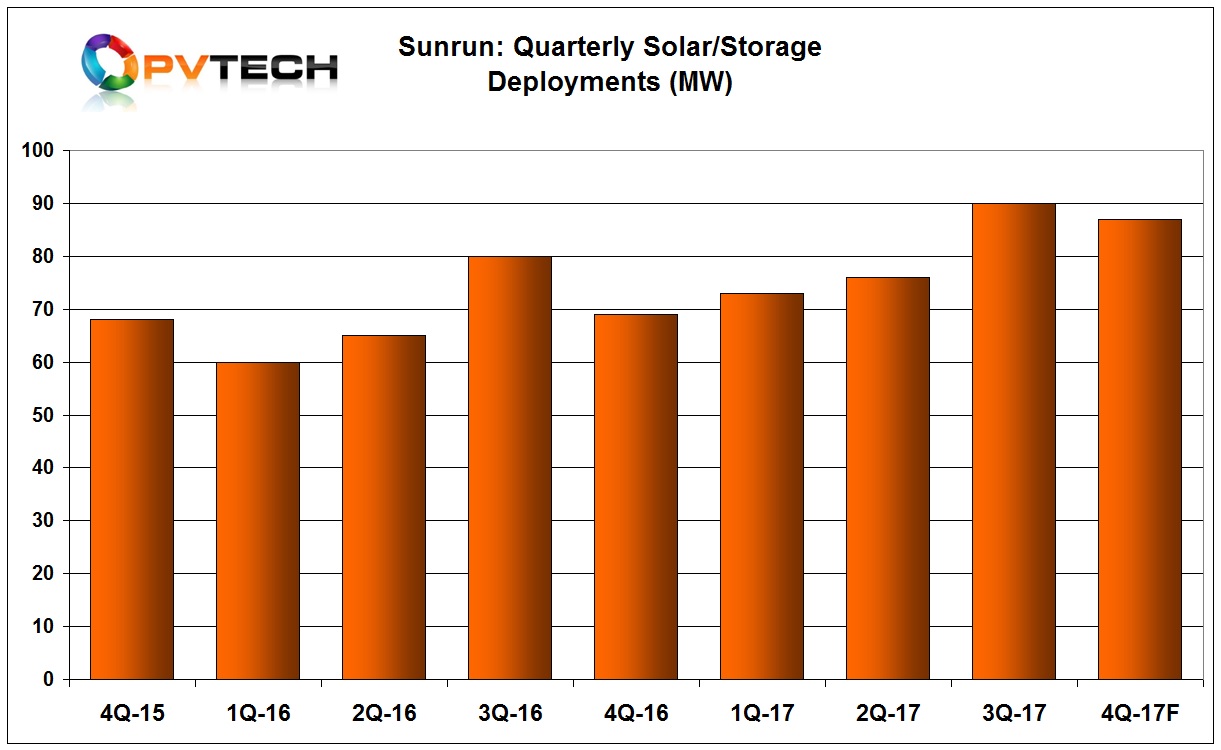

US residential solar PV and energy storage installer Sunrun reported a marginal improvement in third quarter revenue on and 18% megawatt increase in installations.

Changing negative market dynamics across a number of US states, coupled to PV module selling price (ASP) increase due to the US ITC Section 201 case have not impacted Sunrun’s full year guidance which remains on course to deliver total deployments of around 325MW, a 15% year-over-year rate of growth.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

However, to secure modules ahead of new import duties the company is using around US$20 million in cash to purchase and stockpile modules for 2018.

Management noted in its earnings call that the worst case scenario of potential Section 201 tariffs would impact cost but not as much as US$0.12/W. However, management noted that higher costs would be shared by suppliers as well as customers and channel partners.

“Our positive momentum continues in Q3. We are reiterating our full-year guidance of 15% growth in volumes while increasing our annual NPV target to 40% growth,” said Lynn Jurich, Sunrun’s chief executive officer. “I am proud of the company’s performance and industry leadership. We have brought clean, affordable energy to more than 160,000 American families and provided job opportunities in hundreds of communities across the country. We have delivered our highest unit economics in the company’s history and increased our cash balance, even while continuing to invest in new markets, BrightBox and grid services.”

