Major PV inverter manufacturer SMA Solar Technology reported a number of external forces that impacted third quarter financial results that would extend through at least the first half of 2018.

Having reported a strong rebound in revenue in the second quarter of 2017 but impacted by average selling prices (ASP) declines, SMA Solar was hit in the third quarter by semiconductor component shortages, primarily IGBTs and MOSFETs, due to a semiconductor boom and limited capacity at a small number of high-quality producers.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Adding to woes was the lack of demand from the utility-scale market in the US, which has been a boon to the company in the last few years as PV projects are put on hold, due to pending solar module trade tariffs.

As a result, SMA Solar lowered full-year revenue guidance after raising it in the previous quarter. The company said that it expect revenue to more than €900 million, compared to previous guidance range of €900 million to €950 million. EBITDA of between €85 million and €100 million remains unchanged as well as its net cash position of more than €450 million.

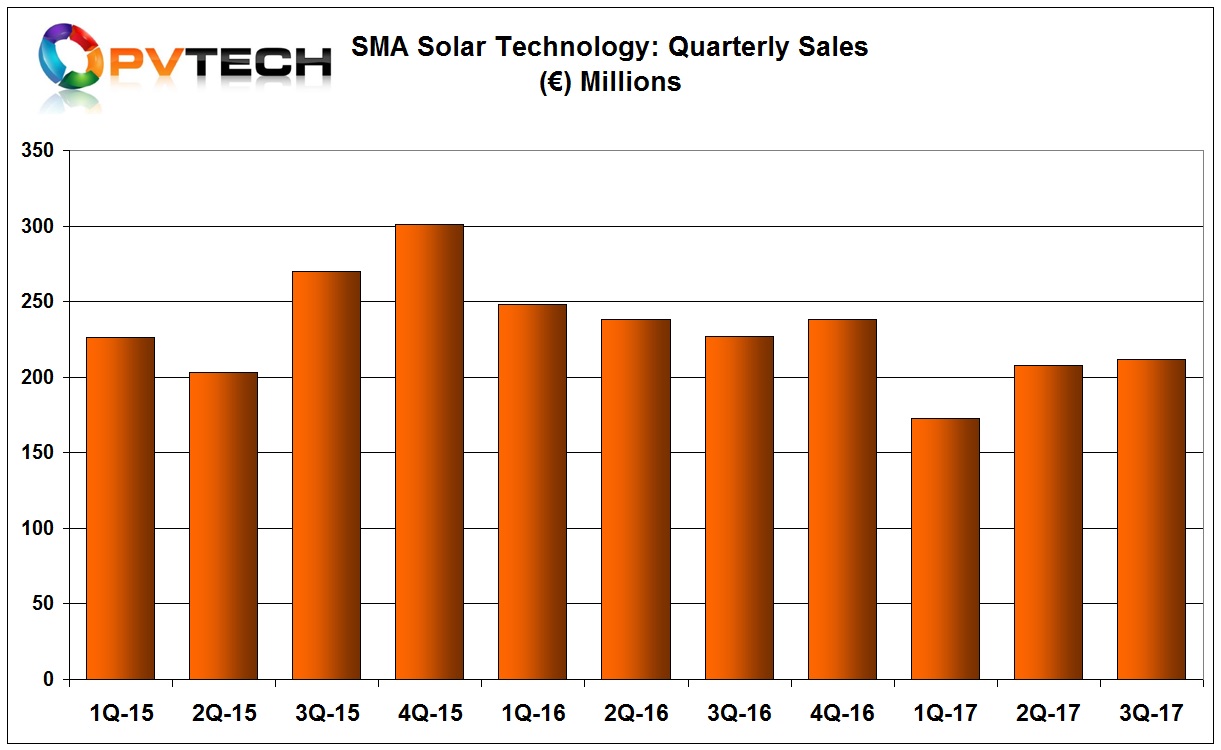

Despite the setbacks, SMA Solar slightly increased sales in the third quarter, reaching €211.5 million, up from €208 million in the previous quarter. However, sales in the first three quarters of 2017 where €592.5 million, compared to €708.8 million in the prior year period.

Although several rounds of major corporate restructuring have lowered operating costs significantly, SMA Solar’s EBITDA) of €55.3 million in the first three quarters was €55.3 million, compared to €107.9 million in same period of 2016.

