China-based integrated monocrystalline PV producer, Solargiga Energy Holdings has reported unaudited shipments and revenue for 2016, which highlights only a small year-on-year revenue gain, despite product shipments increasing 34% as ASP declines worsened in the fourth quarter of the year.

Solargiga reported unaudited full-year revenue of RMB 3,021.3 million (US$438 million), 4.2% higher than the previous year, which included sales of mono c-Si ingots, wafers, cells and modules as well as downstream EPC services and sales of electricity from PV power plants.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

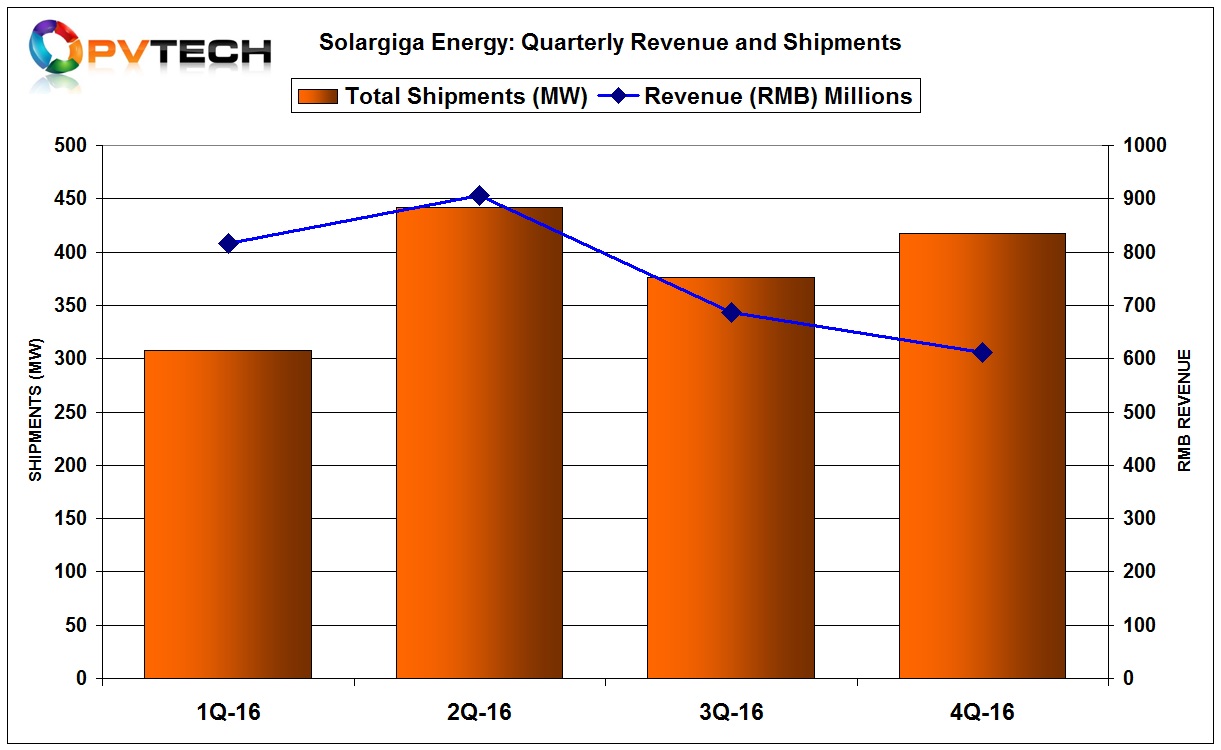

Therefore revenue in the fourth quarter of 2016 was around RMB 611.3 million (US$88.6 million), down around 11% from the previous quarter.

Solargiga reported product shipments in 2016 totalled around 1,543MW, up 34%, from 1,151MW in 2015. Shipments in the fourth quarter reached around 417.5MW, up from 376MW in the previous quarter.

The improved shipments in the fourth quarter were primarily offset by lower ASP’s in the quarter.