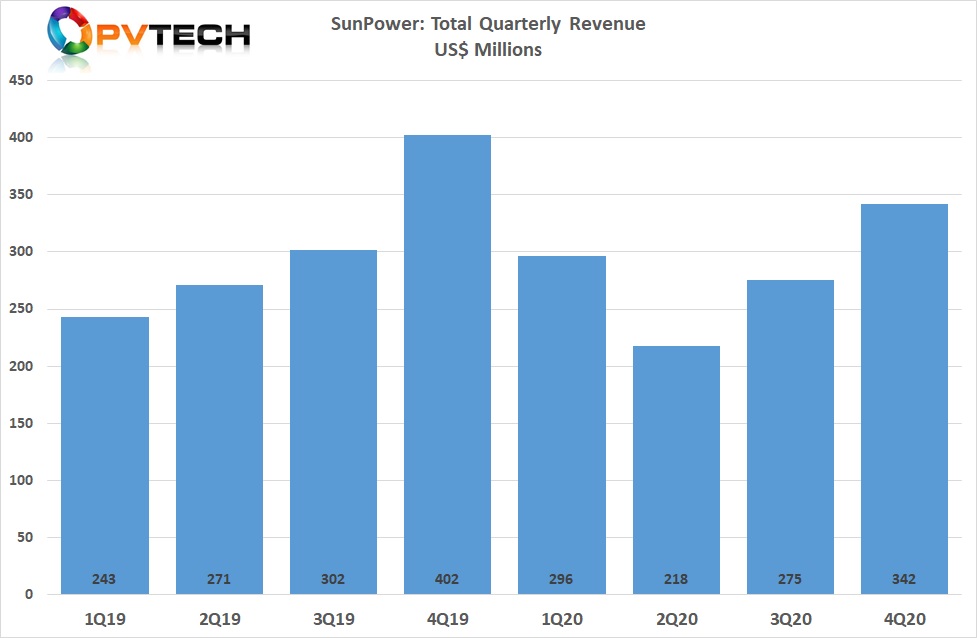

US solar installer SunPower reported a 2.9% increase in annual revenue in 2020 despite total installations falling 5% in what the company has described as a transformational year.

In a year which saw it complete the spin off of its manufacturing division, now dubbed Maxeon Technologies, SunPower reported total annual revenue of US$1,124 million in 2020, up 2.9% from revenue of US$1,092 million in 2019.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Annual revenue from its key market segment of Residential & Light Commercial and Industrial stood at US$824 million, compared to US$853 million in 2019, down 3.5%, year-on-year.

The year started strong, Residential & Light C&I revenue in the first quarter of 2020 reached US$227 million, typically a seasonally weak quarter for residential installs.

However, the impact of COVID-19 in the second quarter meant segment revenue slumped to US$154 million and only started to recover in the third quarter when SunPower reported segment revenue of US$190 million.

The strongest revenue quarter was the fourth quarter, posting segment revenue of US$253 million. But that figure could not completely offset the impact of COVID-19 in full year financial figures.

