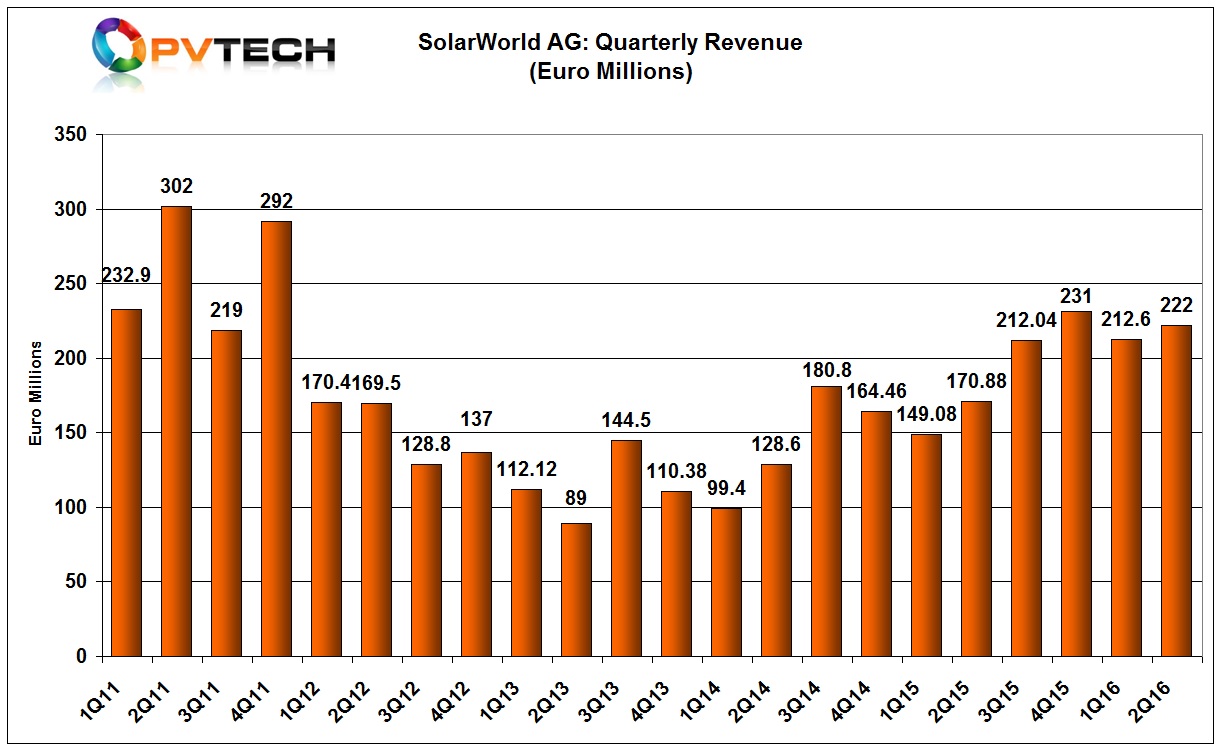

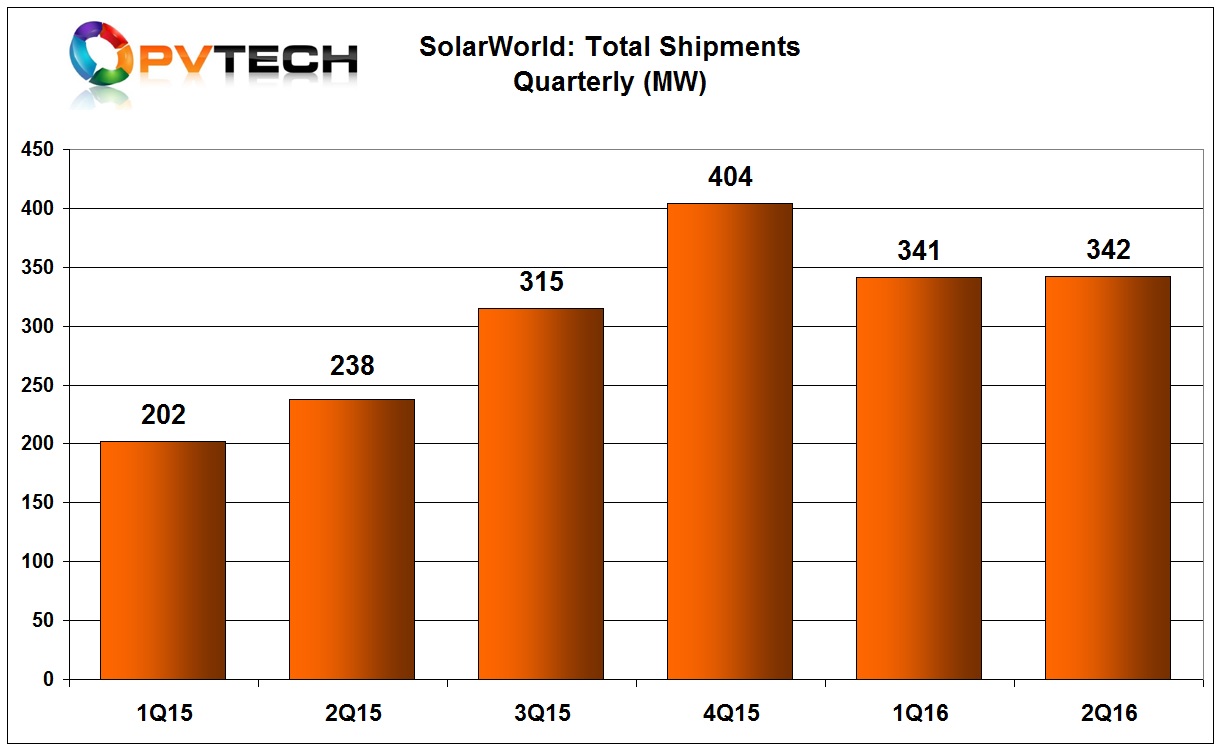

Integrated PV module manufacturer SolarWorld has reported flat revenue and shipments for the second quarter of 2016, compared with the previous quarter.

SolarWorld reported preliminary second quarter revenue of €222 million, around 4.5% higher than the previous quarter revenue of €212.6 million.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Total shipments were 342MW in the quarter, flat with the prior quarter shipments of 341MW. Based on PV Tech’s manufacturing capacity analysis, SolarWorld is operating at near 100% utilisation rates for PV module production. The company does not breakout module shipments and includes rooftop installation kits, which include inverters and mounting systems in its shipment figures.

The company reported second quarter earnings before interest and taxes (EBIT) of €6.6 million, compared to a negative EBIT of €9.7 million in the previous quarter.

EBITDA was €18.5 million, compared to €2.1 million in the previous quarter, indicating continued improvement in its business operating performance.

Preliminary results for the first half of 2016 include revenue of €434 million, up from €320 million in the prior year period and EBITDA of €20.5 million, up from €9.9 million in the prior year period. EBIT also improved to negative €3.1 million, compared to a negative EBIT of €12.2 million in the first half of 2015.

The company noted that it had cash and cash equivalents of €148 million at the end of the first half of the year, down from €182.7 million at the end of the first quarter of 2016. The reduction was said to be due to repayments of loans and interest payments amounting to €27 million and capital expenditure of €9 million in the second quarter of 2016.

Guidance

SolarWorld noted that product ASP pressure had increased, which would impact its previous EBIT guidance, while retaining product shipment guidance.

SolarWorld had previously expected to reach a positive EBIT in the ‘lower double-digit million range’ in 2016, while its latest guidance provides a wider EBIT range of negative €10 million to a positive €10 million figure.

The company reiterated guidance on shipments increasing by more than 20% in 2016, up from 1,159MW in 2015 and revenue increasing by more than 20%, compared to €763 million in 2015.

SolarWorld retained its target of reaching up to €1 billion of revenue in 2016.