Financial results

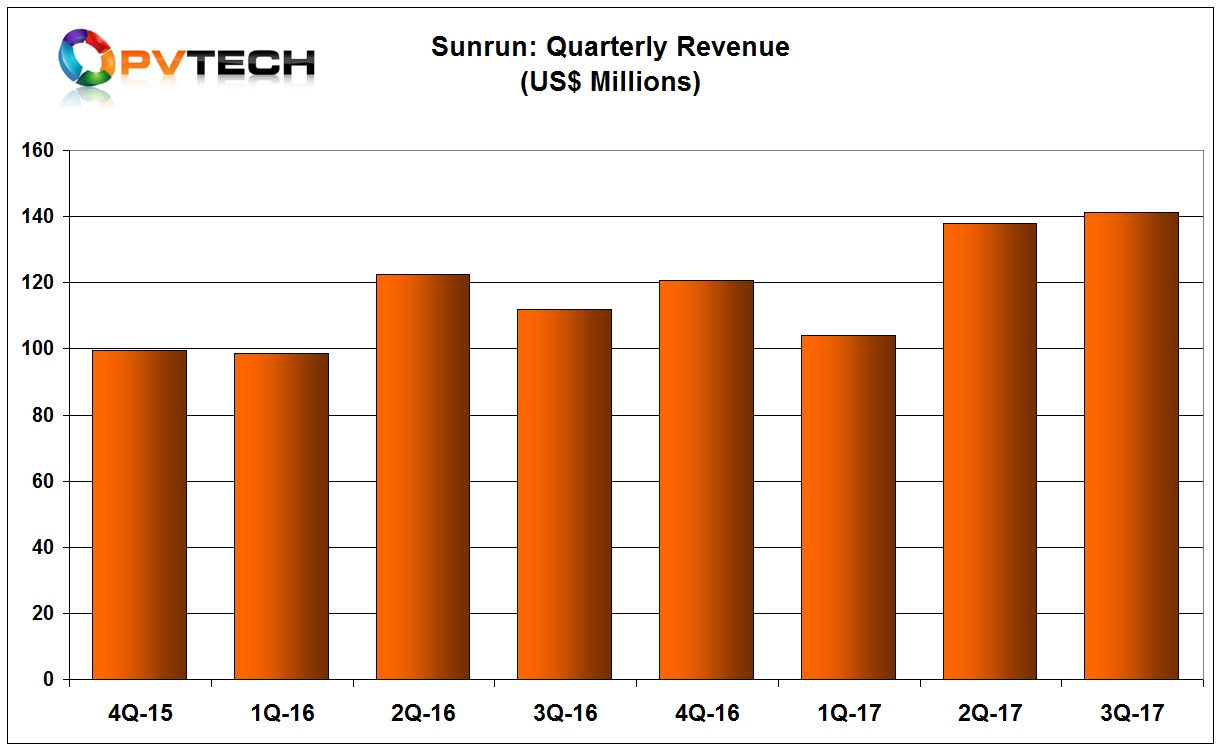

Sunrun reported third quarter revenue of US$141.2 million, up slightly from US$137.8 million in the previous quarter. Both quarters highlight the growth pattern after revenue in the typically slow first quarter was only US$104.1 million.

The company reported third quarter deployments of 90MW, an increase of 12% year-over-year and exceeding the company’s guidance of 88MW.

Operating leases and incentives revenue grew 35% year-over-year to US$58.5 million, down from the previous quarter when operating leases and incentives revenue increased 44% year-over-year.

