As solar component prices continued to decline in Europe in September, demand moved in the other direction and increased, according to the latest pv.index report.

Released by solar wholesaler sun.store, the pv.index report for September showed that the excess of supply continues to “pressure the market”, which was already noticeable back in July.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

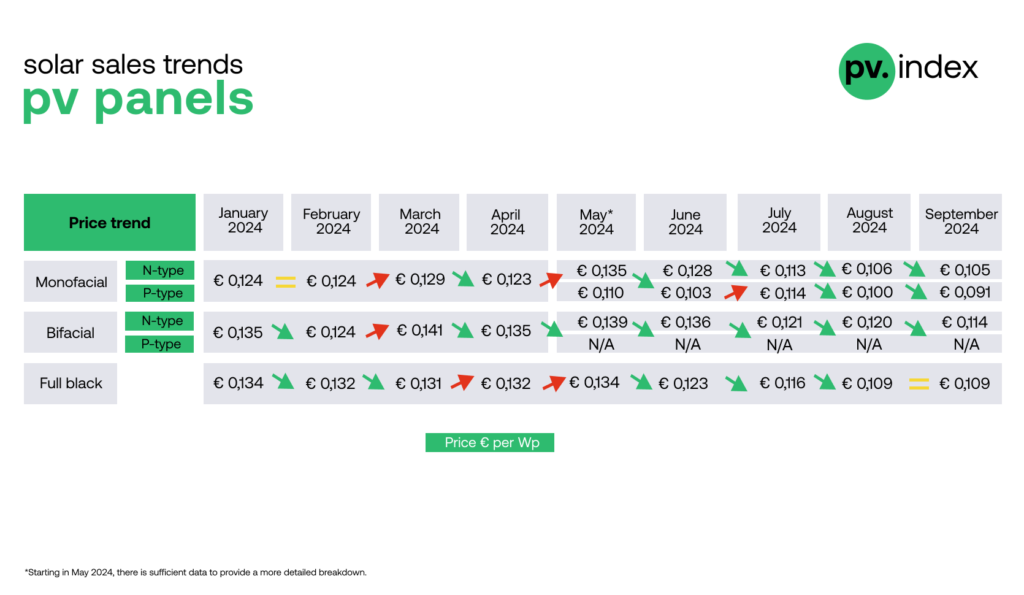

Both monofacial and bifacial module prices have gone down in the single digits, with full black modules staying at the same price of €0.109/Wp (US$0.12/Wp), as shown in the graph above. Monofacial n-type modules saw a 1% price reduction from the previous month, with a price of €0.105/Wp in September, while bifacial n-type modules have had a larger decrease of 9%, falling from €0.1/Wp to €0.091/Wp in September 2024.

“It is, of course, a difficult situation for everyone in the possession of the goods because its value is going down. But for the overall market, end users and energy solar energy prices, this is good because the equipment is getting less expensive overall,” Agata Krawiec-Rokita, CEO and co-founder of sun.store, explained to PV Tech.

Buyer confidence goes up

While module prices continue their downward trend, September has seen an uptick in the solar market with “renewed confidence” from buyers. In its PV PMI (PV Purchasing Managers’ Index)—which gauges buyers’ purchasing intentions on sun.store—the rating increased from 68 to 71, after stagnating for three months at 68.

More than half (54%) of respondents plan to increase their purchases in October, up from the 49% figure registered in August. Meanwhile, for a third month in a row, respondents that said they will buy less products decreased to 11%. The strong PMI reading suggests a “growing momentum” ahead of the market entering the final quarter of 2024.

Victor Cantareli, international business development manager at sun.store, said: “Having exposure to several markets—from the UK and Ireland to the Nordics and Portugal—I’ve observed first-hand a resurgence in both equipment purchases and installations over the past month. Market dynamics do vary significantly between countries, but the overall outlook remains positive as we head into the final quarter of the year, with more projects and contracts being signed.”

‘Storage is the next big thing’

Krawiec-Rokita also notes that energy storage is perhaps the key trend in European solar, and how solar-plus-storage deployments will be more frequent than just solar PV.

“Storage is the next big thing,” Krawiec-Rokita told PV Tech. “Combined annual growth rate for storage is higher than for solar right now, and in many countries, it is solving the grid problem.”

A trend that is picking up across the continent, however, is still driven by subsidies, says Krawiec-Rokita. “We see that in countries where storage is also subsidised, it’s doing better. But overall, it’s a trend everywhere.”

Among the countries that have seen a surge in demand for energy storage, but also solar PV, Krawiec-Rokita highlights that Ukraine has seen a big demand in the past couple of months for the technologies, while Poland has seen a big push for energy storage and increased attachment rates.