Many key PV manufacturers in Taiwan are still reporting monthly sales in February, 2017 that are well below the levels set in the first half of 2016, due primarily to the expected boom in China’s downstream PV market, which has yet to take hold.

In 2016, China installed around 26GW in the first half of the year and 34.54GW in total, according to official figures. There is also greater China emphasis on ‘Top Runner’ programs in 2017, which are expected to spread downstream demand through the second-half of the year, potentially limiting the peak demand ahead of FiT changes at the end of June.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

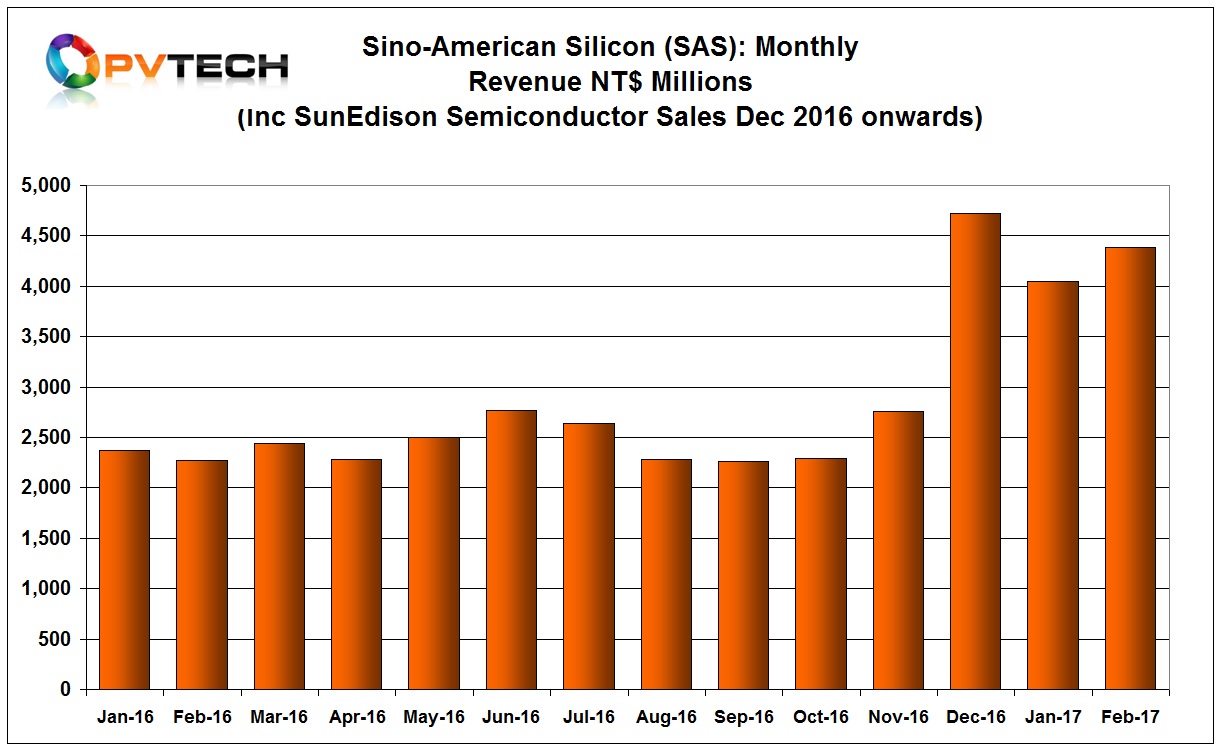

Sino-American Silicon

Taiwan-headquartered integrated PV manufacturer Sino-American Silicon (SAS) reported a slight increase in February, 2017 sales, compared to the previous month.

SAS sales in February were NT$4.384 billion (US$143.8 million), compared to NT$4.04 billion (US$130.2 million) in the previous month, an 8.3% increase month-on-month.

The company recently reported 2016 consolidated financial results with sales of NT$31.599 billion (US$1.03 billion). The company reported a net loss of US$28.09 million.

