On 22 April, Chinese solar company Sungrow released its 2023 annual report and Q1 2024 report, which saw its market valuation surpass that of rival LONGi. The firm posted year-end revenue of RMB72.25 billion (US$9.9 billion) and its stock became the highest by total market value among Chinese PV companies.

On the same day, Sineng, another leader in the inverter industry, also released its 2023 annual report, with revenue more than doubling between 2022 and 2023, to RMB4.9 billion (US$680 million).

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Sungrow ships 130GW of inverters in 2023

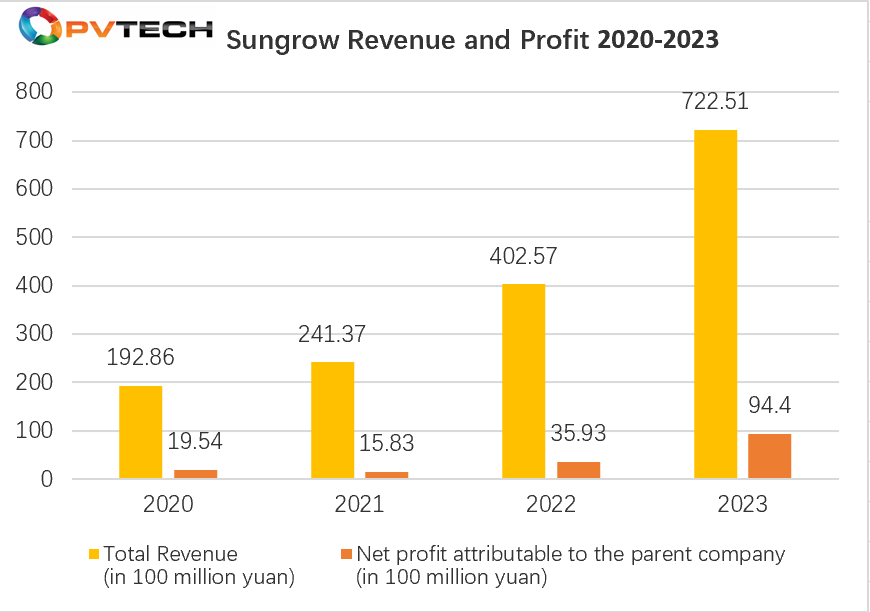

According to Sungrow’s latest report, in 2023, the company achieved revenue of RMB72.25 billion (US$9.9 billion), a year-on-year increase of 79.5% and net profit attributable to the parent company of RMB9.44 billion (US$1.3 billion), a year-on-year increase of 162.7%.

The profit attributable to shareholders of listed companies, after non-recurring gains and losses deductions, was RMB9.22 billion (US$1.27 billion), an increase of 172.18% year-on-year. This is the second consecutive year that Sungrow’s net profit and non-net profit have doubled, and the graph below demonstrates how the company’s revenue has almost quadrupled since 2020.

In terms of business revenue, PV inverters and other power electronic conversion equipment achieved a total operating income of RMB27.65 billion (US$3.82 billion), a year-on-year increase of 60.97%, accounting for 38.27% of the current operating income, and 37.93% of the gross profit margin.

It is worth noting that Sungrow’s new businesses have also begun to grow rapidly. Its renewable investment and development business and storage system business have achieved operating income of RMB24.73 billion (US$3.41 billion) and RMB17.8 billion (US$2.46 billion), respectively, year-on-year increases of 113.15% and 75.79%.

From the perspective of shipment data, Sungrow shipped 130GW of PV inverters globally in 2023, an increase of 68.83% over 2022 and 10.5GWh of energy storage systems.

The growth in Q1 2024, however, was weaker. The company’s revenue was RMB12.61 billion (US$1.74 billion), a year-on-year increase of 0.3%, and net profit attributable to the parent company was RMB2.1 billion (US$290 million), a year-on-year increase of 39.1%. Compared with the past few quarters, Sungrow’s performance growth in the first quarter of this year has slowed down significantly.

Boosted by the strong performance, the share price of Sungrow has risen in the past two days. As of 24 April, its total market value reached RMB144 billion (US$15.73 billion). With its solidstock price performance, Sungrow has also surpassed LONGi as the highest total market value among China’s PV stocks.

Sineng’s revenue and net profit increased significantly

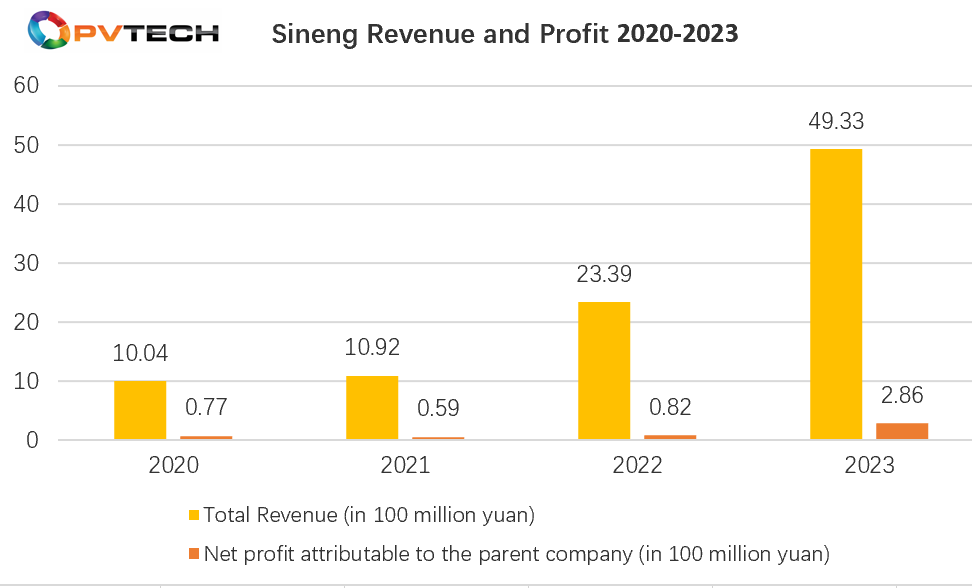

On the evening of the same day, Sineng released its 2023 annual report. According to the report, Sineng achieved an operating income of RMB4.93 billion (US$680,000) in 2023, a year-on-year increase of 110.93%, net profit attributable to shareholders of listed companies of RMB286 million (US$39.46 million), a year-on-year increase of 250.48%, and net profit after deducting non-profits of RMB276 million (US$38.1 million), a year-on-year increase of 295.17%.

The graph below demonstrates how, despite multiple challenges – such as the decline in capacity utilisation rates of the PV industry chain and the inventory risk of overseas PV modules – Sineng has achieved positive growth and has expanded its capacity construction and market share in an orderly manner.

Sineng’s PV inverter business has grown rapidly, with a performance growth rate of 135.13%. Its power quality control products also made significant progress, with a performance growth rate of 42.25%. The company’s bidirectional power converter and system integration products also performed well, with a performance growth rate of 88.62%.

The news follows JinkoSolar’s latest financial results, announced this week, in which the company made plans to sell 35GW more wafers in 2023.