As PV Tech previously reported, Taiwan’s solar industry supply chain failed to recover lost revenue in 2017, despite strong global demand growth and expectation that installations topped 100GW.

Solar cell producers in particular suffered from continued ASP (Average Selling Price) pressure through most of the year, due to increased competition from China-based merchant sell and module suppliers as well as the growing shift to monocrystalline wafers, which left many Taiwanese companies coming to terms with weaker demand.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

In 2018, Taiwanese suppliers are confronted from further competition from China and potentially global PV demand growth being almost flat with 2017.

A potential bright spot is Taiwan’s growing domestic market, due to policies enacted over 18 months ago that could support shipment growth within Taiwan in 2018.

However, January 2018 sales from cell, module and wafer producers highlighted (excluding SAS) declines over 12% month-on-month, although sales for many were up slightly from the same month in 2017.

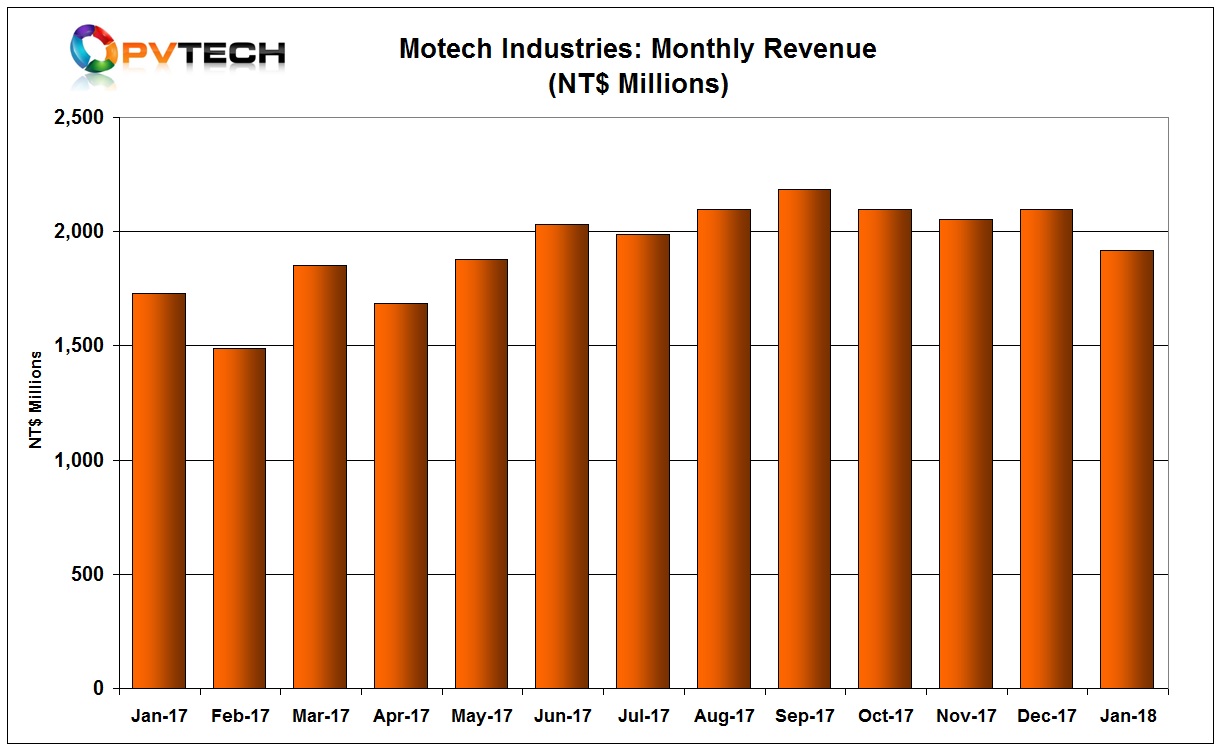

Motech Industries

Leading Taiwanese PV cell and module manufacturer Motech Industries has reported January 2018 sales down over 8% from the previous quarter but sales are over 10% higher than in the prior year period.

