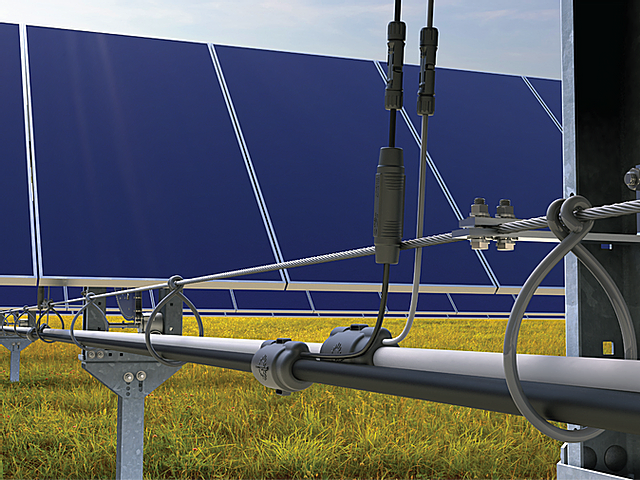

US solar product manufacturer Shoals Technologies Group saw record revenue and gross profit in the second quarter of 2022 due to strong demand for its combine-as-you-go system and a large number of new customers buying up components.

The firm, a provider of BOS solutions for solar, storage, and electric vehicle (EV) charging infrastructure, surmounted the significant problems and uncertainty facing the industry during Q2 to achieve these records whilst also maintaining gross margin within its targeted range.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Only in May, the company had joined other manufacturers in adjusting its guidance for the year, blaming an “increasingly challenging environment” caused by the US AD/CVD investigation, which halted shipments of equipment to the US from certain manufacturers.

Despite this, Shoals, whose technology has been deployed on more than 20GW of solar projects internationally, had backlog and awarded orders of US$327.2 million in Q2, up 63% on the previous year, and up 8% from Q1 this year. These increases were again put down to robust demand for the company’s products.

“Demand for our combine-as-you-go solution continues to grow,” said Jason Whitaker, CEO of Shoals. “During the quarter we converted four additional customers, bringing the total Big Lead Assembly (BLA) [Shoal’s in-line fuse and wire manufacturing technology] customers to 29. Customer interest in our recently introduced products is strong, particularly within battery storage, wire management and EV charging.”

The two-year tariff exemption for solar panels announced by the White House, Whitaker noted, had also been a “turning point” in customer sentiment, that led to the normalising of order patterns.

The company’s revenue increased to US$73.5 million, up 23% on US$59.7 million for the prior-year period, driven by increases of 97% in components and 11% in system solutions, according to its Q2 results.

Components revenue was driven by shipments of both battery storage and solar products to a significant number of new customers. New customers tend to buy components before transitioning to system solutions.

Meanwhile, strong demand for the company’s combine-as-you-go system was the key factor in the growth in system solutions revenue, which represented 77% of the total revenue in the quarter.

Gross profit increased to US$28.6 million, up 9% on US$26.2 million in the prior-year period. Gross profit as a percentage of revenue went slightly down to 38.9% compared to 43.8% in the prior-year period, due to a higher proportion of components sales, which have lower margins than system solutions and higher raw material and logistics costs.

Adjusted EBITDA was US$19.8 million compared to US$20.6 million for the prior-year period.

Looking ahead to the full year, Shoals still expects revenues to be in the range of US$300-325 million, adjusted EBITDA of US$77-86 million and adjusted net income between US$45-53 million.

In March, Shoals said it would double its BOS manufacturing capacity with a new US facility as its backlog and awarded orders reached a record high.

New CFO appointed

In related news, Shoals has appointed Dominic Bardos as CFO, starting from 3 October this year. Bardos has worked in senior finance positions at several companies including at automotive manufacturer Holley, and Tractor Supply Company.

“We are excited to welcome Dominic to our company’s executive leadership team,” said Jason Whitaker, CEO of Shoals. “His extensive experience as a public company finance leader will be instrumental in further supporting Shoals’ continued financial performance and execution of our global growth plans.”