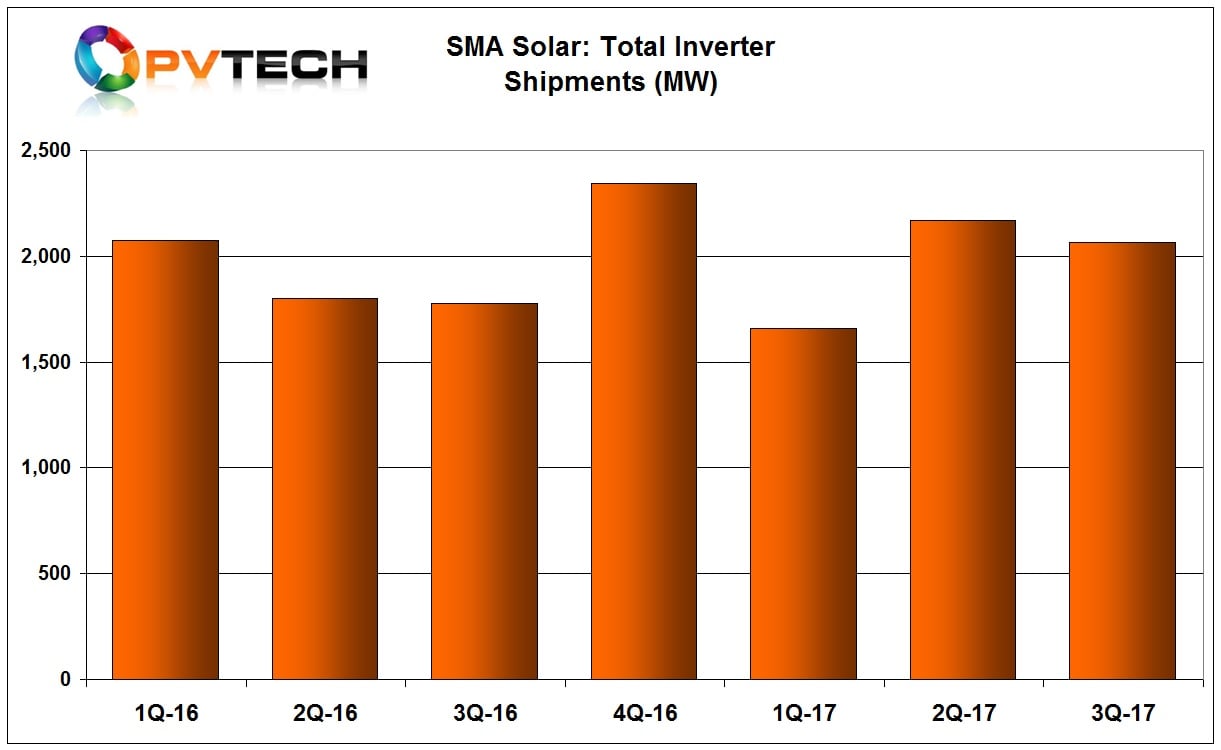

Inverter shipments in the third quarter reached 2,064MW, down from 2,169MW in the previous quarter.

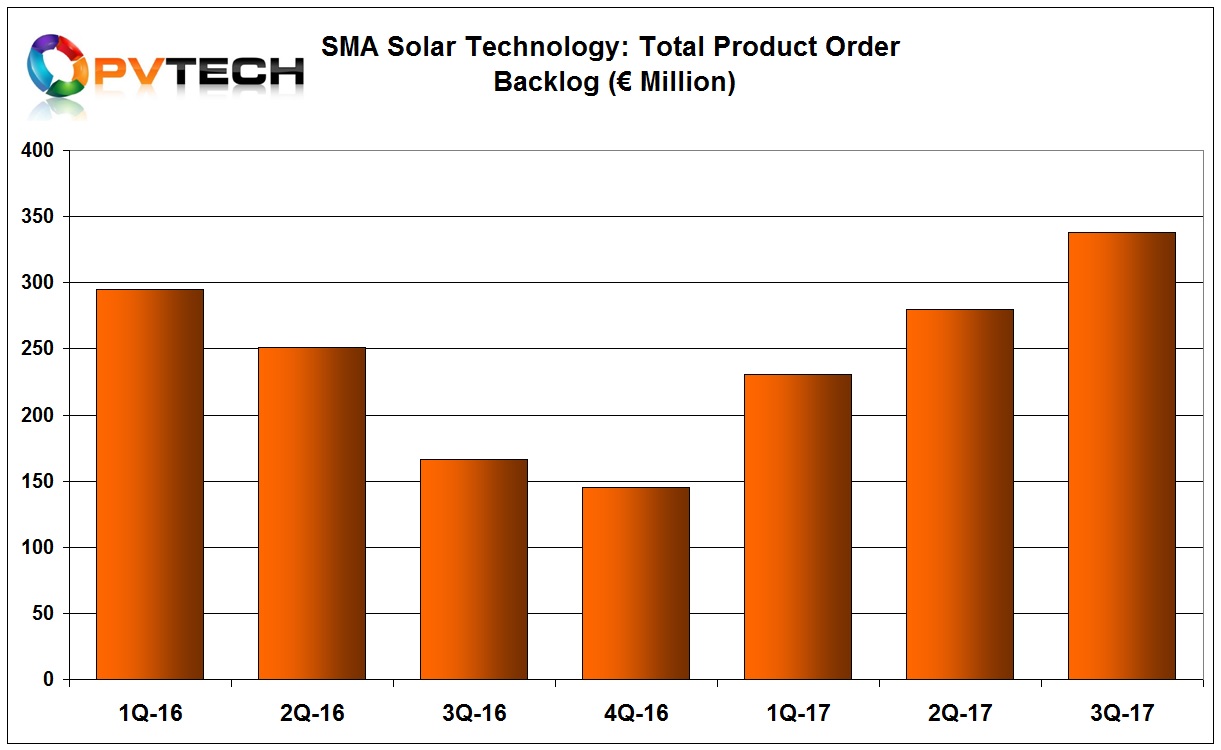

Total product order backlog grew sequentially to €337.9 million, compared to 279.8 million in the previous quarter. However, semiconductor component shortages and the US trade issues may have influenced the increase, which is almost €43 million above the first quarter of 2016, the highest backlog level in recent years.

