Having passed through a period of rapid expansion and capacity supremacy, the PV industry has entered a new round of adjustment in 2024. The continuous decline in prices across the industrial chain, intensified competition among enterprises, imbalanced supply and demand and the shutdown of factories… Such factors foreshadow a new round of reshuffling.

In an exclusive interview with PV Tech, Wu Fei, chairman of Suntech, said the current development of the PV industry has shown three major development trends: specialisation, what he called “characterisation” and internationalisation.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The first one is specialisation. During the past three years of shortages, the industry has exhibited a trend where the upstream sector reigns supreme, with those controlling the upstream resources taking the lead. In reality, upstream components such as polysilicon, wafers and cells are industrial products, while modules serve as both consumer and investment goods. As a result, the sales of modules have become especially critical and challenging.

“Starting from next year, the industry will re-enter an era where modules are king, brands are king and end markets are king,” predicted Wu Fei. “Therefore, from this year and the next, the industry will once again face competition characterised by professional rivalry. Suntech, as a 23-year-old PV brand, will embrace new opportunities.”

The second one is what We Fei called characterisation. In the current PV industry, despite similar appearances, these module products are both homogeneous and significantly different. The so-called homogeneity refers to visual similarities among products, whereas heterogeneity points to product characteristics that are not immediately apparent and need time to be validated, such as performance.

“In such a market environment, only products or brands with unique features can stand out. Whether it is the profound brand heritage and global influence, or the distinctive development philosophy of ‘quality is king’, these have laid the foundation for Suntech to seize the advantage of characterisation,” Wu Fei further elaborated.

The third one is internationalisation. Historically, 90% of the world’s PV products were manufactured and exported by China. However, the future trend will be towards a full-scale internationalisation, with production no longer limited to China but spreading across the globe.

Wu Fei noted that after the market reshuffle, the home appliance industry has shrunk from 300 companies to just over 10 mainstream companies. Similarly, the PV industry is also undergoing such transformation, progressively evolving into a capital-intensive, technology-intensive and brand-intensive industry. It is for this reason that the characterised development is especially critical, otherwise it is likely that companies will be washed out in the major reshuffling wave expected in the coming year.

Walking ‘side by side’ with customers

In response to the new cycle, Suntech has opted to move from “manufacturing” to “quality crafting”. The company continues to innovate and refine its technology while maintaining its product quality. Suntech stands “side by side” with its customers. This 23-year-old PV company is diligently working its way through this round of industry reshuffling.

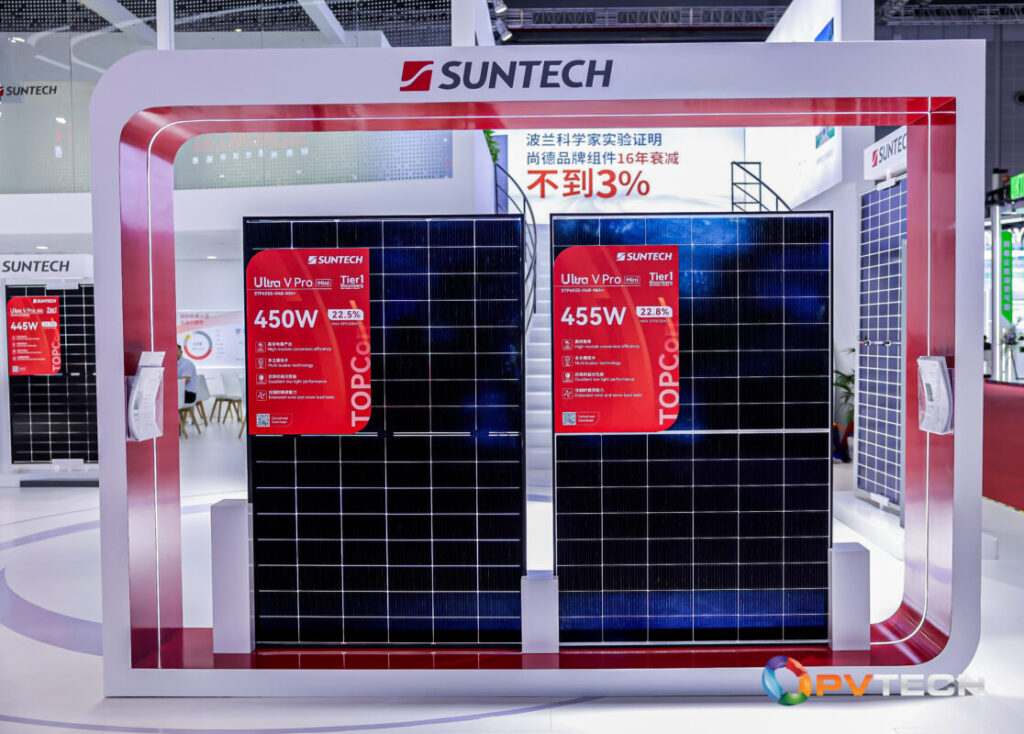

Wu Fei shared that this year, Suntech has conducted a comprehensive upgrade of its product power, introducing the higher-power H48 and H66 module series. At the recently held Intersolar Europe 2024 in Munich, Germany, Suntech showcased the new Ultra V Pro series of upgraded modules.

According to Suntech, its Ultra V Pro series adopts the n-type TOPCon high-efficiency solar cell technology, offering customers a linear power guarantee that spans up to 30 years, comprehensively addressing the demands of residential, commercial and industrial, and utility-scale solar applications. The H48-Nkh+ module boasts a maximum output of 455W, and there are also all-black aesthetic modules designed for the high-end residential rooftop market. Meanwhile, the H66-Nsh+ double-glass module is tailored for commercial and industrial scenarios, aiming to reduce the balance of system costs for engineering, procurement and construction contractors, ultimately delivering a lower levelised cost of electricity (LCOE) to the end consumer.

