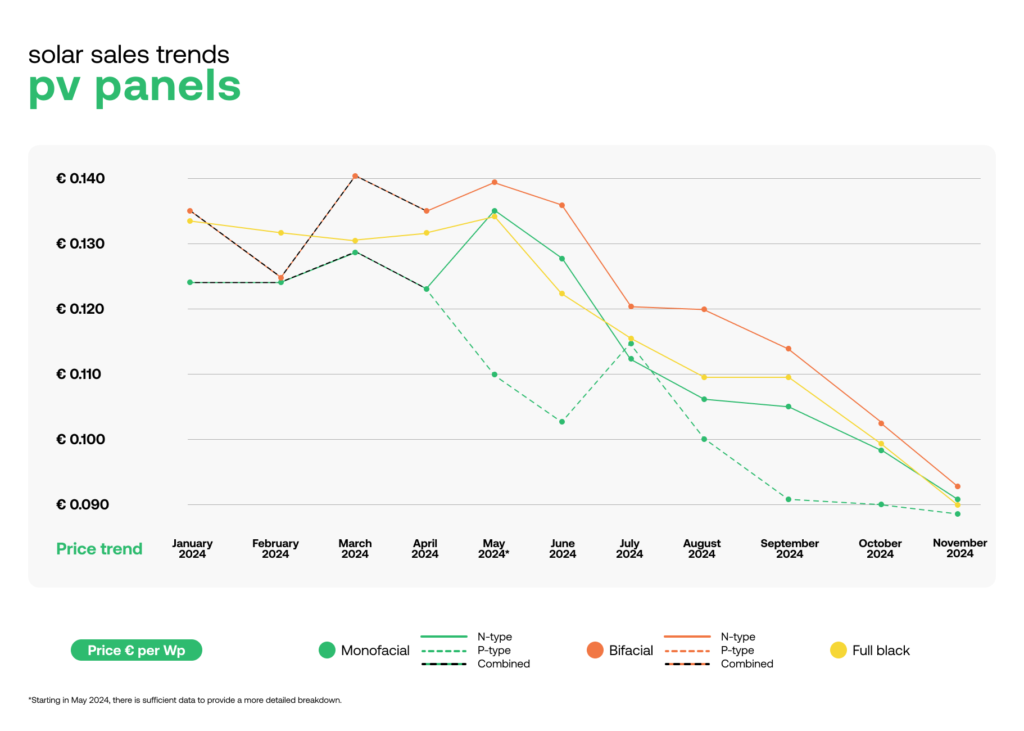

As the price of solar panels continue its downward trend in November, module prices are expected to see a “slight uptick” in December, according to the latest pv.index report.

Released by solar wholesaler sun.store, the pv.index report for November reported prices that have remained relatively consistent since May, with the prices for all modules below €0.1/Wp (US$0.105).

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

“The downward pricing trend persisted in November, with all segments hitting new lows – some module offers even nearing €0.05/Wp. Distributors continue their stock liquidation strategies, driven by end-of-year warehouse clearance efforts,” said Krzysztof Rejek, head of business development at sun.store.

“Looking ahead to December, we anticipate a slight uptick in prices due to China’s limited production capacity and a reduction in export tax rebates for modules. However, the availability of discounted stock from distressed distributors is likely to keep the overall average prices at competitive levels,” added Rejek.

The biggest drop between October and November was for n-type bifacial modules, which decreased by 10% from €0.103/Wp to €0.093/Wp. The decline was driven by intensified competition and surplus stock. Other modules have had a price drop between 2% for monofacial p-type modules and 9% for full black modules, which sit now at €0.09/Wp, as shown in the chart above.

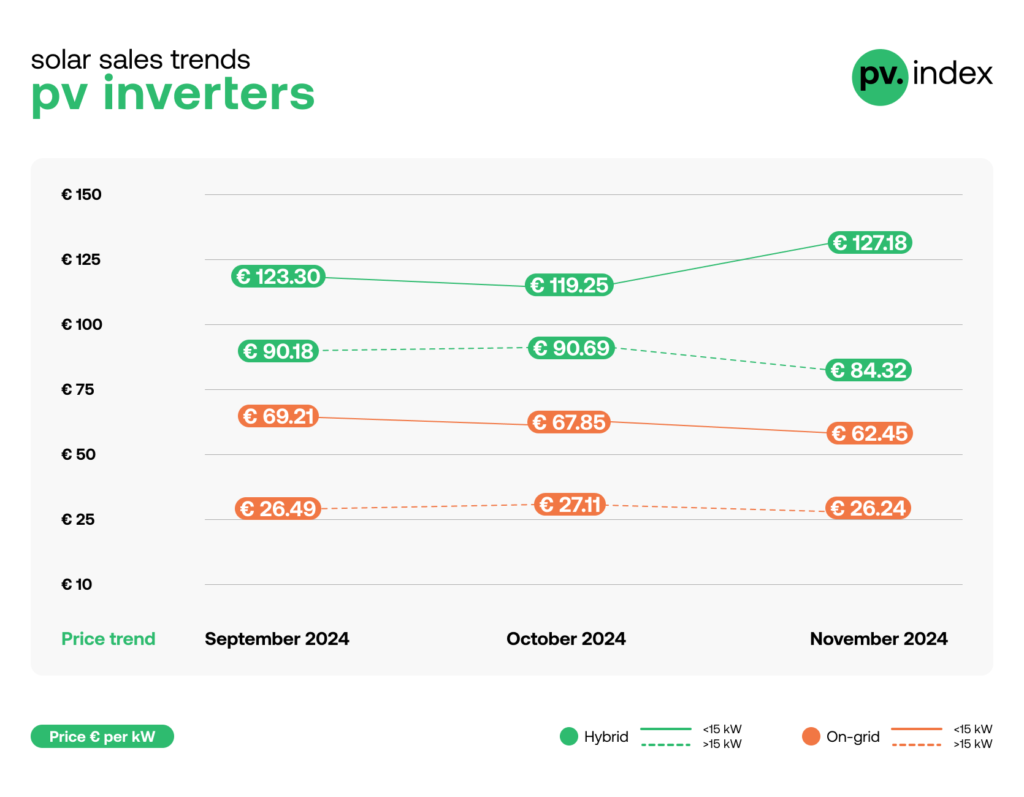

Inverter prices, which were introduced in October, have seen both ups and downs in hybrid inverters, depending on the capacity, while on-grid ones have all declined.

Prices for hybrid inverters with a capacity of less than 15kW has increased in a monthly basis by 7% to €127.18/kW due to a growth in demand for advanced residential solutions. This could be a positive outcome for the inverter market, as several inverter manufacturers have faced lower revenue and shipments in 2024 (Premium access) and struggled with the ‘challenging’ residential PV market.

Resilience in the European solar market

Another metric covered by sun.store is called the PV Purchasing Managers’ Index (PMI), which gauges the intentions of the platform’s registered users. In November, the PMI remained stable at 68, similar to the previous month.

Although this could show some resilience in the demand-side, it also reflects seasonality transitions and broader economic uncertainties, according to sun.store.

Filip Kierzkowski, head of partnerships and trading, said: “This steady PMI demonstrates the resilience of the European solar market, even as we enter the traditionally slower months. It’s encouraging to see consistent interest in high-quality components, despite external challenges.”

For the final month of the year, purchasing intentions are on par with November as 51% of the respondents said they plan to increase purchases – up from 50% last month – while 35% plan to maintain the current buying levels and only 14% to reduce their orders.