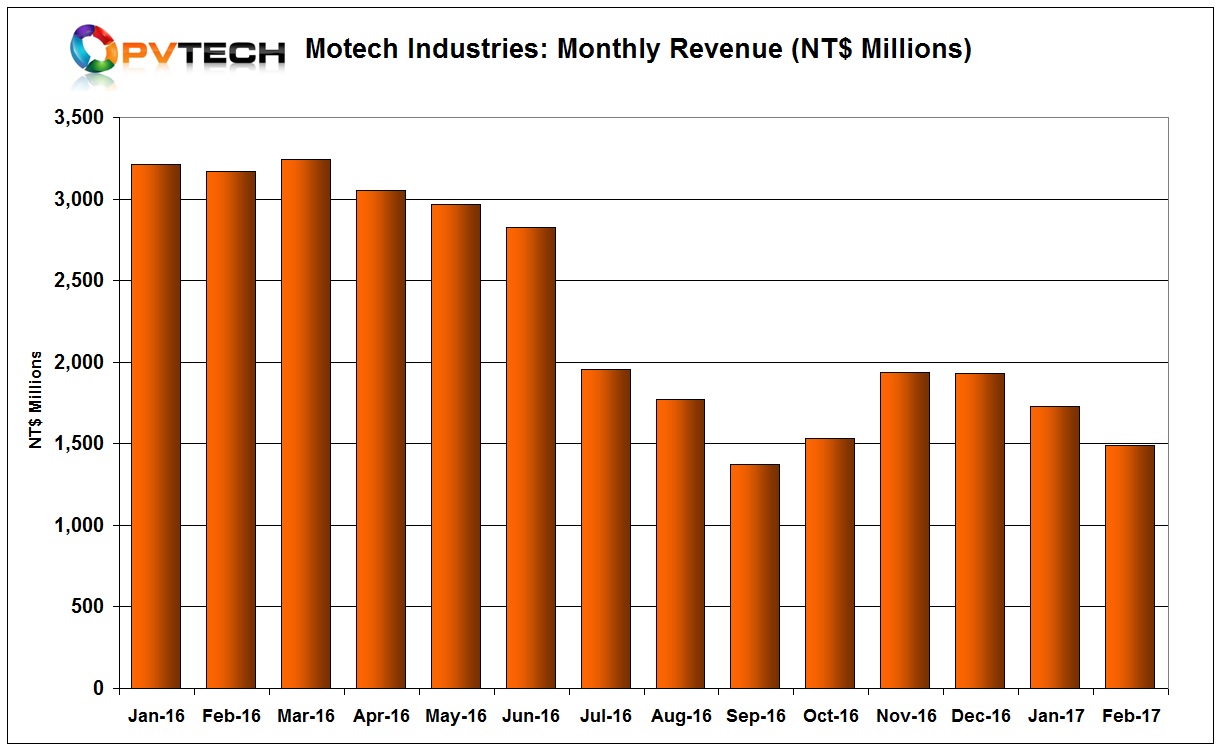

Motech Industries

PV cell and module manufacturer Motech Industries reported further declines in sales in February, 2017, which almost at the low point reached in September, 2016.

Motech reported sales of NT$1.487 billion (US$48.78 million) in February, compared to NT$1.782 billion (US$57.4 million) in the previous month. Sales are down around 53% from the previous year.

The company recently reported 2016 consolidated financial results, noting that in the second half of 2016 the company suffered from the impact of a decline in manufacturing capacity utilization rates, due to weak demand and ASP erosion that resulted in a consolidated gross profit decrease by 26%, compared to 2015.

Motech reported a net loss and NT$1.243 billion (US$40.77 million) in 2016 on revenue of NT$21.105 billion (US$692.37 million).

