaks and to provide resilient power supplies are all values that grid planning must more accurately come to recognise, the trade group said.

One of the main benefits that could come from such an undertaking is that compensation for the value of the DERs to a network could be determined on a long-term basis, giving project developers and asset owners the ability to bank on revenue streams that will support their DERs over several years, thereby reducing capital cost for ratepayers, utilities, grid operators and the asset owners or operators themselves.

Download SEIA's whitepaper: ‘Getting more granular: How value of location and time may change compensation for Distributed Energy Resources”, here.