Competitive deal processes are rising in the US tax credit transfer market for clean energy technologies, particularly for large-scale technologies with better prices secured competitively than with bilateral sales, according to a report by US sustainable finance company Crux.

Tax credit transferability was introduced under the Inflation Reduction Act (IRA), allowing clean energy developers to sell all or a portion of their credits to third parties after the release of proposed regulations by the Internal Revenue Service (IRS) in June 2023.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Alfred Johnson, CEO and co-founder of Crux, tells PV Tech Premium that there has been a cumulative effect where the more entities participate in the spot market, the more competition there is. In turn, this allows the seller to be able to select the best price and counterparty.

This also means greater liquidity in the forward commitment market. Crux has seen a significant rise in this competitiveness and transparency on its platform, with much more competitive bidding activity in Q2 this year alone.

At present, these trends are truer for utility-scale sellers, such as large-scale solar PV than for smaller sellers or new technologies, adds Johnson.

‘Transacting in a marketplace context’

There was some uncertainty in the early stages of the market over what percentage of credits would be sold directly and bilaterally, and what percentage would be sold in a competitive context. However, Crux’s data found a recent increase in selling through competitive processes.

Furthermore, the price received by the seller has also been shown to be better when the credit is sold in a competitive process versus a bilateral deal because competition gives the seller added leverage to drive the price up. Competitive deals are 67% more likely than bilaterally negotiated deals to achieve above-market pricing, the report states.

Buyers also prefer participating in a “liquid, transparent, deep, wide market”, because they can see more of the market and choose the credits that fit their specific profile. This transparency also gives confidence in the transaction. The speed of bids coming in and the amount of bids are also increasing due to this liquidity.

“There’s a definitely a movement in the market towards transacting in a marketplace context,” says Johnson.

Focusing on trends specific to utility-scale solar PV and energy storage, Johnson says that, at present, tax credit transfer deals are secured mainly with established technologies, such as utility-scale solar, wind and storage and the average pricing so far in 2024 is higher than it was in the 2023 sample, which started in August last year.

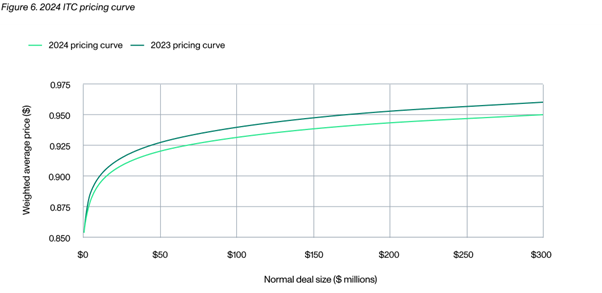

This is partly down to the deals transacted on so far this year being larger than deals of the previous year and there is a clear correlation between deal size and price. This increase in pricing is therefore reflecting more utility-scale solar and other larger deals being picked up in the first half of the year, and this correlation, for investment tax credits (ITC), is shown below.

Growth in other sectors

However, residential solar deals are expected to be signed in the second half of this year alongside a significant rise in advanced manufacturing transactions, which refers to the production credits associated with manufacturing solar panels, electrical inverters, wind energy and battery components.

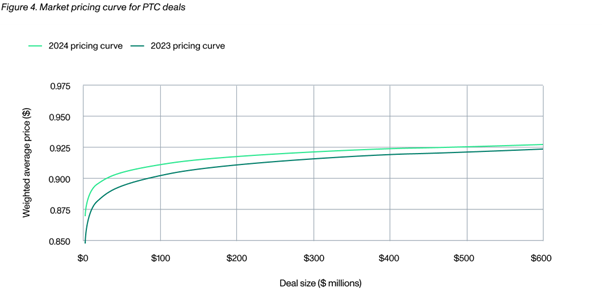

The graph below demonstrates how production tax credits (PTC) also see a higher average price of deal as the size of the deal increases. Johnson notes that both curves flatten around the US$90m deal size mark, noting there is a “definitive” trend that deal size between US$100-300 million has much less of an effect on pricing than deals between US$5-100m in size.

Another trend involves buyers, which have visibility into their future tax liability, increasingly looking forward in their behaviour, perhaps by bidding on 2025 credits for their 2025 tax liability.

This dynamic is “very healthy to the market,” says Johnson, as it provides more visibility for the developer into what the price and the buyer will be for future credits, which helps with financial planning and access to capital in debt finance in the late stages of a project.

Established technologies have dominated the market to date, but things can change as it is still a very young market having existed only since August last year.

‘Unexpected’ advanced manufacturing activity

During the active stages of 2023 around half of the deals involved wind, solar and energy storage, with the next largest allocation to advanced manufacturing.

“Those are very large and unexpected segments of the market in 2023 in part because those credits are also eligible for what’s called direct pay,” says Johnson. “They were choosing to sell through the transfer market because of the vitality of that market and the pricing that was observed on 45X credits.”

So far in 2024, the market has been dominated by traditional technologies, with about 75% dedicated to solar, wind and storage, though with a healthy component still coming in the form of advanced manufacturing. Advanced manufacturing and traditional renewables currently account for around 95% of the market.

Crux estimates that by the end of this year, however, the numbers will look very different because many of the larger wind, solar and storage credits will have already been sold. Thus, the deals signed in the back half of the year will shift more towards smaller technologies, like residential solar PV, as well as a greater proportion of less well-established technology types, such as bioenergy or nuclear. Crux also projects a significant rise in advanced manufacturing transactions in the second half of this year

Johnson notes that several very large advanced manufacturing credits were settled at the end of 2023 and this may signal a trend. For example, thin film PV manufacturing specialist First Solar announced the sale of US$700 million in tax credits to payments firm Fiserv in December.

“Maybe another dynamic that you have here is that these credits are production credits, and they are produced over the course of the year,” adds Johnson. “So, in some cases, they may be waiting to see what the full production is over the course of the year to sell.”

As PV Tech Premium has previously reported, the tax credit transfer market has seen a significant number of huge energy storage deals from the offset. This is partly down to storage projects being more difficult to finance through traditional tax equity than a more predictable solar energy facility.

The Crux report, based upon a dataset of over US$6.8 billion in transactions of tax credits closed in the first half of 2024, refers to the overall transferability market using three data sources: the Crux platform; a survey conducted by Crux sourcing from 100 buyers, sellers and intermediaries; and publicly announced transactions.

The report estimated US$9-11 billion of transactions closed so far this year across the market with potential to reach US$20-25 billion by year end.