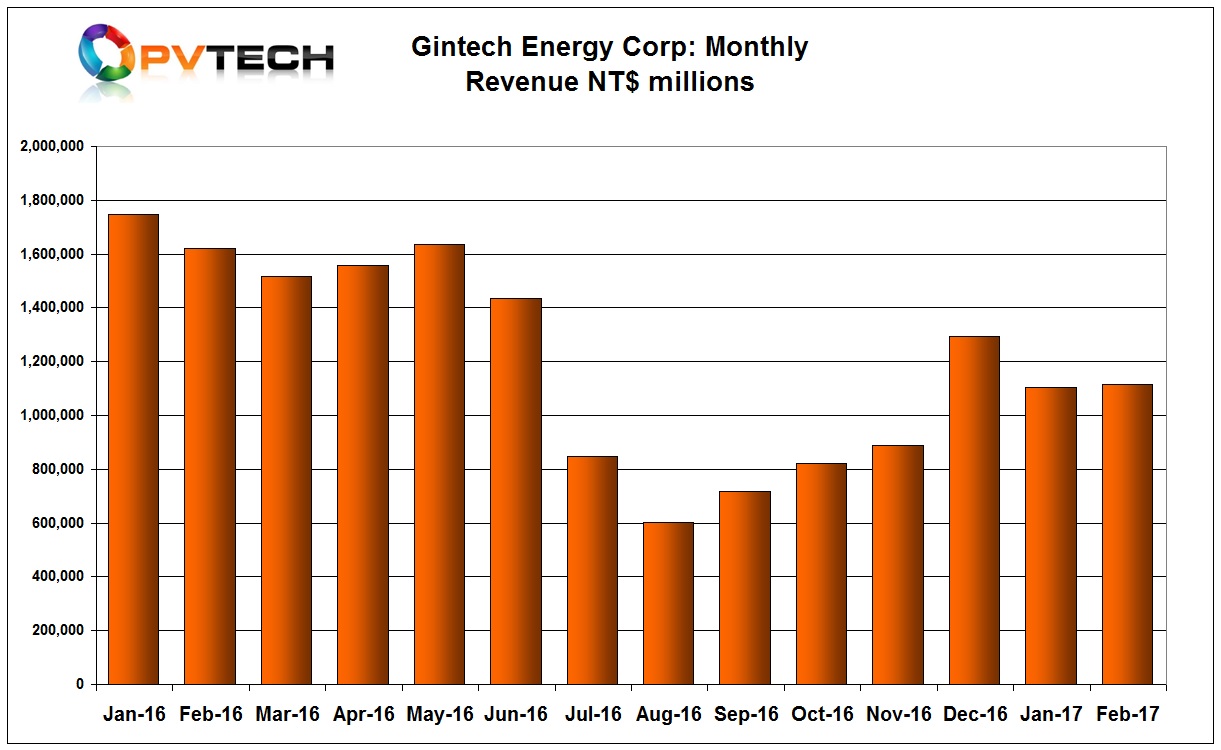

Gintech Energy

Merchant solar cell and module producer Gintech Energy reported relatively flat February, 2017 sales with the previous month and remain 34% below sales reported in the prior year period.

Gintech’s February 2017 sales were NT$1.116 billion (US$36.6 million), up just 1% from NT$1.105 billion (US$35.62 million) in the previous month.

The company recently reported full-year 2016 consolidated sales of NT$30 billion and a net loss of US$10 million.