The largest segment of product order backlog in the first nine months of 2017 was utility-scale at €133 million. Commercial segment was €133 million and residential was €46 million.

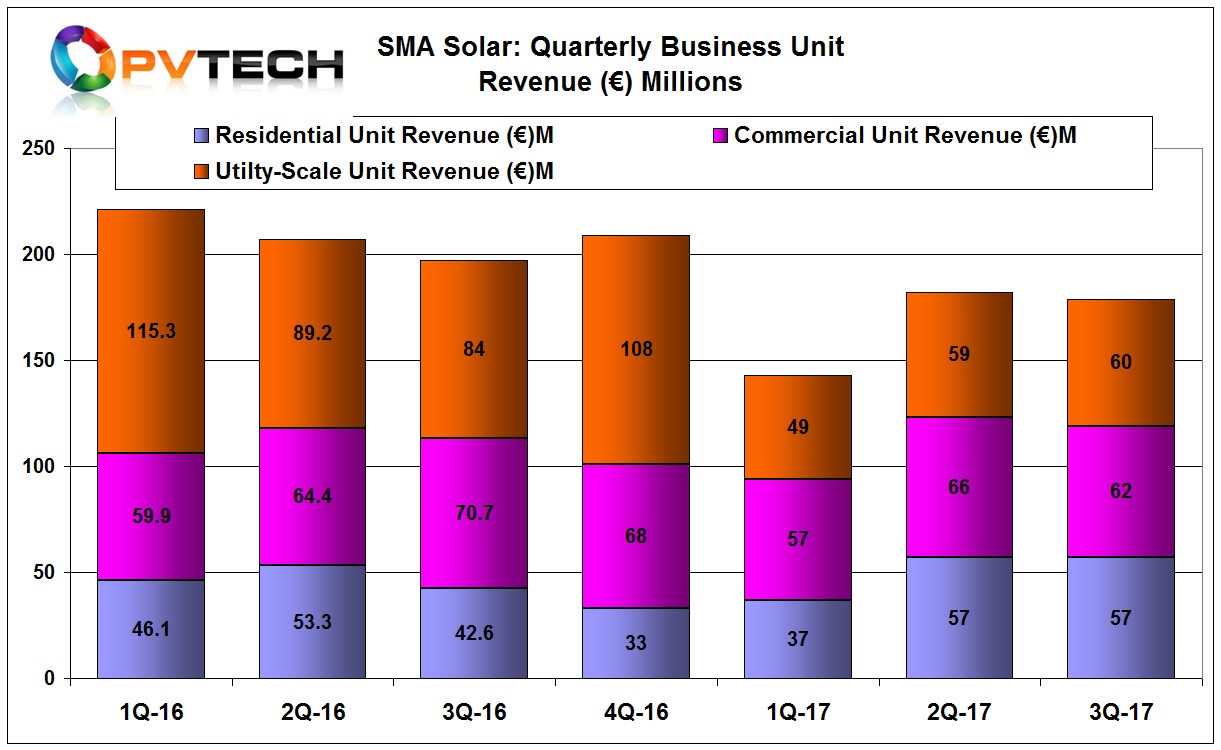

Residential market sales were flat quarter-on-quarter at €57 million and stood at €151 million in the first nine months, flat year-on-year.

Commercial sales were down quarter-on-quarter at €62 million and down to €185 million in the first nine months of 2017, compared to €200 million in the prior year period.

The utility market sales were flat quarter-on-quarter at €60 million, compared to €59 million in the previous quarter. However, utility sales were significantly down year-on-year at €168 million in the first nine months of 2017, compared to €289 million in the prior year period.

“To date, the fiscal year has gone better for SMA than we had expected at the start of the year,” said SMA CEO Pierre-Pascal Urbon. “We have once more shown that we are good at adapting to the quickly changing market conditions. Thanks to our international presence and our new products, we have increased the product-related order backlog by 25% to €350 million since the end of the first half of 2017. We expect strong end-of-year business and are confident about achieving our objective for the year.

However, due to a supply shortage of critical components we will probably come in at the lower end of the sales guidance. With Strategy 2020, we are going one step further. As an energy service provider, we want to benefit from the digitization of the energy industry in the future. Therefore, SMA will invest in platforms to connect energy producers with energy consumers and create network effects. The PV inverter remains our core area of expertise because it is the ideal sensor for valuable energy data,” added Urbon.