The origin of solar cells has had an impact on the price of US solar modules in the past few months, according to a report from solar and storage software company Anza.

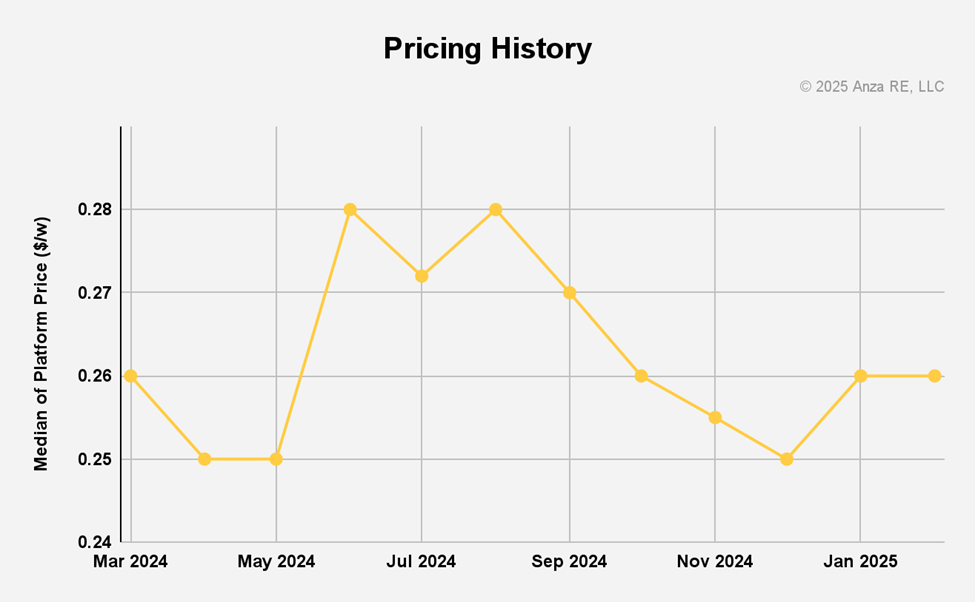

Modules with cells sourced from designated tariff-affected countries in Southeast Asia (Cambodia, Malaysia, Thailand, and Vietnam) have seen a 7.7% price increase since November 2024, which has been driven by tariff implications that “directly inflate procurement costs”, said Anza. This latest report looks at price evolution between November 2024 and February 2025, with prices going from US$0.26/W in November 2024 to US$0.28/W in February 2025 for cells that originated from the tariff-affected countries in Southeast Asia.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

On the other hand, modules with non-Southeast Asian solar cells have seen a price drop of 0.8% to US$0.25/W in February 2025. The price gap between tariff-impacted Southeast Asian and non-impacted cells or domestic cells continues to widen, explains Aaron Hall, president at Anza, to PV Tech.

“As domestic cell capacity ramps, we may see a gradual narrowing of that gap—but in the near term, domestic cells will still command a premium due to limited supply and high demand from buyers looking to minimise tariff exposure. However, it’s important to note there is still a very limited supply of domestic US cells, and it is almost all PERC or thin film.”

At the beginning of February, the US had a 2GW annual nameplate for solar cells, while modules hit the 50GW milestone, according to data from trade body the Solar Energy Industries Association (SEIA). As more domestic capacity becomes available, Anza expects prices to start decreasing in 2026.

“The acceleration of US manufacturing, primarily driven by federal incentives tied to domestic content incentives under the IRA, is reshaping the market. We do see lower prices starting in 2026 for domestic content as much more supply and competition comes online.”

Regarding the ongoing policy and tariff uncertainty affecting the supply chain of solar PV in the US, Hall says: “If one is looking for a fixed-price contract, then the pricing is increasing and the options are decreasing. Additionally, the ability for some sort of tariff and duties hedging becomes more limited with more uncertainty.

“In the US, more tariff news is slated for April 2nd. We expect to see continued price increases and even more challenges in getting suppliers to accept future risk. If we don’t see any new tariffs, the current environment will persist.”