Motech reported January 2018 sales of NT$ 1,917 million (US$65.8 million), down 8.65% from the previous month and up 10.94% from the prior year period.

The company had unaudited 2017 sales of around NT$ 23.189 billion (US$796.5 million, down 19.94% year-on-year.

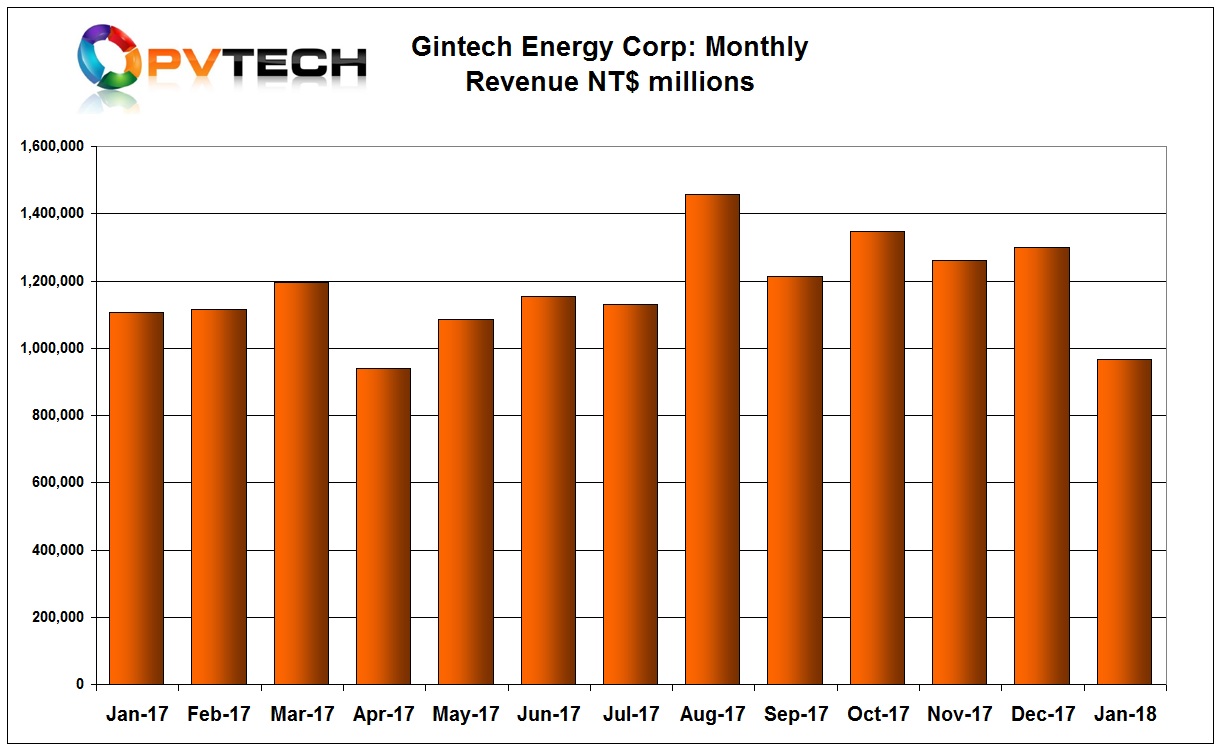

Gintech Energy

Merchant solar cell and module producer Gintech Energy reported January 2018 sales down over 25% from the previous month and down over 12% from the prior year period.

Gintech’s January 2018 sales were NT$ 965.501 million (US$33.21 million), compared to NT$1,300 million in the previous month, a 25.76% decrease.

The company had previously reported unaudited full-year 2017 sales of NT$ 14,306,211 million (US$ 493 million approx), down 2.55% from the prior year.