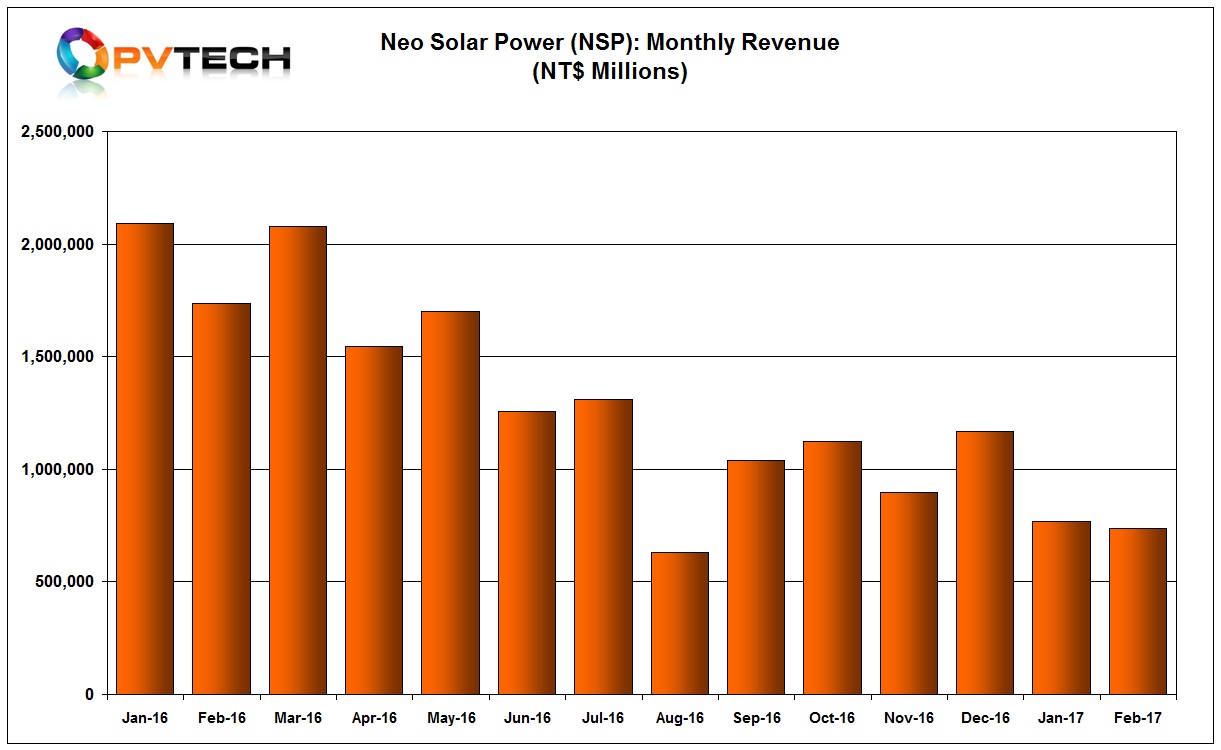

Neo Solar Power

Taiwan-based cell and module producer Neo Solar Power (NSP) reported slightly lower sales in February 2017 than the previous month, citing fewer working days in the month for the decline.

NSP reported February sales of NT$735 million (US$24.1 million), down 4% from the previous month when sales were NT$766 million (US$25.12 million). Sales are down 60% from the prior year period.

The company recently reported full-year 2016 consolidated sales of NT$16.53 billion and a net loss of US$62.7 million. The company is continuing to restructure its manufacturing operations. Sales have been in a downward motion through most of the last 12 months.

