US solar balance of systems (BOS) solutions provider Shoals Technology Group reported a record Q2 revenue increase of 38% on last year, bringing the total to US$59.7 million.

Its system solutions grew 62% year-on-year and contributed an increased share of last quarter’s revenue compared with the same period the year before. However revenue from its components business slipped owing to changes to the timing of certain customer orders, Shoals said, indicative of a trend for utility-scale solar projects being impacted by component price increases elsewhere.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Speaking to analysts after the results disclosure yesterday, Shoals CEO Jason Whittaker said that while the company had seen “some project movement” on a quarter-to-quarter basis, this was not expected to be material moving forward and Shoals had yet to see any projects cancelling.

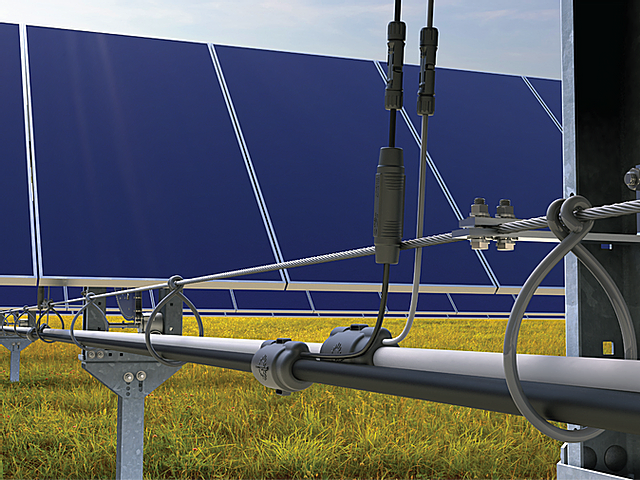

Shoals said growth in its system solutions revenue is down to strong demand for its combine-as-you-go system and system solutions, sales of which represented 86% of total revenue last quarter, compared with 73% last year.

In turn, gross profit increased to US$26.2 million, up 56% from US$16.8 million in Q2 2020. Gross profit as a percentage of revenue increased from 38.8% to 43.8%, driven by increased revenue, purchasing efficiencies, improved material planning, reduces logistic costs, product enhancements and other manufacturing efficiencies, according to Shoals.

Income from its operations was US$14.1 million compared with US$5.4 million during the same period in the prior year, an increase of 159%, while net income was US$9.2 million, up from US$5.2 million a year earlier.

Adjusted earnings before tax, interest, depreciation and amortisation (EBITDA) in Q2 increased 34% to US$20.6 million, compared to US$15.4 million last year.

The Portland, Tennessee-based company has also reaffirmed its growth outlook for the remainder of the year. “The continued strength in our results and robust customer demand support our growth outlook,” said Jason Whitaker, CEO of Shoals.

In Q1 2021, Shoals revenue hit new highs of US$181 million at the end of March 2021, driven by strong demand for its products in the US, while an IPO earlier this year has seen the company celebrate a “record year” in which revenues grew 21%.

“Since going public in January, we have more than doubled the number of BLA customers and have an additional 13 customers in transition to our system, including two international customers,” said Whitaker.

Shoals reaffirmed its full year guidance for revenues to be within the US$230 – 240 million range, equivalent to a 31 – 37% increase year-on-year, while earnings is expected to amount to US$75 – 80 million.