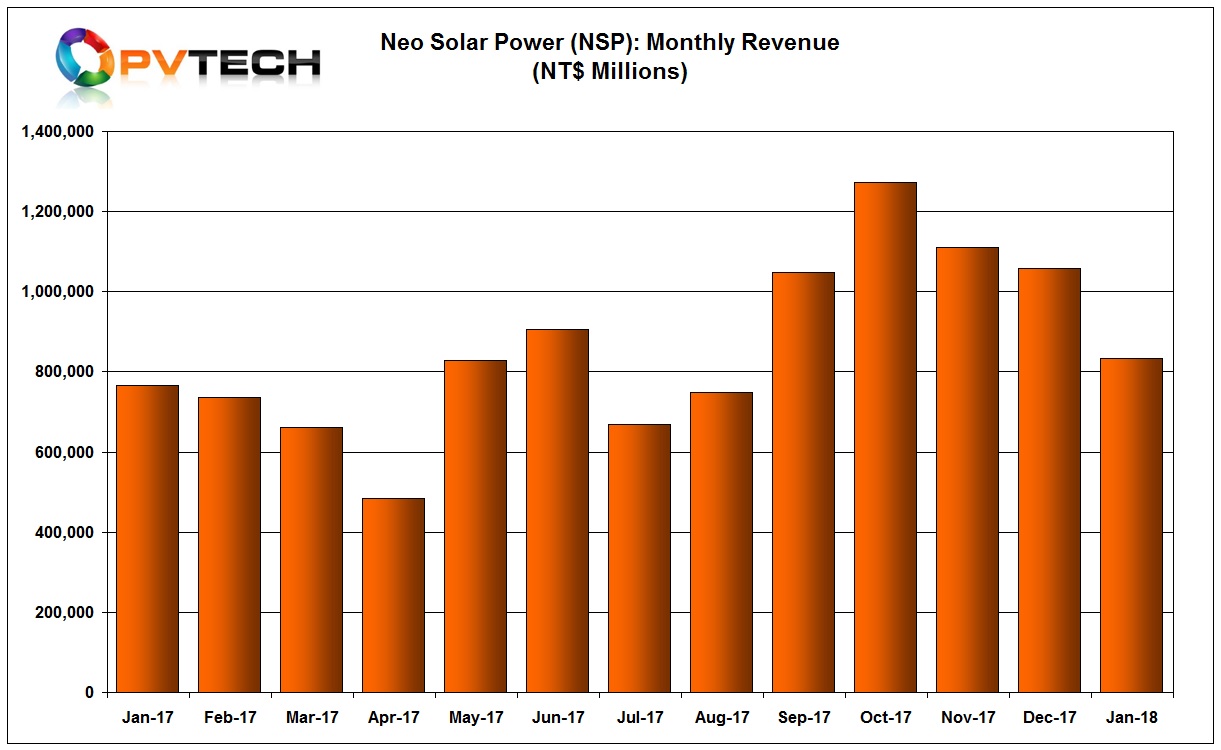

Neo Solar Power

Taiwan-based merchant solar cell and module producer Neo Solar Power (NSP) reported sales were down over 21% in January 2018, compared to the previous month but were over 8% higher than the prior year period.

NSP said sales reached NT$ 832 million (US$28.57 million) in January 2018, a 21.34% month-on-month decline but a growth of 8.67%, year-on-year.

Preliminary unaudited sales in 2017 were around NT$ 10.289 billion in 2017, down 37.78% year-on-year.

