PV wafer and module manufacturer ReneSola reported lower than expected PV module shipments and revenue in 2015, while expanding wafer shipments.

Full-year 2015 revenue was guided to be between US$1.5 billion to US$1.6 billion, on lower external module shipments than in 2014 as the company shifted its business model downstream and entered the LED market.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

However, actual revenue was reported to be US$1.28 billion on external PV module shipments of 1.6GW, down 18.9%, compared the previous years and down compared to PV Tech estimates of 1.72GW. The company reported 2014 revenue of US$1.56 billion.

The company also guided 2016 revenue to be lower than last year at US$1 billion to US$1.2 billion, with the anticipation of lower module shipments to third parties.

Wafer capacity expansion

The company took full advantage of solar wafer tight supply and higher ASPs, shipping a total of 1.09GW of wafers, up 28.7% year-on-year. ReneSola also said it expected to increase wafer production capacity through technology improvements by 500MW to reach a nameplate capacity of 2.9GW by mid 2016.

Fourth quarter results

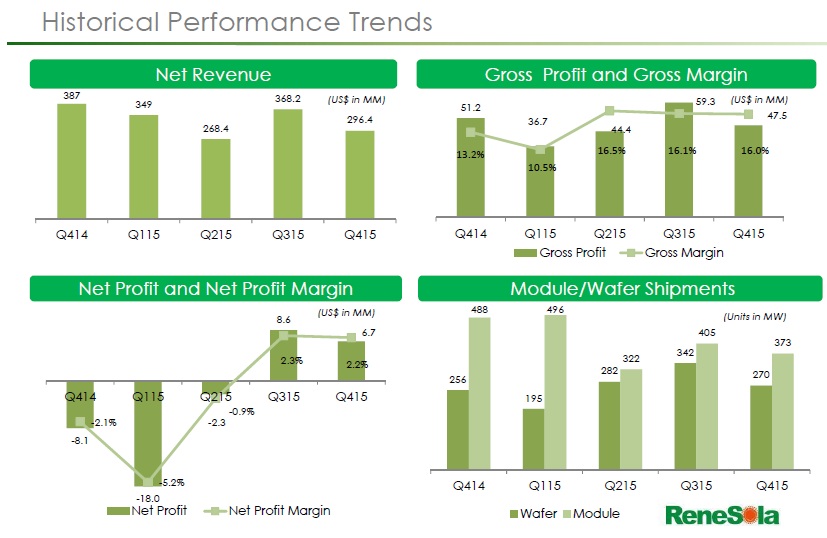

ReneSola reported fourth quarter 2015 revenue of US$296.4 million was down 19.5% from the previous quarter and down 23.4% year-on-year and slightly exceeded guidance of US$275-$295 million. The revenue decline was said to be due to lower ASP and lower shipments to external customers.

The company reported a gross profit of US$47.5 million, down 20.0% from the prior quarter and 7.3% in the prior year period. Gross margin expanded to 16.0% when compared to the fourth quarter of 2014, but was down slightly sequentially.

The increased gross margin was said to be due to reduced operating expenses, a reduction in debt by US$59 million and a shift to higher margin PV power plant building and selling outside China.

Net income in the quarter was US$6.7 million, which compares to a net income of US$8.6 million in Q3 of 2015 and a net loss of US$8.1 million in the prior-year period.

Full-year financial results

Although revenue was down 17.9% and gross profit down 10.2% (US$187.9 million) from the previous year, gross margin expanded to 14.7% from 13.4% in 2014, which was supported by lower operating expenses of US$158.6 million, or 12.4% of revenue, compared to US$201.1 million, or 12.9% in 2014.

Operating income for the full year was US$29.3 million, or 2.3% of revenue, compared to US$8.2 million, or 0.5% in 2014.

The company reported a net loss of US$5.1 million, compared to a net loss of US$33.6 million in 2014.

PV projects update

ReneSola reported that earnings from PV power plant project sales totalled US$110.7 million in 2015 with an average gross margin of over 23%.

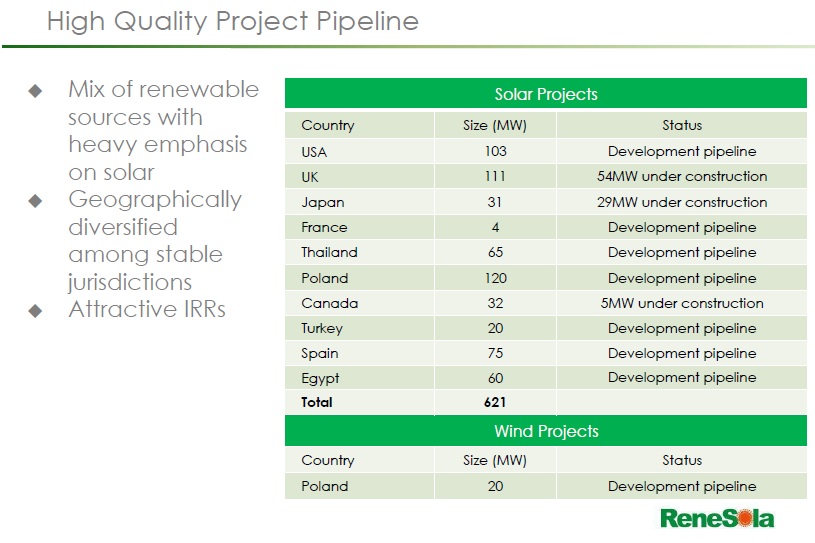

The company said it currently had 641MW of PV projects in various stages of development across a broad geographical mix outside China.