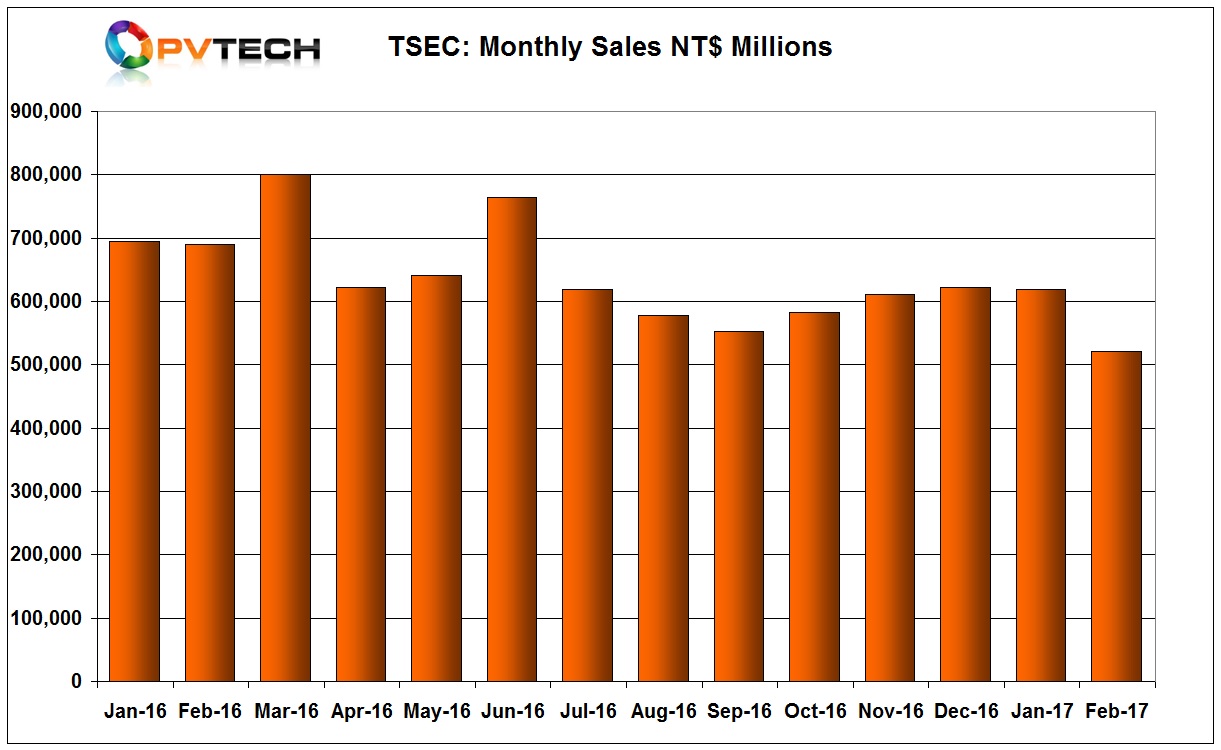

TSEC Corporation

PV cell and module manufacturer TSEC Corporation sales took a slide in February, 2017, after a modest recovery in the second-half of 2016.

TSEC reported February sales of NT$520 million (US$17.06 million), down over 24% from the previous month when sales reached NT$619 million (US$20.3 million).