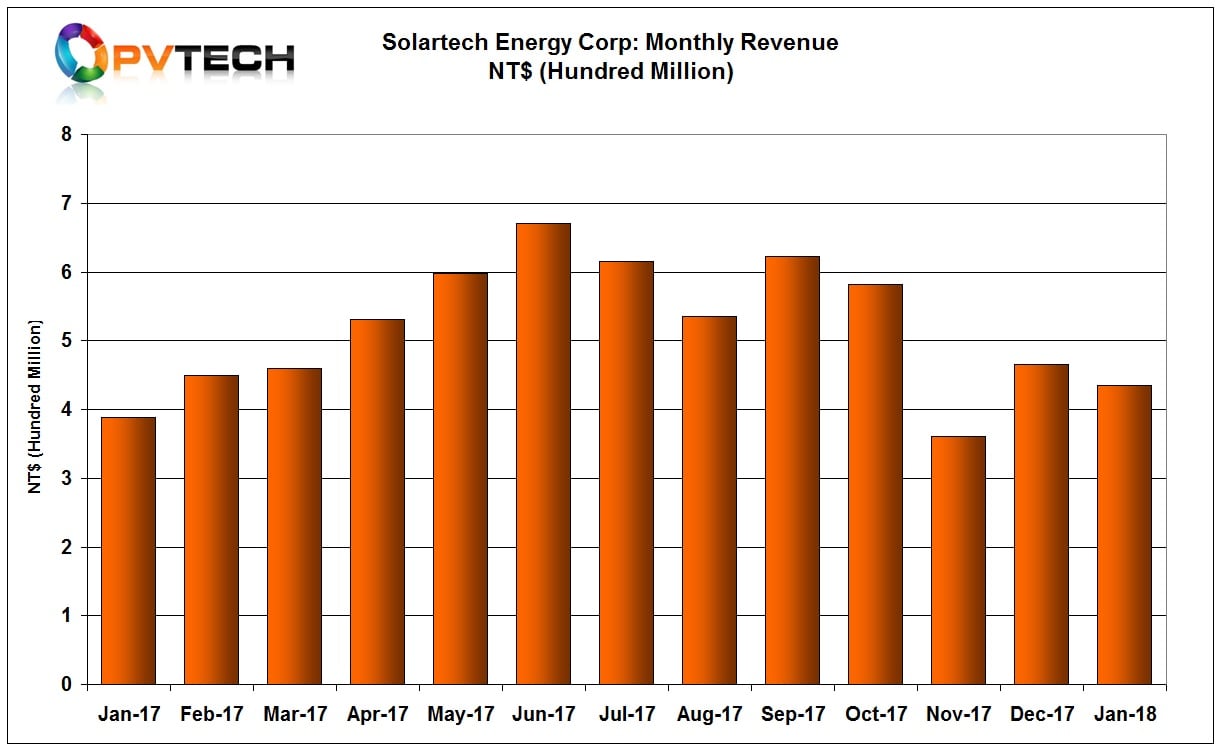

Solartech Energy

Merchant solar cell producer Solartech Energy Corp reported January 2018 sales down 12% on a month-on-month basis, continuing the trend of monthly volatility seen in 2017.

Solartech’s sales in January 2018 were NT$ 435 million (US$14.95 million), a 12.17% decline from the previous month. However, sales were up year-on-year by 12%.

Full-year 2017 sales were around NT$6,282 million, down almost 35% year-on-year.