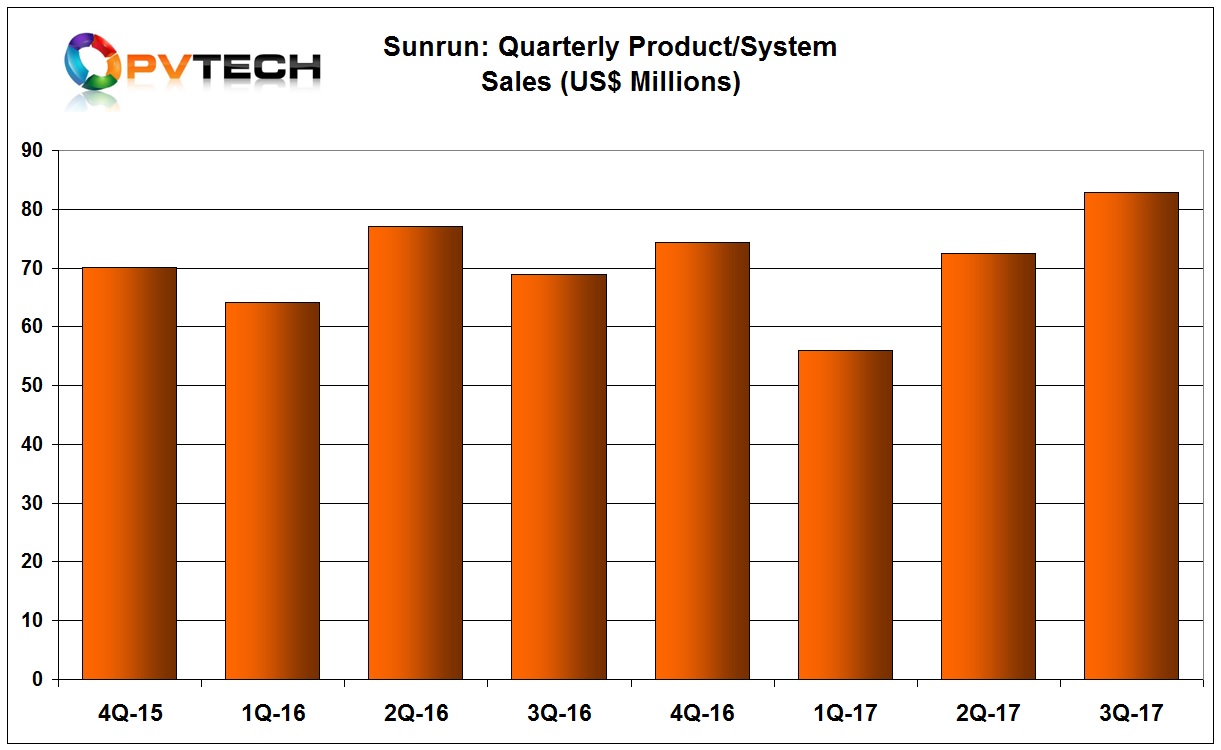

However, solar energy systems and product sales increased 20% year-over-year to US$82.8 million, up from US$72.5 million in the previous quarter.

unrun reported third quarter total cost of revenue of US$118.8 million, an increase of 21% year-over-year and up from US$108.1 million in the second quarter.

Total operating expenses were $189.0 million, an increase of 16% year-over-year, compared to US$170.8 million in the second quarter, which proved to be a decline of 0.1% year-over-year.

NPV created in the third quarter of 2017 was US$93 million, a 21% increase from US$76 million in the third quarter of 2016. The unlevered NPV per watt in the third quarter was a record US$1.15 compared to US$1.07 in the prior year.

Management noted that the increase was due to the channel mix as well as a contribution from momentum building in energy storage adoption, which was said to be around 10% of deployments in California, which was only around 5% in the previous quarter.

The company reported a net loss of US$80.1 million, compared to US$65.2 million in the second quarter of 2017.

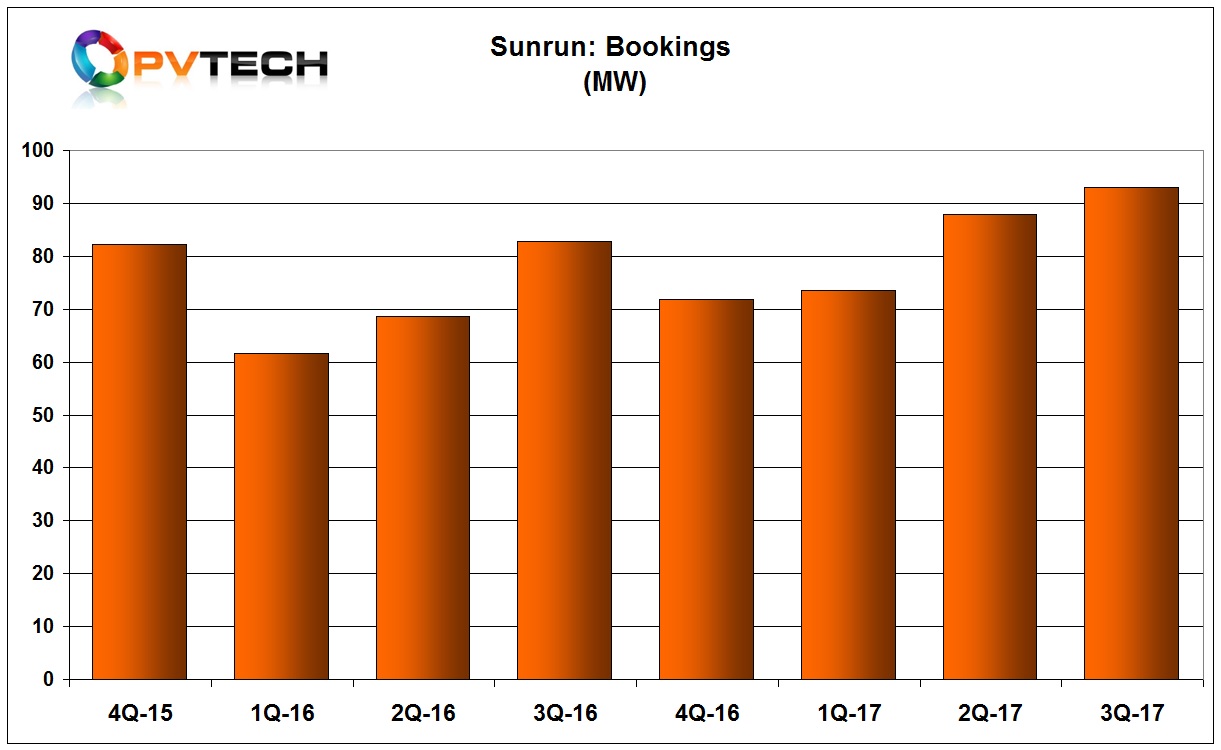

New bookings in the quarter were 93MW, up from 88MW in the second quarter of 2017. Sunrun expects fourth quarter deployments to be around 87MW.

Heading into 2018, Sunrun expects longer term growth rates to continue to be in the 15% to 20% range as new sales partnerships and growth in energy storage inclusions with PV systems would become a compelling customer value proposition.