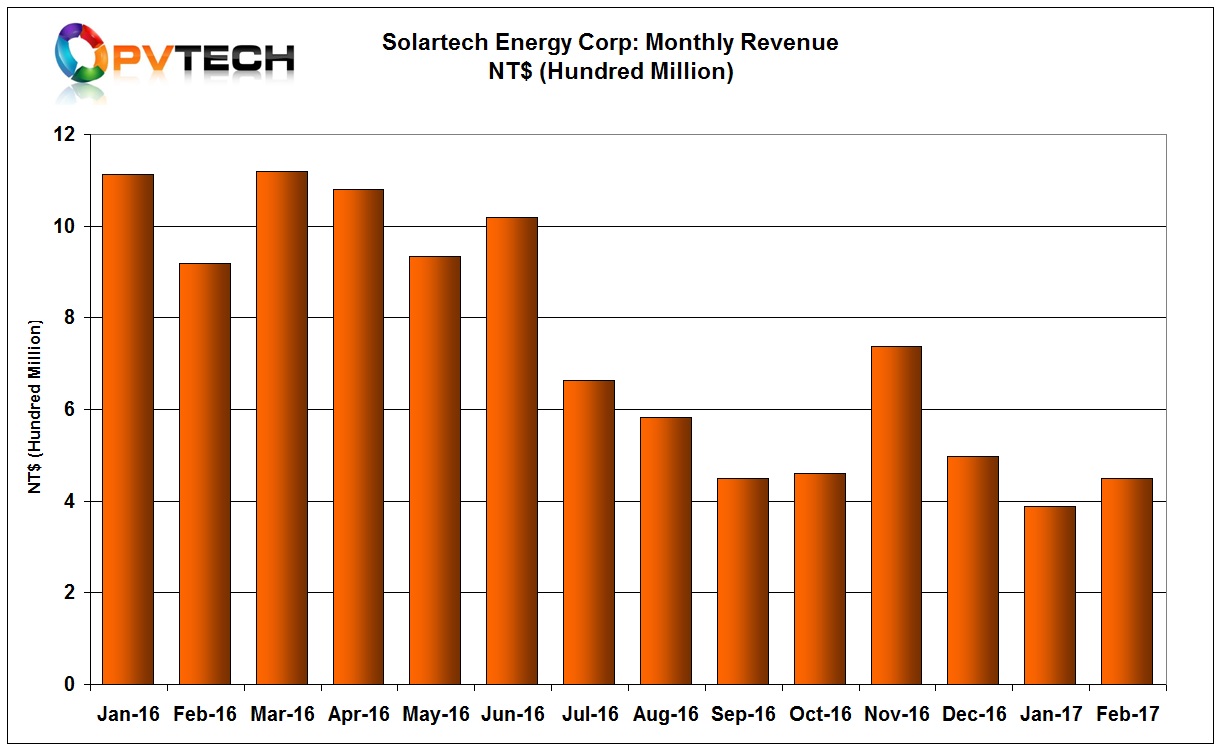

Solartech Energy

Merchant solar cell producer Solartech Energy Corp reported increased sales in February 2017.

Solartech reported February sales of NT$449 million (US$14.73 million), up 15.7% from the previous month when sales were report to be NT$388 million (US$12.5 million). Sales are still down 58.8% from the prior year period.

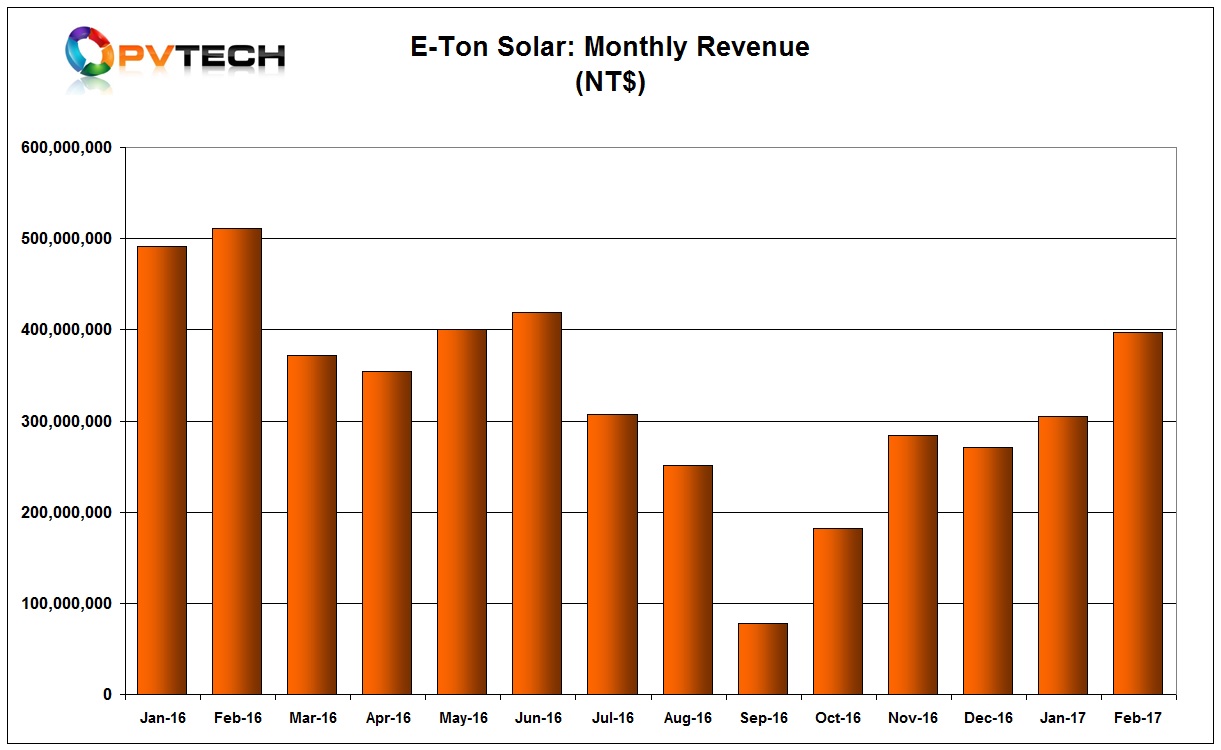

E-Ton Solar Tech

Mono and multicrystalline solar cell producer E-Ton Solar Tech reported a significant jump in February sales, continuing a recovery started in October, 2016.