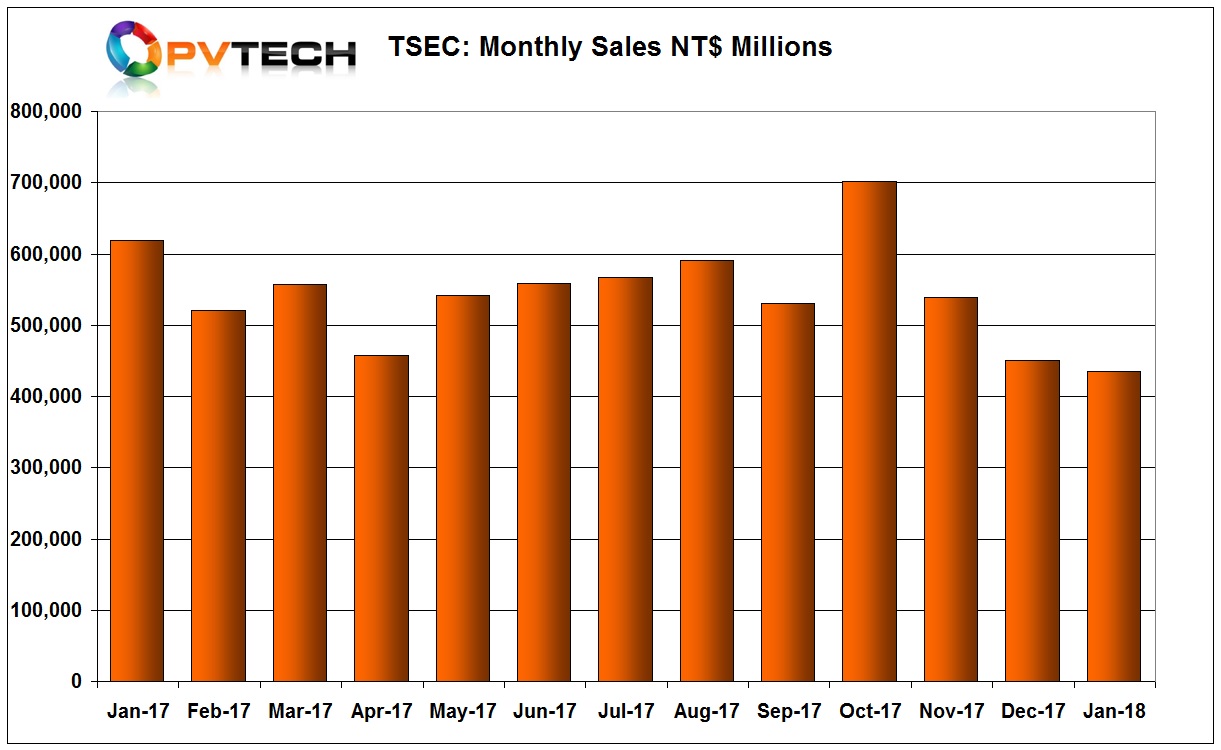

TSEC Corporation

PV cell and module manufacturer TSEC Corporation sales decline slowed in January 2018, after rapidly dropping in the fourth quarter of 2017.

TSEC reported January sales of NT$ 434.6 million (US$14.93 million), down 3.67%, month-on-month and down 29.85%, year-on-year.

Full year 2017 sales were around NT$6,636 million, compared to NT$ 7,747 million in 2016.

