Chinese solar manufacturer Tongwei has planned to invest RMB20 billion (US$2.7 billion) in its Leshan project, in the Chinese province of Sichuan, to expand ingot pulling, slicing and cell production capacity, so as to accelerate the establishment of “China’s Green Silicon Valley”.

According to the announcement made on 21 August, Tongwei intends to sign a project investment agreement with the government of the city of Leshan and Leshan City Wutongqiao District People’s Government on the cooperation to construct an annual capacity of 16GW ingot pulling, slicing and cell projects in the Wutongqiao District. The investment is expected to total RMB10 billion.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Moreover, the company intends to sign another project investment agreement with the government of the city of Leshan and Leshan Emishan City government, to cooperate on the company’s investment and construction of an annual capacity of 16GW ingot pulling, slicing, and cell project in Leshan Emishan City. Similar to the previous project, this investment is also expected to be around RMB10 billion.

This is not the first capacity expansion the company has unveiled this year in the Sichuan province, where it invested RMB6 billion in a 120,000-ton high-purity crystalline silicon project, with construction slated to begin in June 2023.

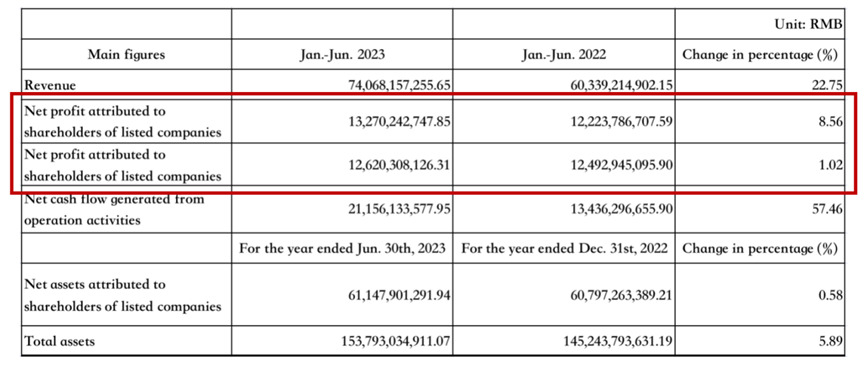

Parallel to that announcement, Tongwei released its 2023 Interim Report for the first half of the year for which it achieved an operating income of RMB74.068 billion, an increase of 22.75% from the same period last year; net profit attributable to shareholders reached RMB13.27 billion, up by 8.56% year-on-year; basic earnings per share were RMB2.95. Wind data show that as of the close of trading on August 21, the latest market value of Tongwei was ¥142.5 billion.

In its interim report, Tongwei reported that it owns an annual production of 420,000 tons of high-purity silicon, 9GW of solar cells and 55GW of modules, while the 25GW module project in Yancheng and 16GW module project in Jintang are in full operation.

Production of modules has become one of Tongwei’s key layouts, with an annual production capacity of 55GW and 8.96GW of modules shipped during the first six months of 2023

Furthermore, Tongwei managed to grasp opportunities in line with the trend to speed up solar and wind projects in China. Through leveraging the advantages of brand power of its own industrial chain and manufacturing capabilities, Tongwei focused on developing big clients by winning the biddings for China Resources Power, Three Gorges, China Power Construction, National Energy Group and other projects, achieving a cumulative capacity of over 9GW.

For the distributed market in China, Tongwei laid out sales networks by reaching partnerships with Chint, Sungrow, Skyworth and other platforms, leading to a significant increase in market share.

For global markets, Tongwei continues to focus on Europe, Asia Pacific and South America. Through cooperation with leading distributors, agency promotions, and global team building, the company managed to expand its channels, and comprehensively strengthen its module brand exposure, thus helping the brand influence to improve rapidly. So far, it has signed more than 6GW of overseas framework orders.