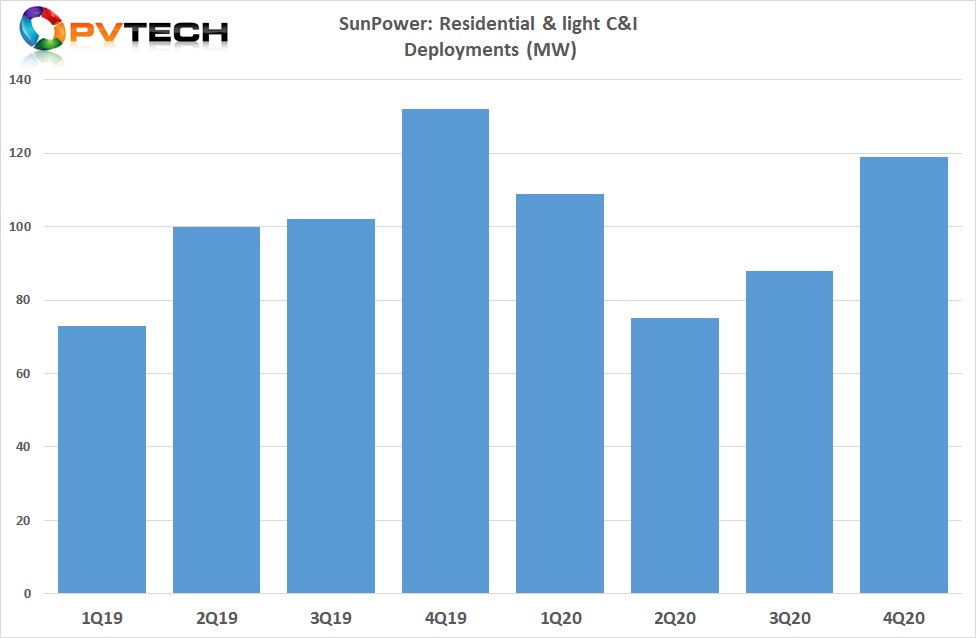

Residential & Light C&I deployments in 2020 reached 391MW, down from 407MW in 2019. In tandem with segment revenue, fourth quarter deployments were the highpoint, reaching 119MW.

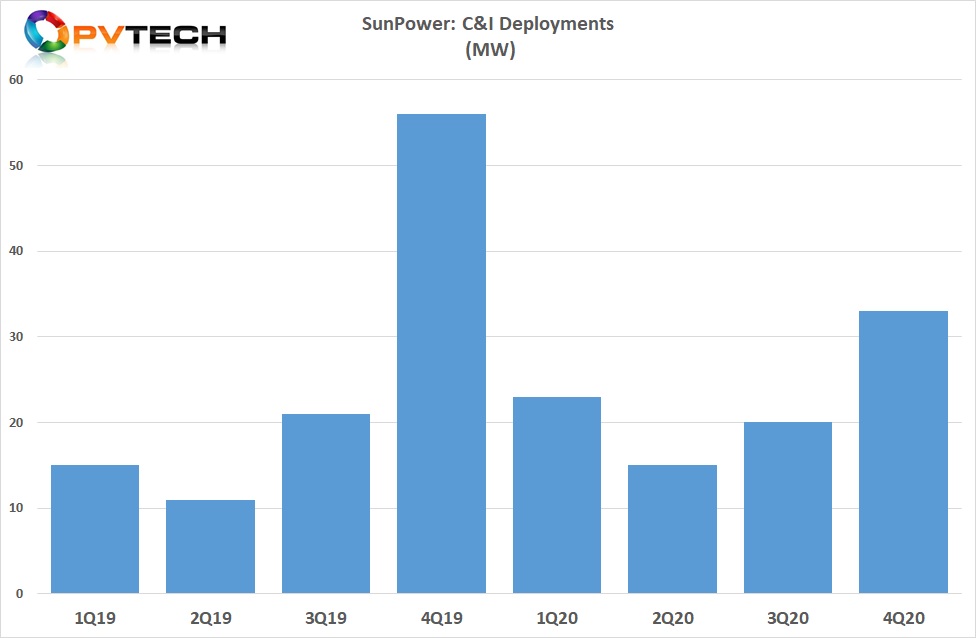

SunPower’s C&I segment followed a similar revenue and deployment scenario in 2020, although historically the fourth quarter results are the highest segment quarterly figures in a given year.

Total 2020 C&I segment revenue was US$242 million, up from US$211 million in 2019. The revenue increase was primarily due to over a 30% sales attach rate for energy storage in 2020, according to the company. Energy storage deployments only started in the later part of the year. SunPower said it had over a 50MWh backlog and a pipeline of over 750MWh in the C&I segment.

Guidance

SunPower guided total GAAP revenue in the first quarter of 2021 to be in the range of $270 to $330 million with a GAAP net loss in the range of US$20 million to US$10 million.

Total solar deployments were covered in a wide range between 115MW to 145MW.

SunPower had noted in its fourth quarter earnings call that it expected new residential homes solar deployments to exceed 40% growth rates over the next few years. SunPower said it had a backlog of more than 180MW. New home deployments in 2020 was 45MW.

In the C&I segment, SunPower expects to deliver 20% revenue growth in 2020.