On May 29 LONGi Green Energy updated its mono silicon wafer prices, with a decline of over 30% across the board, drawing the industry’s attention.

According to the update, 150μm M10 mono p-type wafer was adjusted from RMB6.3 (US$0.89) to RMB4.36, 30.8% lower, while the 150μm M6 mono p-type wafer was down from RMB5.44 to RMB3.81, a decline of 30%.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

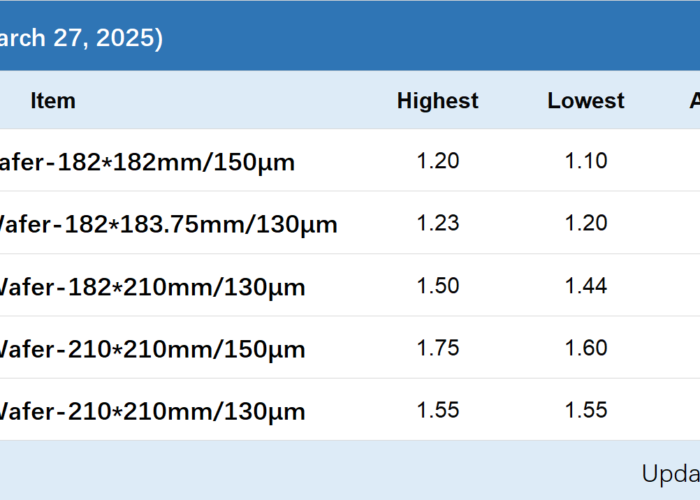

With these steep drops, these low prices for LONGi’s M10 and M6 wafers have not been seen since March and April 2021 respectively, as shown in the chart below.

Price competition between the two industry giants, LONGi and TCL Zhonghuan are shifting from nip-and-tuck to more widely divergent. Take 128 mm wafer as an example; LONGi’s price is 12.8% lower than that of TCL’s RMB5/piece after the latest adjustment. The whole industry is speculating on TCL’s next move.

Sales staff told PV Tech that recently wafer prices have varied day by day. Last week they seemed to stabilise at RMB4-4.2/piece, while this week RMB3.8/piece is already being seen in the market. According to Silicon Industry Branch, the lowest price level tracked currently sits at RMB4.2/piece, while Jibang Consulting’s quote is even lower at RMB4.15/piece.

Wafer prices collected by InfoLink, EnergyTrend and Shanghai Metals Market (SMM) have been dropping since April, with a big drop after the Labor Day holiday in early May. Wwafer manufacturers have been looking to destock their current assets according to InfoLink, adding that wafer manufacturers have cut production. However, prices will continue to decline before stabilising.

As for fused silica, Silicon Industry Branch published on May 24 that n-type product price reached RMB135-140/kg for the week, with the trading price at RMB135.4/kg, a week-on-week decline of 9.55%, while mono-dense polysilicon was priced between RMB125-130/kg, with the average trading price at RMB128/kg, a week-on-week decline of 10.3%.

For the week beginning in 29 May, the declining trend of polysilicon prices remained at a significant level of 10%. Since the end of April, silicon prices plunged by over RMB53/kg, equivalent to RMB1/piece lower on the cost side. LONGi’s 182 mm wafer price dropped by RMB1.94/piece, equivalent to RMB0.26/W lower at the cost of cells.

Industry experts think that LONGi’s RMB1.94/piece for wafer price was due to a decrease in the silicon price and a discount at the wafer segment.

Module bidding price lower than RMB1.5/W

The price fluctuations in the upstream manufacturing sector are gradually extending to the downstream. Recently, the lowest bidding prices for the modules from two major Chinese state-owned enterprises have dropped below RMB1.5/W (US$0.21/W). Along with the further decline in the prices of silicon wafers in this cycle, it is expected that the PV module prices will rapidly reach below RMB1.5/W in June.

Regarding the subsequent price trends, the Silicon Industry Branch analysis suggests that the future price trends will be subject to adjustments based on various factors such as the pace of new silicon production capacity, the actual reduction of silicon wafers, and end-user demand.

According to industry insiders, the silicon material segment currently faces an issue of high inventory. As more capacity is released subsequently, the oversupply of silicon will persist long-term, and the price of silicon material is expected to drop to around RMB80/kg.

Driven by the decline in silicon material prices, the prices of silicon wafers, solar cells and modules will further decrease. By June, it is expected that the market may see prices at or around RMB1.5/W.

Concerns over excess capacity, industry may face a new round of reshuffle

At the recent SNEC conference and exhibition, Li Zhenguo, the founder and president of LONGi Green Energy, was asked about the excess capacity issue in the PV industry during a media interview.

Li Zhenguo stated that a consensus on carbon neutrality has been reached, so the energy transition has become inevitable. Considering the ultimate goal, the market scale of the PV industry will remain very large. However, temporary overcapacity could happen at any time. The later it occurs, the more severe the next round of overcapacity may be.

“The ones that would be hurt first may be companies that are not sufficiently prepared, such as those with relatively fragile finances or not in a leading position in terms of technology. Whether these companies can survive in this round of reshuffling will be questionable,” said Li Zhenguo.

LONGi has taken measures in preparation for these potential risks. Li Zhenguo mentioned that the company has sufficient funds, and they have recently launched a Global Depositary Receipt (GDR) issuance in the capital market, expecting to have enough cash reserves.

Furthermore, LONGi has relied on technological manufacturing as its core competitiveness in previous years, so in the future they aim to build a dual drive with both “technological manufacturing” and “technology services”. In terms of customer service, LONGi will see about ten times the growth in human resource investment over the next three years.