Prices of all upstream PV products such as silicon wafers and silicon ingots increased recently, but downstream module prices continued to decline and reached new lows.

According to statistics released on 2 August by the Silicon Industry Branch, silicon prices rose continuously for three consecutive weeks. Specifically, n-type materials were priced at RMB78,000-85,000 (US$10,860-US$11,834.7) /tonne, with an average transaction price of RMB80,400/tonne, representing a week-on-week increase of 2.03%.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Mono recharging chips were priced at RMB67,000-78,000/tonne, with an average transaction price of RMB71,800/tonne, increasing by 2.28% week-on-week.

Mono dense polysilicon was priced at RMB65,000-76,000/tonne, with an average transaction price of RMB70,200/tonne, a week-on-week increase of 2.93%. Mono popcorns were priced at 62,000-73,000/tonne, with an average transaction price of RMB66,500/tonne, a week-on-week increase of 3.91%.

The Silicon Industry Branch predicted that the destocking of polysilicon will continue in August, and the prices will continue to rise. On the demand side, overseas module stockpiling continued, supporting high silicon wafer production rates and a growth trend in silicon material demand.

On the supply side, due to recent reports of power rationing in Baotou in Inner Mongolia and Leshan in Sichuan, in addition to technical upgrades, silicon material production companies experienced a decrease in output. Additionally, new production capacity was delayed due to market factors while inventory levels of existing producers were depleted, resulting in a much lower supply of silicon materials than expected.

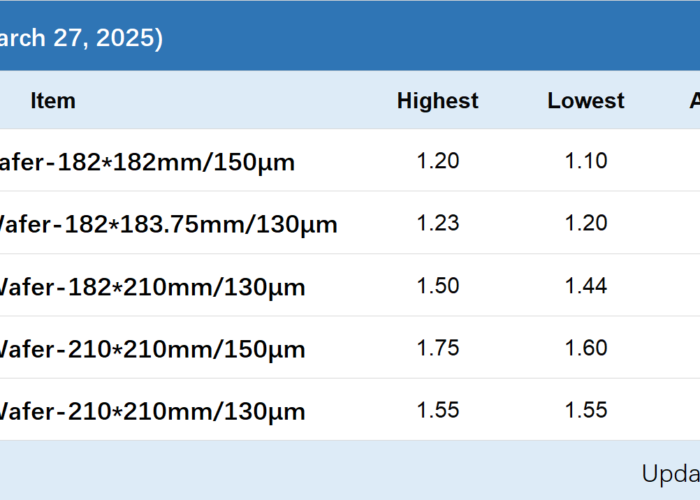

With this background, silicon wafer prices rose, and silicon wafer inventories were low. As a result, prices for some n-type silicon wafers also slightly increased. Silicon wafer companies were now more capable of withstanding the increase in raw material prices, and their willingness to raise prices for transactions also increased.

On 29 July, TCL Zhonghuan updated its quotes for mono silicon wafers, which rose by RMB0.1-0.19/piece, representing an increase of 3.5%-5.2%.

There were indications in the industry that cell prices also showed upward signs recently, climbing from around RMB 0.7-0.73/watt. The latest data from Infolink also indicated that silicon wafers and cells continued to rise in price in addition to silicon materials. Among them, silicon wafers increased by about 5%, and cells of different sizes increased by 1.4%-2.1%.

Competition in modules, prices hit new lows

In contrast to the upstream of the PV manufacturing chain, module prices were declining.

Low prices frequently appeared especially in recent tenders launched by state-owned enterprises. The lowest price for first-tier module manufacturers reached RMB1.168/watt, setting a new record for the lowest bid price in recent module tenders. Meanwhile, another first-tier brand submitted a bid of RMB1.262/watt in the n-type section.

From recent tenders, the prices of p-type modules dropped from about RMB1.78/watt to the current average of around RMB1.2/watt. The prices of n-type modules also dropped from RMB1.85/watt to the current average of approximately RMB1.3/watt.

The module market competition is becoming increasingly fierce, with first-tier and new first-tier brands joining the race as their competitive edge lies in production capacity, scale, and financial reserves.

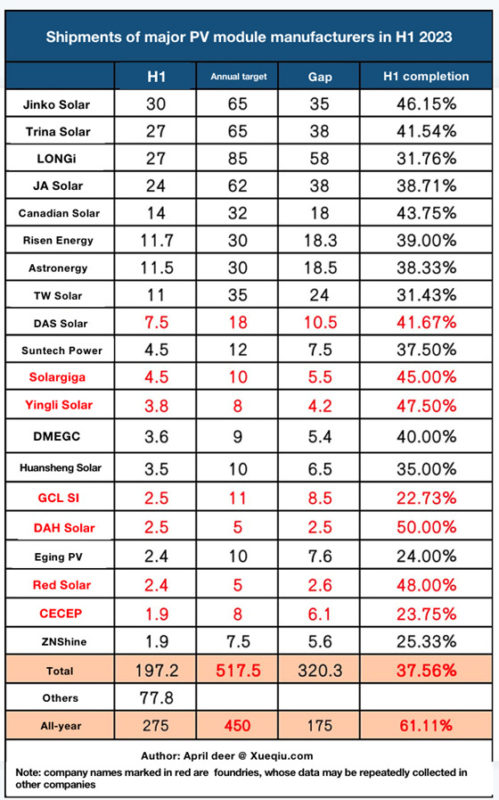

Apart from competing for market share, there was also pressure from shipments. An industry analyst, named April Deer, said the price war initiated by first-tier companies might be related to the lower-than-expected shipments of mainstream module companies in the first half of the year. According to statistics, the completion rates of shipments for most mainstream module companies in H1 2023 ranged from 23%-48%, with an average completion rate of only 37.56%.

The chart showed that most mainstream module manufacturers’ shipments in H1 2023 did not meet the expectations. To maintain the same supply targets throughout the year, companies will compete more fiercely in H2 2023.