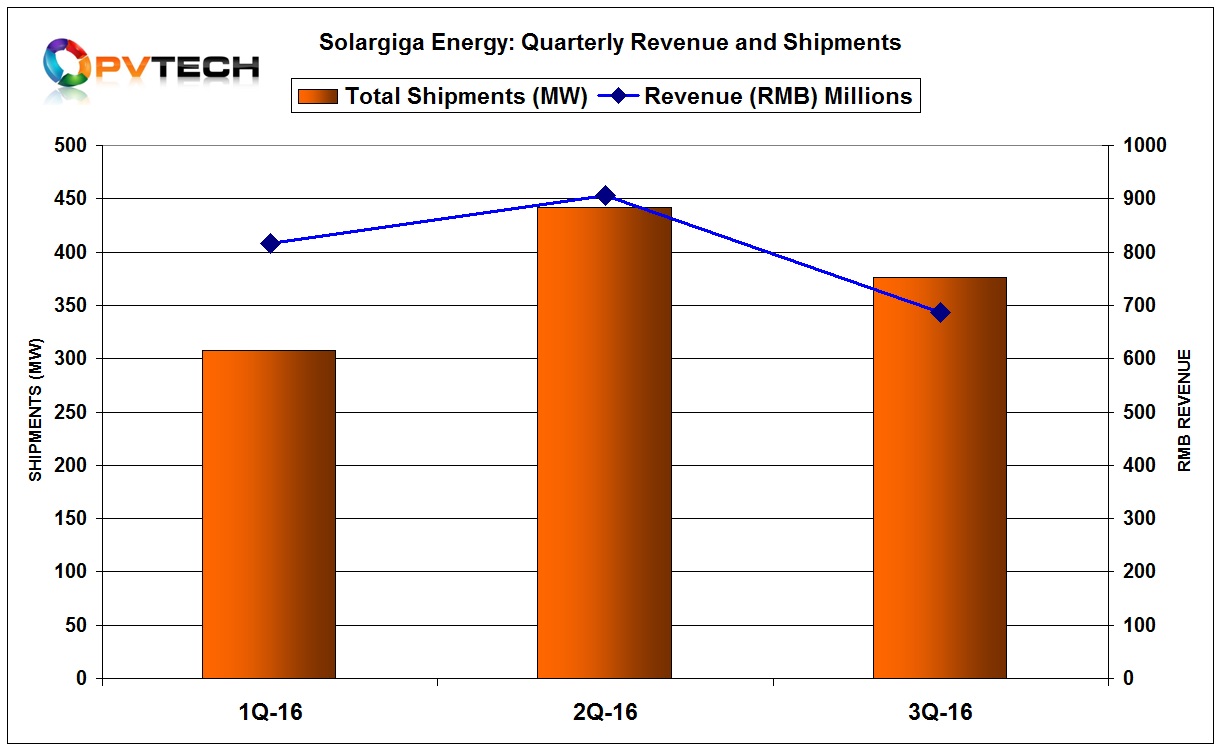

Integrated China-based monocrystalline PV producer, Solargiga Energy Holdings has reported certain unaudited operating figures for the third quarter of 2016, indicating a significant revenue and shipment decline, compared to the previous quarter.

Solargiga reported total preliminary third quarter 2016 revenue of around RMB 687 million (US$102 million), down over 24% (US$134.5) million from the previous quarter.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Revenue for the first nine months of 2016 was RMB 2,410 million (US$357.5 million), up 23.5% (US$289.4 million) from the prior year period.

Total product shipments which included processing service; sales of silicon solar ingots, wafers, cells and photovoltaic modules; and the engineering, procurement and construction of photovoltaic systems service reached 376MW in the third quarter, down around 15% from the previous quarter when shipments reached 442MW.

Shipments in the first nine months of 2016 reached 1,125.5MW, up from 763.9MW in the prior year period, a 47.3% increase from the prior year period.

Solargiga is one of the first China-based producers to provide insight into third quarter financials after a major slowdown in PV project development in China at the end of the second quarter of 2016, which has driven a rapidly developing period of overcapacity, resulting in steep price declines.