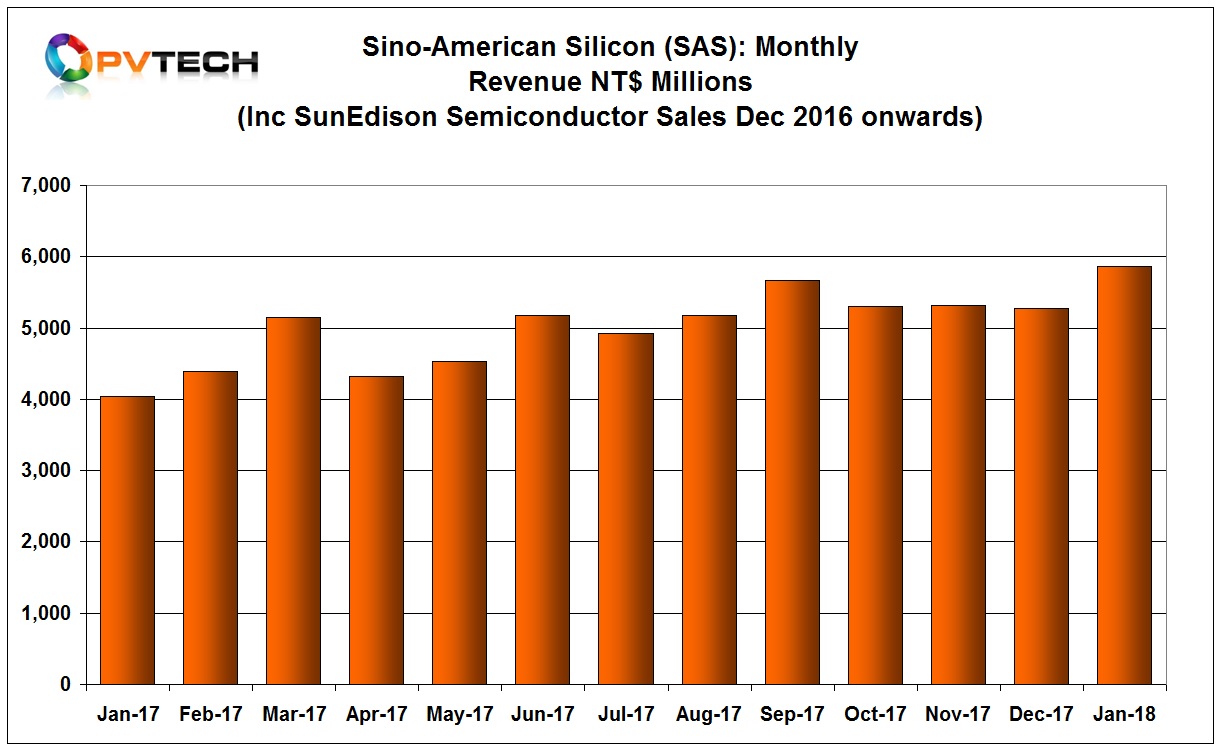

Sino-American Silicon

Integrated PV and wafer manufacturer Sino-American Silicon (SAS) sales hit a new record in January

SAS reported January 2018 sales of NT$ 5,865 million (US$201 million), up from US$176 million in the previous month.

SAS is continuing to benefit from strong demand for semiconductor silicon wafers after its acquisition of SunEdison Semiconductor.

According to trade organisation SEMI, silicon global revenues totalled US$8.71 billion in 2017, up 21% from the prior year.

Green Energy Technology

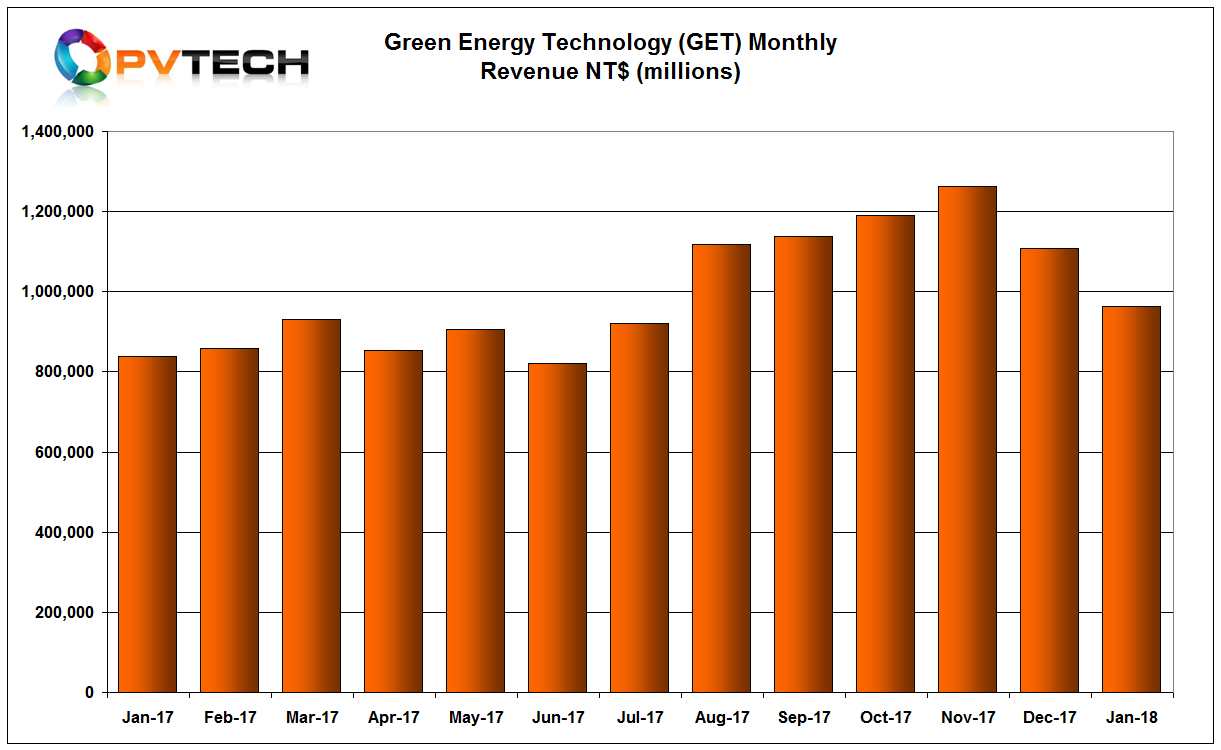

Taiwan-based multicrystalline wafer producer Green Energy Technology (GET) sales were down 13% month-on-month and up 15%, year-on-year.