Overall, solar module prices momentarily dropped to a near-record low of US$0.25/W in December but went up by 4% in January. Anza said this was due to the market recalibrating its pricing in response to the tariffs imposed by Donald Trump as soon as he took office and the following duties on Chinese solar products in February.

“As uncertainty over future tariff adjustments and policy debates grew by February, prices appear to have levelled off,” said Anza.

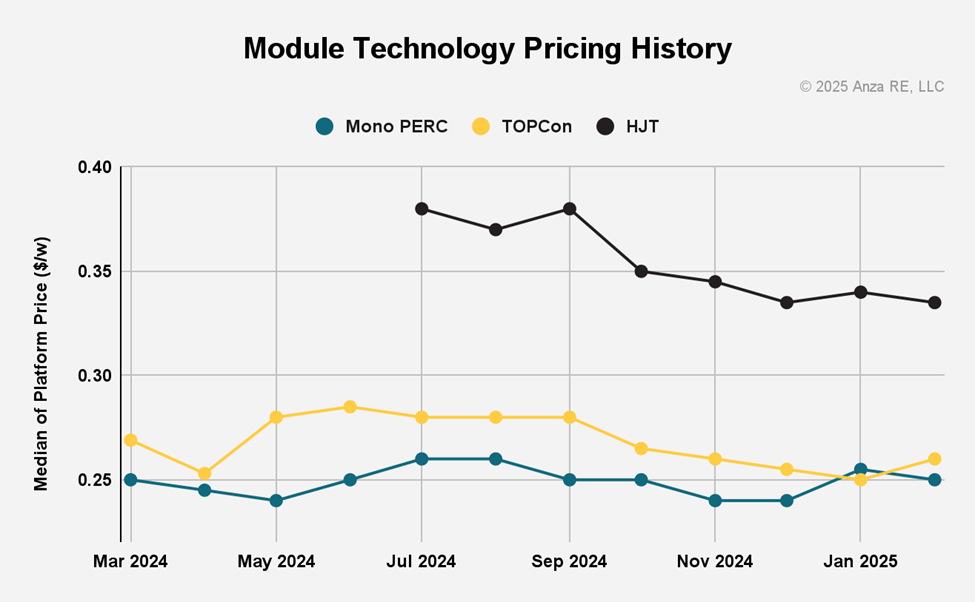

HJT price goes down, TOPCon steady

On the technology side, TOPCon module prices have remained steady at US$0.26/W between November and February. However, prices ticked up between January and February after four months of price decreases, as shown in the chart below.

Prices for TOPCon modules are almost on par with mono PERC modules increasing by 4.2% between November and February 2025, to US$0.25/W. Anza said that the price increase for mono PERC was due to concerns over potential disruptions in TOPCon availability and the possibility of retroactive fines.

“We suspect a lot of what we’re seeing is that the combination of tariffs, duties and buyer focus on managing risk is, in some cases, more impactful than the economic advantage of TopCon. That said, for those buyers looking to procure lower-priced inventory (that derisks UFLPA and tariffs) or those that require domestic content, PERC is still desirable or the only option,” explains Hall.

Moreover, prices for heterojunction modules continue to decrease since September and dropped by 2.9% between November and February, although its price still remains higher compared to TOPCon and Mono PERC modules, as shown in the chart above.

Overall, Hall says that interest in domestic content remains strong “across the board” as buyers prioritise sources less impacted by tariffs.

“The goal of mitigating risk has been a priority with both the Biden and Trump administrations, though increased uncertainty has escalated risk aversion. The buyers that want to hedge against future price increases are moving forward, but there seems to be a larger cohort of buyers waiting and seeing how the policy front will shape up.”

PV Tech publisher Solar Media will be organising the fourth edition of Large Scale Solar USA in Dallas, Texas 29-30 April. After a record year for solar PV additions in the US, the event will dive into the ongoing uncertainties on tariffs, tax credits and trade policies as more domestic manufacturing becomes operational. Other challenges, such as the interconnection queues and permitting, will also be covered in Dallas. More information, including how to attend, can be read here.