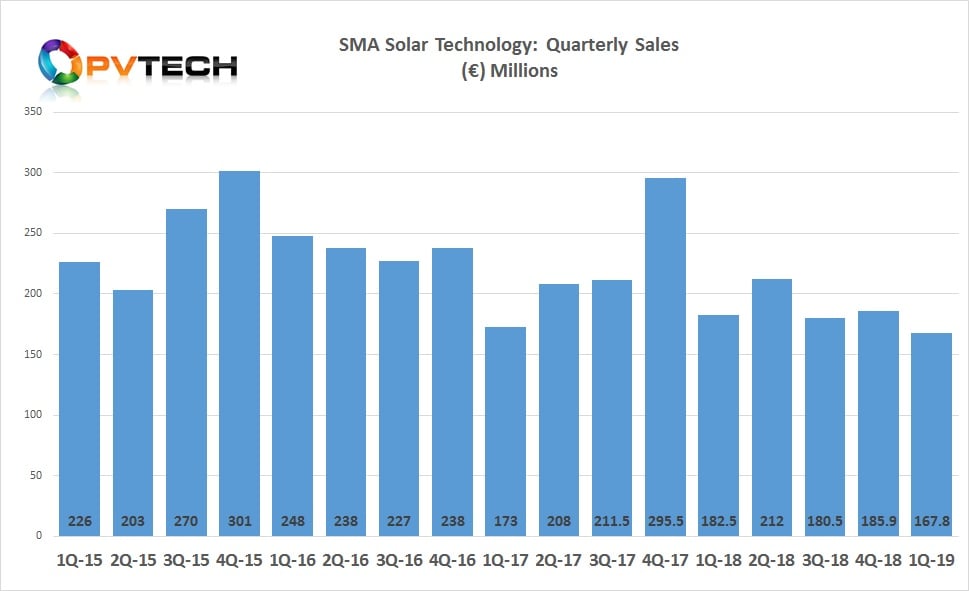

Major PV inverter manufacturer SMA Solar Technology reported its lowest quarterly revenue and a meagre EBITDA of €0.6 million as its main inverter business units made losses in the first quarter of 2019.

SMA Solar reported first quarter sales of €167.8 million, down from €185.9 million in the previous quarter and down from €182.5 million in the first quarter of 2018.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

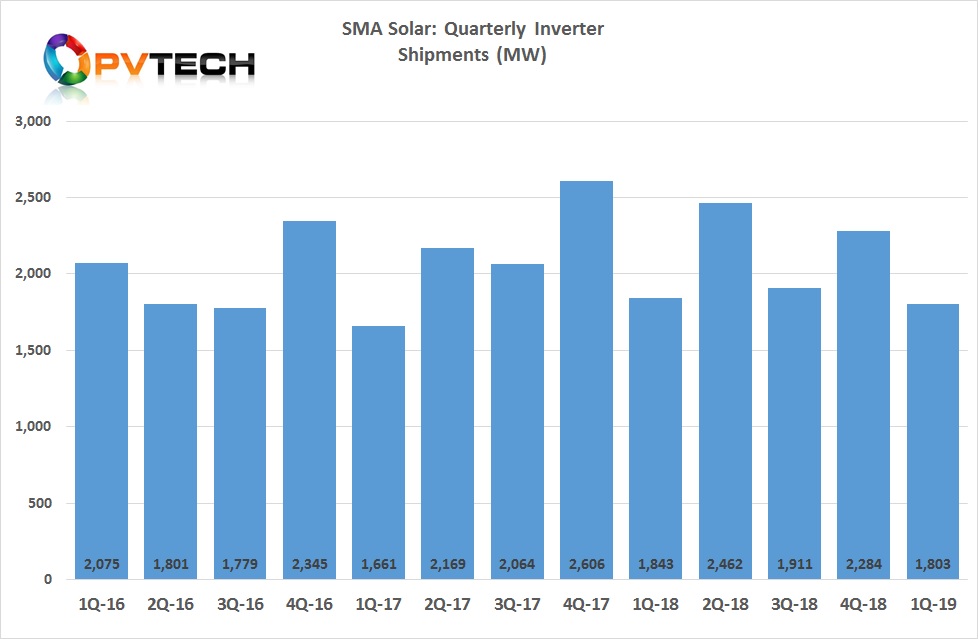

PV inverter unit sales were 1,803MW in the reporting quarter, down from 2,284MW in the previous quarter and down slightly (1,843MW) from the first quarter of 2018.

The company said in its quarterly report that the decline in sales was primarily due to weaker utility-scale business, specifically in Australia as well as weak demand (seasonality) from the US.

