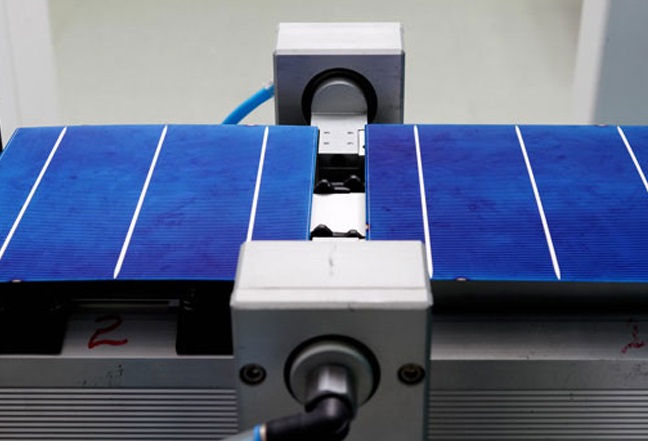

Tata Power Solar has expanded its PV manufacturing facility in Bengaluru, India, taking the total production capacity of solar modules and cells to 1.1GW.

Mono Passivated Emitter Rear Cell (PERC) cell manufacturing capacity at the unit has increased from 300MW to 530MW, while module assembly capacity (using half-cut mono PERC cells) has risen from 400MW to 580MW. The production lines are capable of handling 166mm – 210mm size wafers and module wattage ranging from 440W to 530W, with an option for bifacial modules.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Tata Power Solar, a subsidiary of Indian utility Tata Power, said the expansion is based on the “significant increase in demand” it has seen for its solar equipment. With India’s government aiming to reduce the domestic solar industry’s reliance on imports, Tata is now forecasting a further boost in demand.

Government plans to boost domestic PV manufacturing have seen it increase the import duty on solar inverters to 20%, while in April 2022 a 40% basic customs duty on modules and 25% duty on cells will come into effect.

Following months of uncertainty about when the module and cell levies would be introduced, Indian solar developers have welcomed the clarification about the timeline. However, ratings agency India Ratings and Research has suggested there may be an initial dependence on imports as a result of a limited insurance availability by international insurers for providing warranties on domestic cells and modules.

Other government policies to boost domestic solar manufacturing have seen the country’s Union Cabinet this week approve a production-linked incentives scheme for high-efficiency modules that will provide INR45 billion (US$603 million) over five years.

Recent manufacturing expansions in the country include Sungrow’s plans to grow its inverter production capacity in India to 10GW this year, while solar equipment provider Yingkou Jinchen Machinery (Jinchen) is supplying Waaree Energies with a 3GW module production line for its facility in Mumbai.

Following a 2020 that saw just 2.6GW of utility-scale solar installed, in part due to disruptions caused by the COVID-19 pandemic, consultancy JMK Research & Analytics expects figures to bounce back this year, with around 9.7GW of utility-scale and 2GW of rooftop solar to be commissioned.

However, with the country’s total installed solar capacity at around 37GW as of January, it is set to miss its ambition of reaching 100GW of solar by 2022.