January 2018 sales were NT$ 963 million (US$33.1 million), which resulted in lower utilisation rates of 85%, down from over 95% in the fourth quarter of 2017.

GET had previously reported unaudited 2017 annual sales of NT$ 11,947 million, down 22% from 2016.

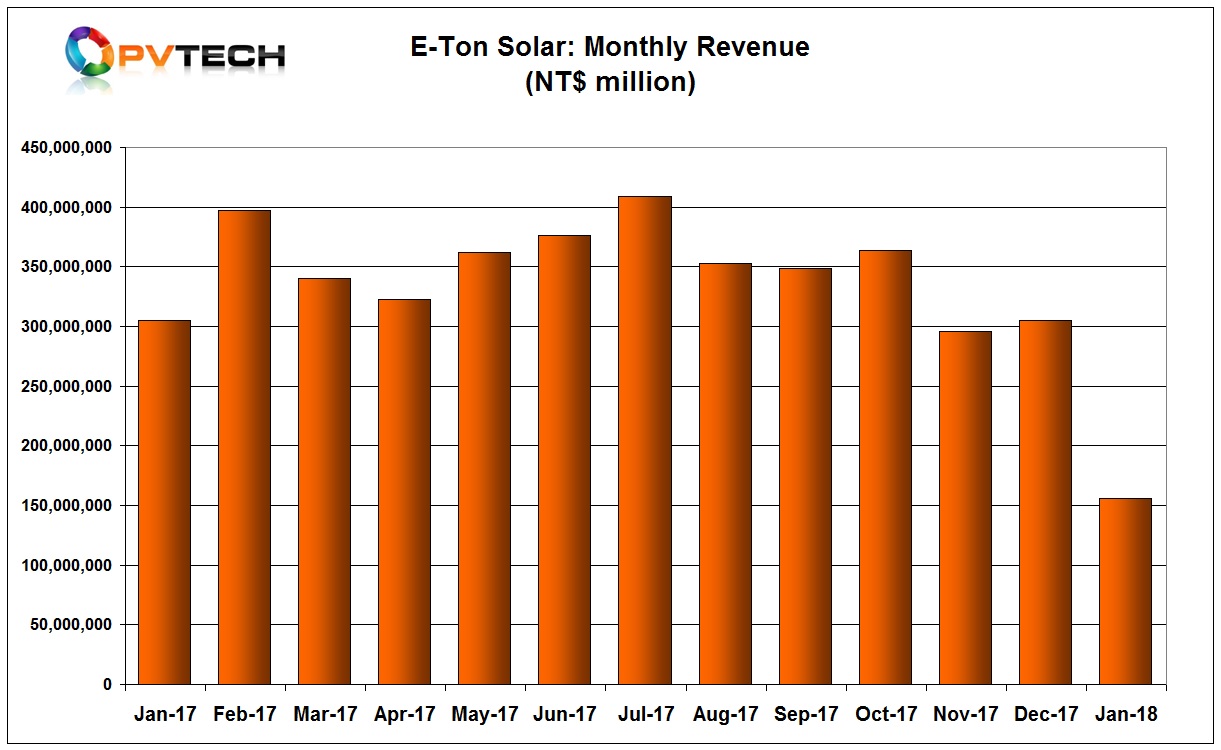

E-Ton Solar Tech

Mono and multicrystalline solar cell producer E-Ton Solar Tech reported a major collapse in sales for January 2018, declining almost 50% from the previous month and almost 50%, year-on-year.

E-Ton had sales of NT$156.2 million in January 2018, compared to NT$ 305 million in December 2017. The company did not provide a commentary on the 48.8% collapse in sales.

Full-year 2017 sales were NT$ 4,178 million, up from NT$ 3,920 million in the prior year.