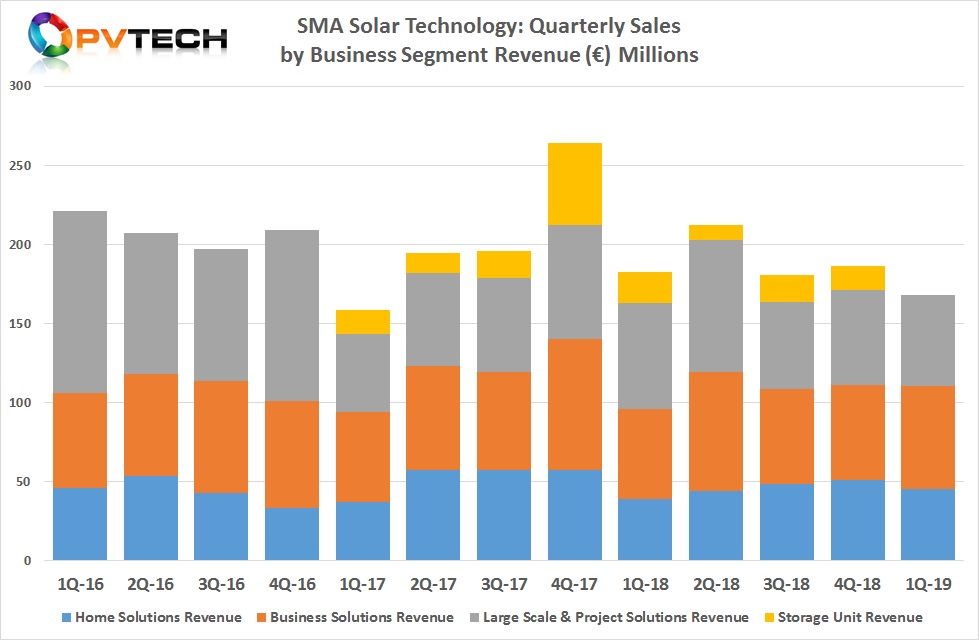

SMA Solar has reclassified its business units, which have been changed to Home Solutions (formerly Residential), Business Solutions (formerly Commercial) and Large Scale & Project Solutions (formerly Utility-scale).

In the process, the energy storage business sales as well as its digital energy unit sales will no longer be reported separately and have been merged into the new segment classifications.This is despite SMA Solar expecting a strong rebound in energy storage sales in 2019.The company did not give a reason for discontinuing with the energy storage reporting.

Large Scale & Project Solutions segment sales in the reporting quarter were €57.5 million, down from €60 million in the previous quarter and down from €66.9 million in the prior year period. EBIT was negative €6.6 million.

Business Solutions segment sales in the reporting quarter were €64.9 million, up from €60 million in the previous quarter and up from €56.8 million in the first quarter of 2018. EBIT was negative €0.2 million.

Home Solutions segment sales in the first quarter of 2019 were €45.4 million, compared to €51 million in the fourth quarter of 2018 and up from €38.9 million in the first quarter of 2018. The EMEA region accounted for 74.1% of total Home Solutions sales in the quarter, compared to 60.4% in the prior year period. EBIT was negative €5.2 million.

All business segments were also under continued product pricing pressure in the quarter.

“In the first quarter of 2019, SMA's sales and earnings remained down year on year, as the Management Board had predicted,” said SMA Chief Executive Officer Jürgen Reinert. “At the same time, order intake has developed particularly well in all segments in recent months. As of March 31, our product-related order backlog rose by 33% to EUR233.2 million compared to the end of the previous year. In the utility segment in particular, we are experiencing an extremely positive development, which will have an impact on sales and earnings in the second half of the year. The implementation of our measures to reduce SMA's costs by approximately EUR40 million per year is progressing as planned. With our SMA Energy Systems, we are also positioning ourselves as a system provider with perfectly matched and modularly extendable photovoltaic, storage and digital energy solutions for residential, commercial and industrial applications, thus opening up further sales potential.”

As noted, SMA reported that its product-related order backlog stood at €233 million at the end of the quarter, up from €175.4 million at the end of the fourth quarter of 2018, but lower than the €256.3 million at the end of the first quarter of 2018.

Guidance

SMA Solar reiterated sales guidance for 2019 to be in the range of €800 million to €880 million. Sales are therefore expected to increase in the second half of the year.

The company expects to return a positive EBITDA in the range of €20 million to €50 million, compared to a negative EBITDA of €69.1 million in 2018.