E-Ton’s sales in February were NT$396.8 million (US$13 million), up from NT$305.2 million in the previous month. However, sales are still down around 22% from the prior year period.

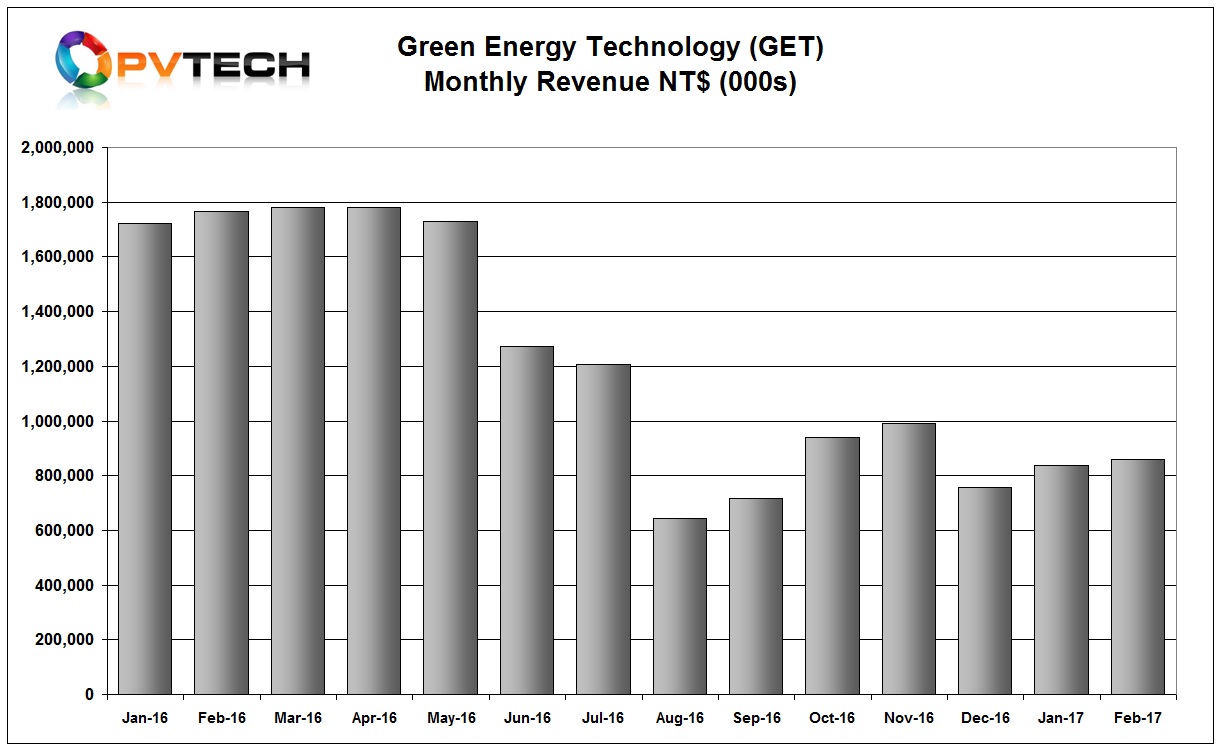

Green Energy Technology

Multicrystalline wafer producer Green Energy Technology (GET) sales have continued to improve modestly in February.

GET reported February, 2017 sales of NT$857 million (US$28.1 million), an increase of 2.3% from the previous month but remain 51% below the prior year period. The company noted that high-efficiency wafer ASP’s actually increased mildly in February.

However, GET recently reported a net loss for 2016 of around US$32.8 million.