In the global market, “quality crafting” is essential for long-term development. Wu Fei said: “We consistently uphold the mission of ‘generating power for the Earth and ensuring quality for our customers’, strictly controlling product quality without pursuing short-term gains. Our longstanding customers often tell us that while Suntech’s products may be more expensive, they do not wish us to lower production costs to the minimum. Against this backdrop, we must enhance management and reduce operational costs through lean production. The materials we utilise are subject to the most stringent tests and outdoor inspections.”

Leveraging its leading technical strength, Suntech has introduced a series of revolutionary products over the past 23 years, including the Ultra X series 210mm cells, the Ultra V series 182mm cells, and the Ultra V Pro series and Ultra X Pro series, which incorporate advanced n-type TOPCon cell technology.

With stringent quality control, leading technological advantages and robust R&D strength, in Q1 this year, Suntech’s TOPCon modules have received the French carbon footprint certification and set a new low (376.1kg eq CO2/kWc) for the carbon footprint certification value of the entire domestic supply chain in the industry.

Talking about the company’s key initiatives and strategies in various global markets for this year, Wu Fei stated: “For Suntech, the focus of our efforts in key global markets this year is to develop agents and distributors. We are laying the groundwork this year, with plans to increase shipments next year. Our aim is to enable Suntech’s distributors to be free from the inventory pressure, to truly profit from their business with Suntech, and to continue to operate sustainably, growing hand in hand with Suntech.”

In particular, against the backdrop of declining industry prices, addressing the issue of overseas distributors facing significant economic pressure from inventory backlogs, to the extent of incurring losses or even bankruptcy, Suntech will collaborate with distributors worldwide to establish an efficient and effective inventory management system in the future. “Our objective is not merely to sell products to distributors but to ensure our distributors can sell these products effectively, thereby achieving a long-term cooperation. This long-term cooperative strategy will contribute to market stability and mitigate inventory risks.”

Continuous expansion

In line with the trend of comprehensive internationalisation, in 2024, building upon its existing foundations, Suntech has further strengthened its efforts to expand into segmented global markets.

In an interview, Wu Fei disclosed that the company would continue to expand its business scope in overseas markets, innovate and refine services for traditional markets. It would continue to enhance investment in product upgrades, and research and development to offer global customers higher-quality PV products and solutions.

Looking at the important leading markets under the internationalisation trend, the European PV market has witnessed remarkable growth over the past decade.

According to SolarPower Europe, new installations in Europe for the year 2023 approached 65GW, far exceeding expectations, with projections to reach 62GW for 2024 and 93GW by 2026. Moreover, data from the International Energy Agency indicate that Europe is the world’s second-largest PV market following China, accounting for approximately 30% of the global PV demand.

As a barometer for the global PV market, the European PV market is highly valued by major PV module enterprises, and Suntech possesses a first-mover advantage in this domain.

Wu Fei stated: “Since its inception in 2001, Suntech has been a part of the European market. We have established subsidiaries, built warehouses and numerous projects of our own in Europe. As one of the pioneering brands to enter the European market, Suntech has a group of customers with whom we have enjoyed long-standing cooperation. They place their trust in the quality of Suntech’s products, which constitute our most valuable asset, and we greatly cherish these relationships.”

“We have received feedback from many of our longstanding European customers that Suntech modules exhibit exceptional performance over the long term in outdoor conditions. For instance, in an old power plant tested by the Polish Academy of Sciences, Suntech modules that had been in use for 16 years showed an annual degradation rate of less than 3%. More recently, a Greek customer informed us that in a PV power plant that has been operational for nine years, Suntech modules have shown zero degradation, and the low degradation rate has delivered excess returns to our customers.”

Regarding future actions in the European market, Wu Fei shared that in general, European customers are quite rational. When selecting PV modules, they take into account both the price and the quality of the product, especially those that have been proven over many years in outdoor power plants. Moving forward, Suntech will continue to expand its investment in the European market and enhance pre-sales and after-sales services. The company will not just focus on business relationships but also offer a comprehensive set of solutions considering the future development of the industry and the application of new technologies. Additionally, Suntech will increase its support for European agents in all aspects, including brand, technology and market, to aid in its business expansion.

From the first Suntech product that crossed the sea in 2002, marking the first step in its internationalisation, to shipping to 100 countries and regions around the world, the Suntech brand has built a complete global sales and service network through its continuously refined supply chain and after-sales service.

Beyond Europe, in the Japanese market, which has always emphasised the long-term value and the product life cycle, local customers also highly recognise Suntech’s products. Real estate developers there are very concerned about the quality of PV buildings, which is in line with Suntech’s positioning. Additionally, the Middle East and North Africa markets, which have stringent requirements for module quality, are also key markets that Suntech focuses on.

Talking about the global PV market trends this year, Wu Fei said: “In the long run, PV will have at least a tenfold growth potential over the next 10-15 years. Overall, PV markets worldwide will move from explosive growth to sustained and stable growth. Early markets such as Europe, Japan, China, the United States and India have already experienced this, and this year we will also see significant growth in regions like Pakistan, Saudi Arabia and Central Asia.”

As for the focus of future work, Wu Fei particularly highlighted the localisation strategy: “Suntech will adhere to localisation and place emphasis on strengthening pre-sales and after-sales services. By offering more support in terms of products and technology, we aim to enable our staff to serve our customers better, thus providing a solid foundation for the long-term profitability of our clients.”